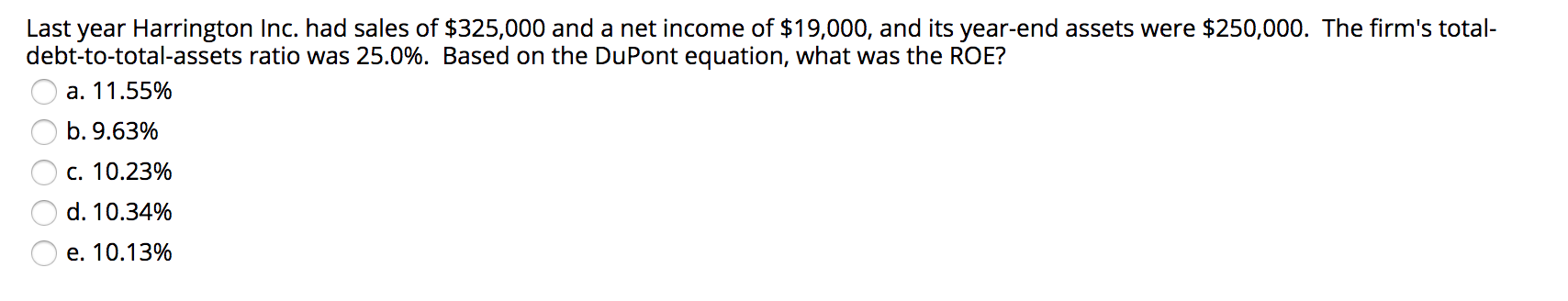

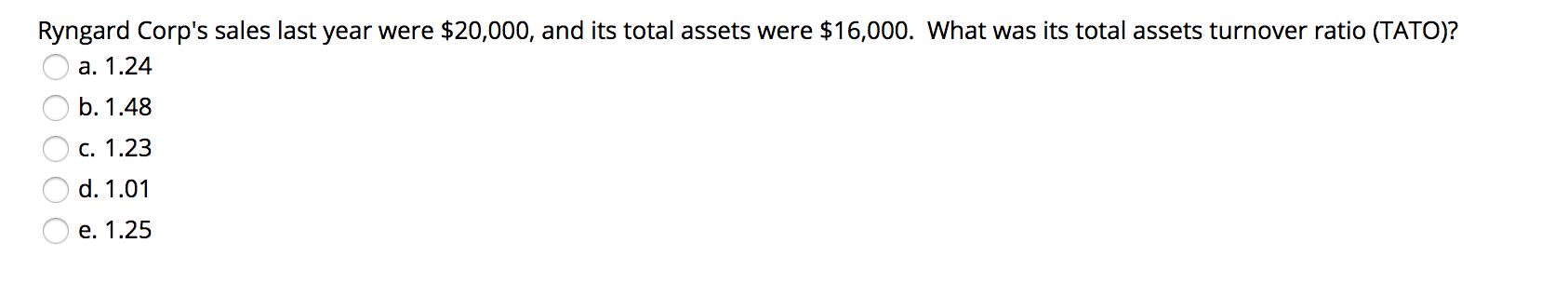

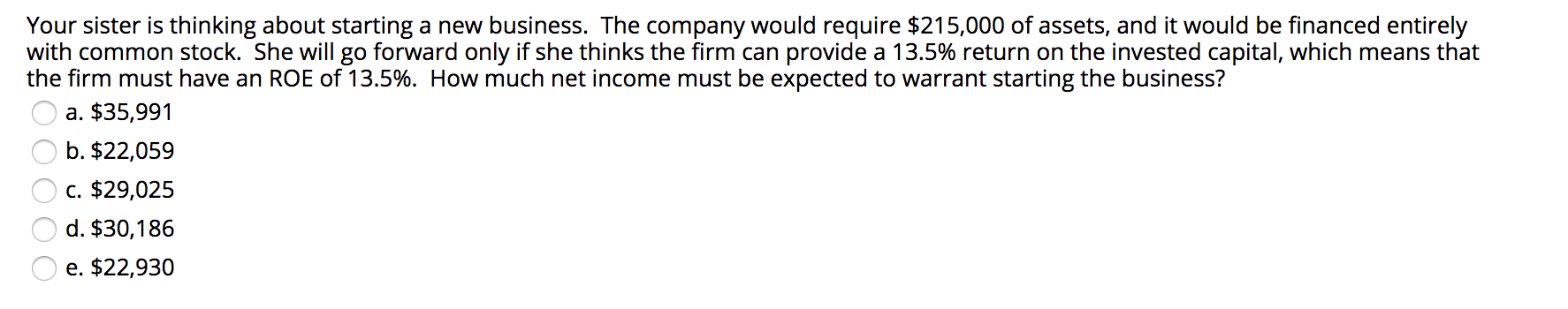

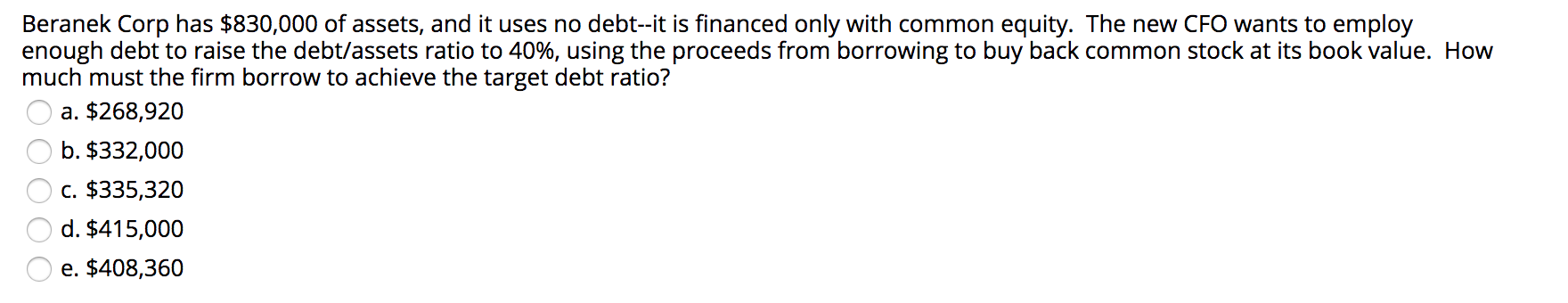

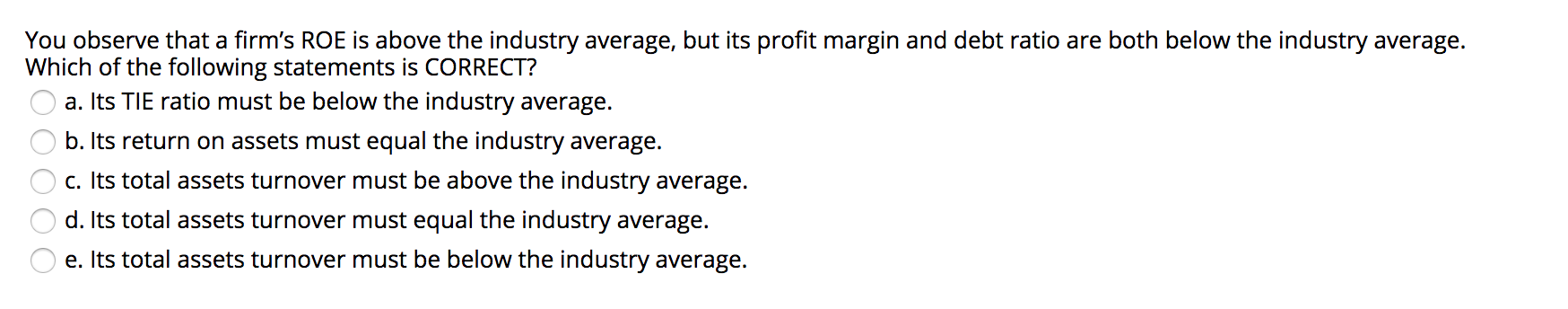

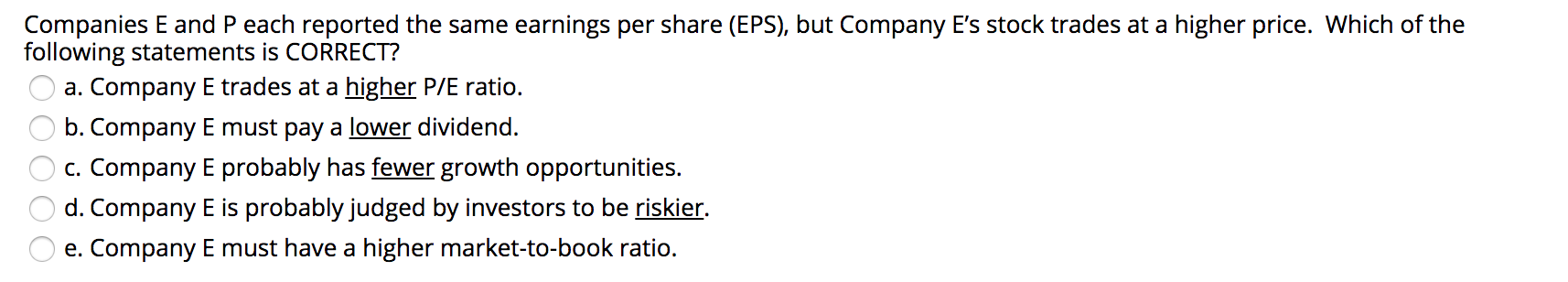

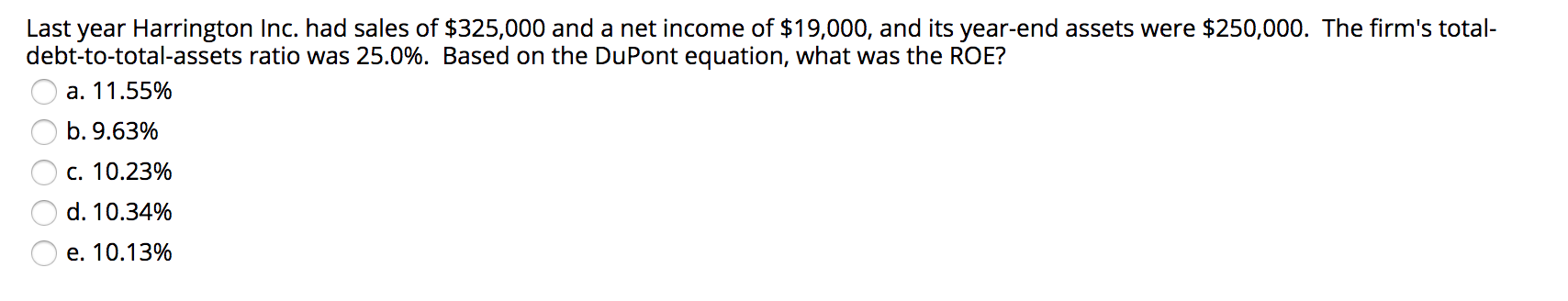

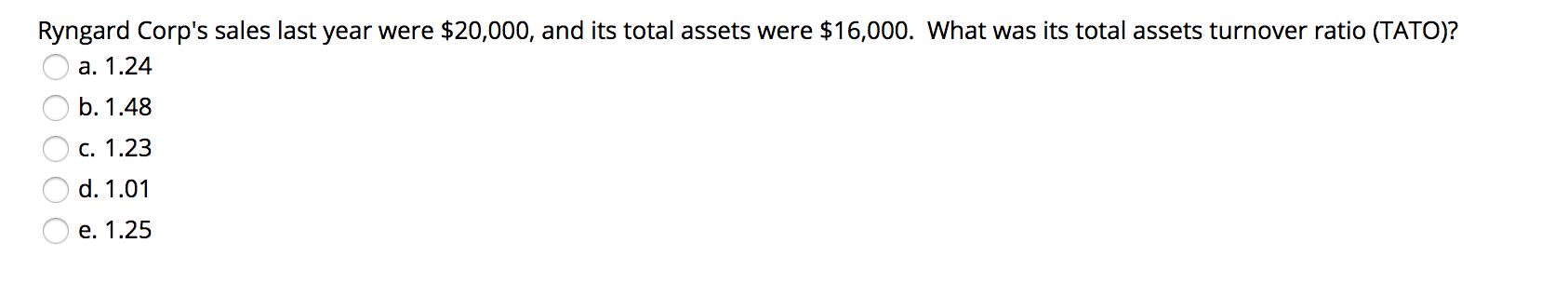

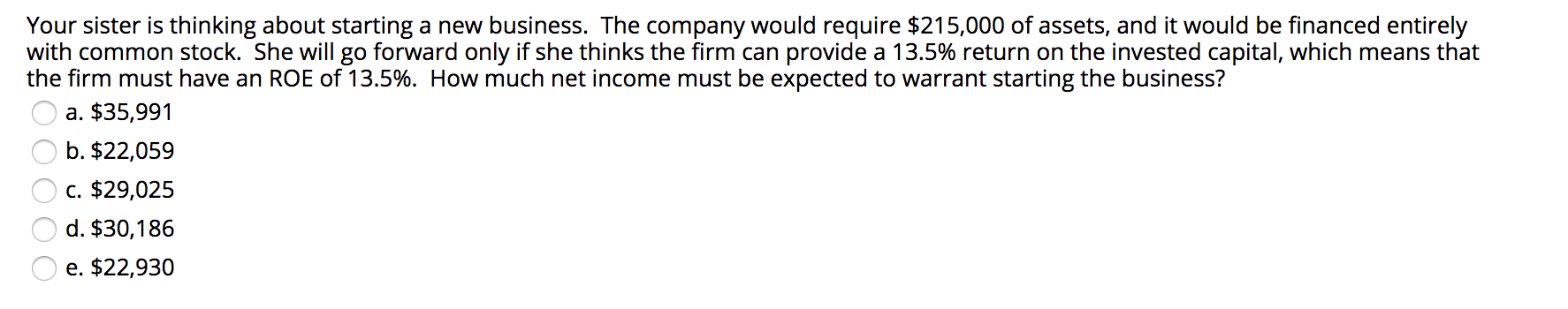

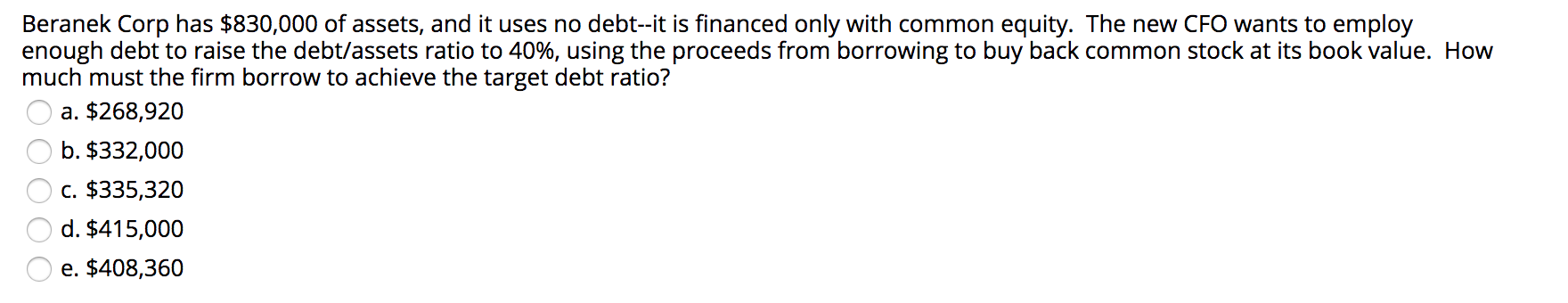

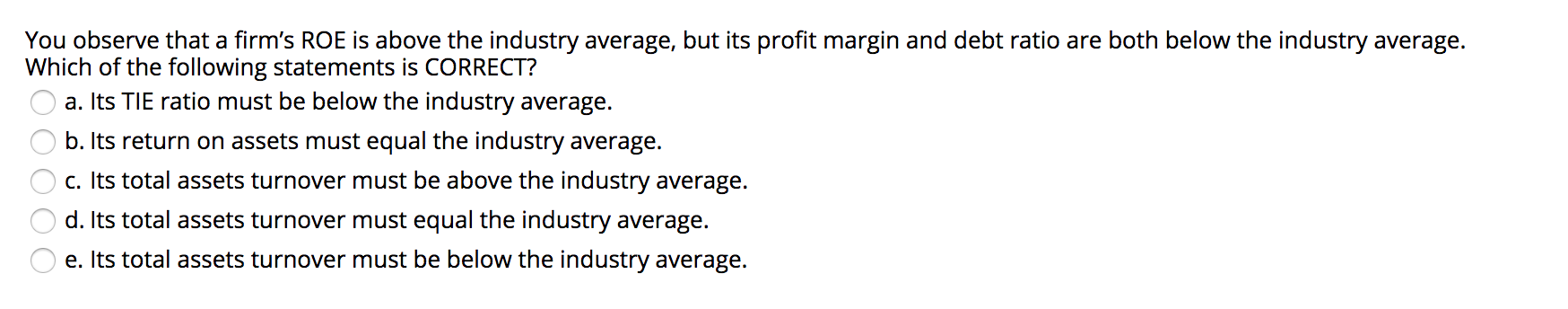

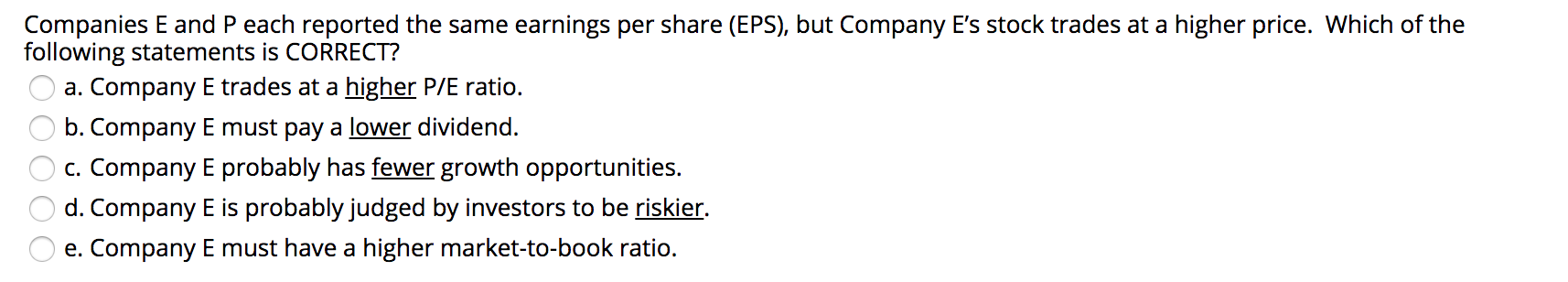

