Question

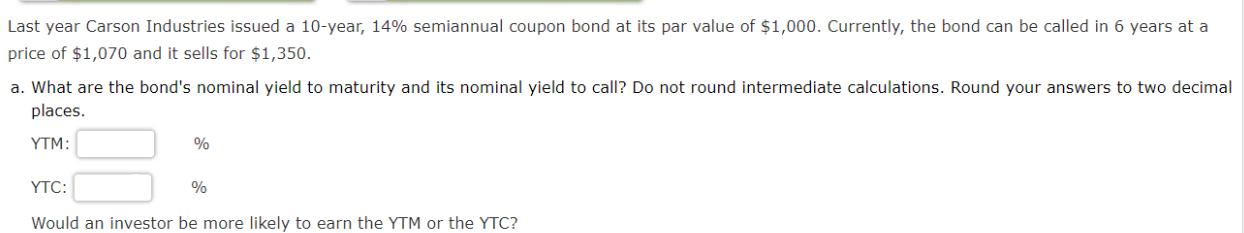

Last year Carson Industries issued a 10-year, 14% semiannual coupon bond at its par value of $1,000. Currently, the bond can be called in

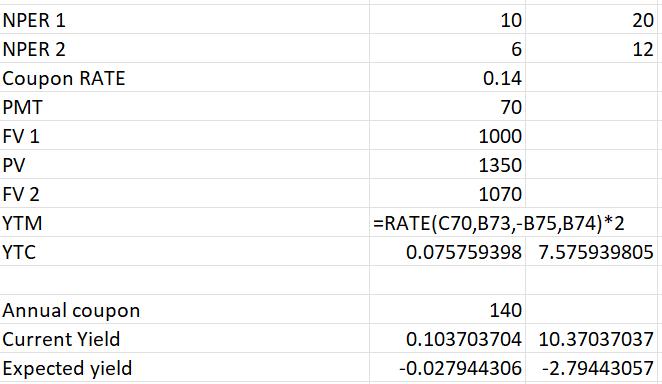

Last year Carson Industries issued a 10-year, 14% semiannual coupon bond at its par value of $1,000. Currently, the bond can be called in 6 years at a price of $1,070 and it sells for $1,350. a. What are the bond's nominal yield to maturity and its nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: Would an investor be more likely to earn the YTM or the YTC? % NPER 1 NPER 2 Coupon RATE PMT FV 1 PV FV 2 YTM YTC Annual coupon Current Yield Expected yield 10 6 20 12 0.14 70 1000 1350 1070 =RATE(C70,B73,-B75,B74)*2 0.075759398 7.575939805 140 0.103703704 10.37037037 -0.027944306 -2.79443057

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay here are the calculations Bond details Term 10 years Coup...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham

Concise 9th Edition

1305635937, 1305635930, 978-1305635937

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App