Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Last year, ASI Company paid P1.00 per share dividend. ASI's growthrate is expected to be constant for 10% for 2 years after which dividends

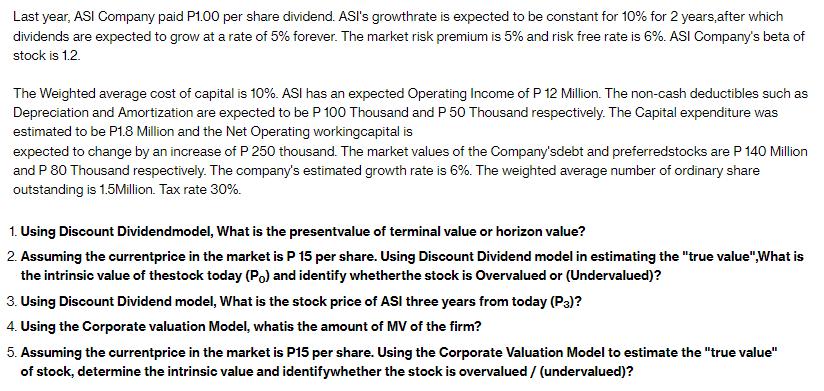

Last year, ASI Company paid P1.00 per share dividend. ASI's growthrate is expected to be constant for 10% for 2 years after which dividends are expected to grow at a rate of 5% forever. The market risk premium is 5% and risk free rate is 6%. ASI Company's beta of stock is 1.2. The Weighted average cost of capital is 10%. ASI has an expected Operating Income of P 12 Million. The non-cash deductibles such as Depreciation and Amortization are expected to be P 100 Thousand and P 50 Thousand respectively. The Capital expenditure was estimated to be P1.8 Million and the Net Operating workingcapital is expected to change by an increase of P 250 thousand. The market values of the Company'sdebt and preferredstocks are P 140 Million and P 80 Thousand respectively. The company's estimated growth rate is 6%. The weighted average number of ordinary share outstanding is 1.5Million. Tax rate 30%. 1. Using Discount Dividendmodel, What is the presentvalue of terminal value or horizon value? 2. Assuming the currentprice in the market is P 15 per share. Using Discount Dividend model in estimating the "true value", What is the intrinsic value of thestock today (Po) and identify whether the stock is Overvalued or (Undervalued)? 3. Using Discount Dividend model, What is the stock price of ASI three years from today (P3)? 4. Using the Corporate valuation Model, whatis the amount of MV of the firm? 5. Assuming the currentprice in the market is P15 per share. Using the Corporate Valuation Model to estimate the "true value" of stock, determine the intrinsic value and identifywhether the stock is overvalued / (undervalued)?

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Present Value of Terminal Value Horizon Value using the Dividend Discount Model DDM The terminal value is the present value of all future dividends beyond the explicit forecast period It can be calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started