Question

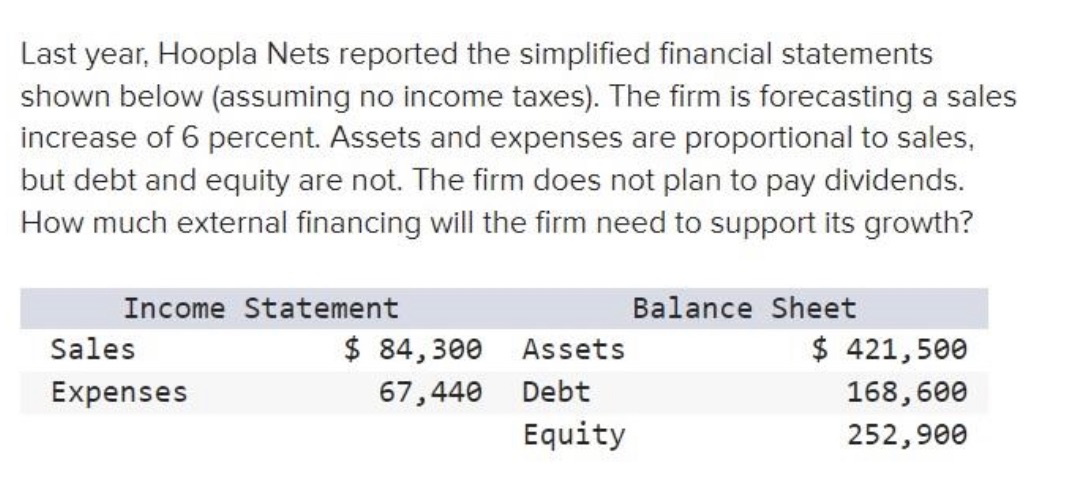

Last year, Hoopla Nets reported the simplified financial statements shown below (assuming no income taxes). The firm is forecasting a sales increase of 6

Last year, Hoopla Nets reported the simplified financial statements shown below (assuming no income taxes). The firm is forecasting a sales increase of 6 percent. Assets and expenses are proportional to sales, but debt and equity are not. The firm does not plan to pay dividends. How much external financing will the firm need to support its growth? Income Statement Sales Expenses Balance Sheet $ 84,300 Assets $ 421,500 67,440 Debt 168,600 Equity 252,900

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the external financing needed to support the firms growth we can start by projecting th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Stephen M. Ross, Randolph W Westerfield, Robert R. Dockson, Bradford D Jordan

12th edition

007353062X, 73530628, 1260153592, 1260153590, 978-1260153590

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App