Answered step by step

Verified Expert Solution

Question

1 Approved Answer

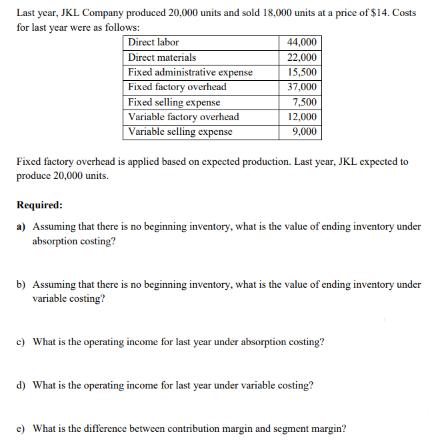

Last year, JKL Company produced 20.000 units and sold 18,000 units at a price of $14. Costs for last year were as follows: Direct

Last year, JKL Company produced 20.000 units and sold 18,000 units at a price of $14. Costs for last year were as follows: Direct labor Direct materials Fixed administrative expense Fixed factory overhead Fixed selling expense Variable factory overhead Variable selling expense 44,000 22,000 15,500 37,000 7,500 12,000 9,000 Fixed factory overhead is applied based on expected production. Last year, JKL expected to produce 20,000 units. Required: a) Assuming that there is no beginning inventory, what is the value of ending inventory under absorption costing? b) Assuming that there is no beginning inventory, what is the value of ending inventory under variable costing? c) What is the operating income for last year under absorption costing? d) What is the operating income for last year under variable costing? e) What is the difference between contribution margin and segment margin?

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the values required well first determine the variable and fixed costs per unit and then calculate the ending inventory and operating inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started