Last year Harrington Inc. had sales of $325,000 and a net income of $19,000, and its year-end assets were $250,000. The firm's total- debt-to-total-assets ratio was 25.0%. Based on the DuPont equation, what was the ROE? O a. 11.55% O b.9.63% O c. 10.23% O d. 10.34% O e. 10.13% Ryngard Corp's sales last year were $20,000, and its total assets were $16,000. What was its total assets turnover ratio (TATO)? O a. 1.24 O b. 1.48 O c. 1.23 O d. 1.01 O e. 1.25 Your sister is thinking about starting a new business. The company would require $215,000 of assets, and it would be financed entirely with common stock. She will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an ROE of 13.5%. How much net income must be expected to warrant starting the business? O a. $35,991 O b. $22,059 O c. $29,025 O d. $30,186 o e. $22,930 Beranek Corp has $830,000 of assets, and it uses no debt--it is financed only with common equity. The new CFO wants to employ enough debt to raise the debt/assets ratio to 40%, using the proceeds from borrowing to buy back common stock at its book value. How much must the firm borrow to achieve the target debt ratio? O a. $268,920 O b. $332,000 O c. $335,320 O d. $415,000 O e. $408,360 You observe that a firm's ROE is above the industry average, but its profit margin and debt ratio are both below the industry average. Which of the following statements is CORRECT? O a. Its TIE ratio must be below the industry average. O b. Its return on assets must equal the industry average. O c. Its total assets turnover must be above the industry average. O d. Its total assets turnover must equal the industry average. O e. Its total assets turnover must be below the industry average. Companies E and P each reported the same earnings per share (EPS), but Company E's stock trades at a higher price. Which of the following statements is CORRECT? O a. Company E trades at a higher P/E ratio. O b. Company E must pay a lower dividend. O c. Company E probably has fewer growth opportunities. O d. Company E is probably judged by investors to be riskier. O e. Company E must have a higher market-to-book ratio