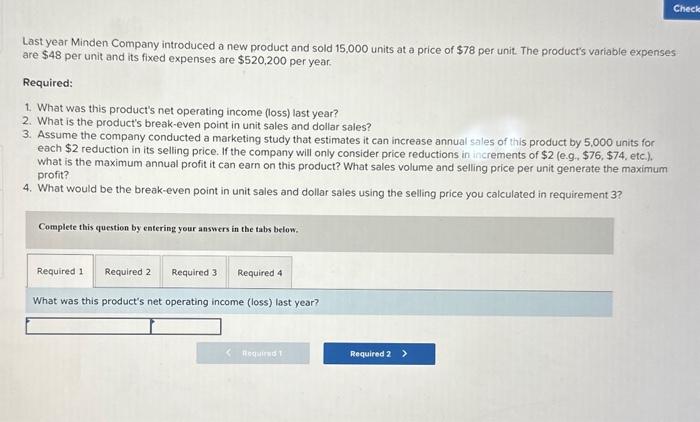

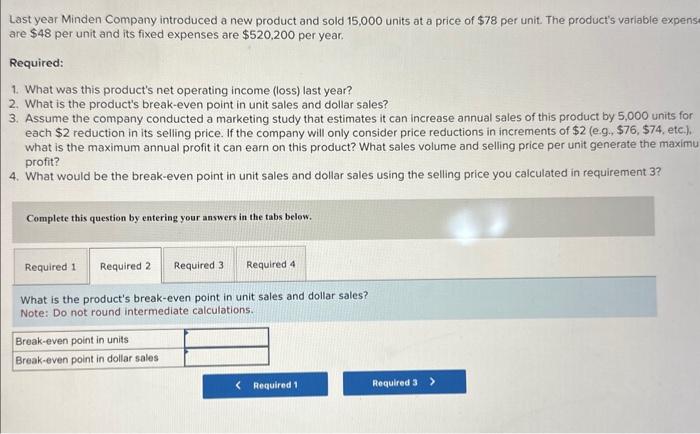

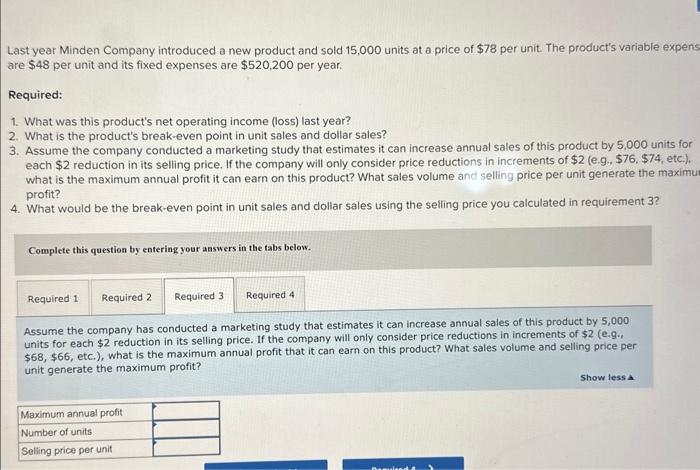

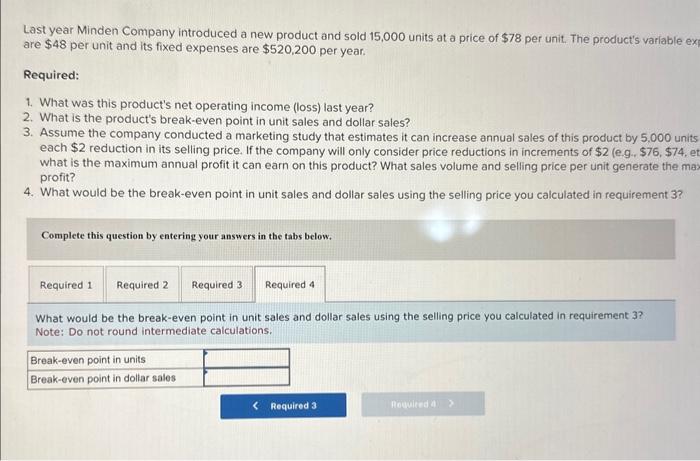

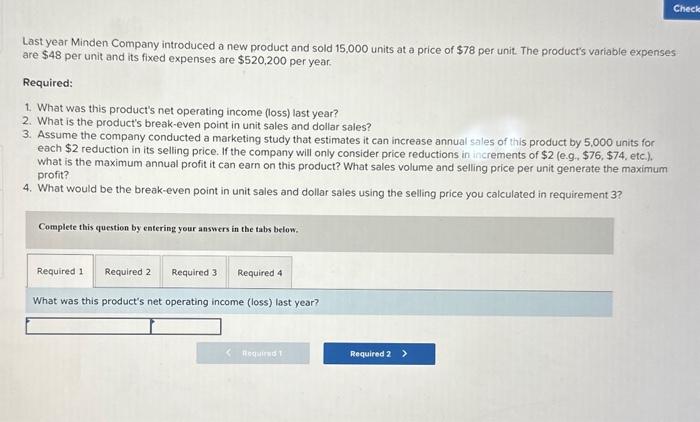

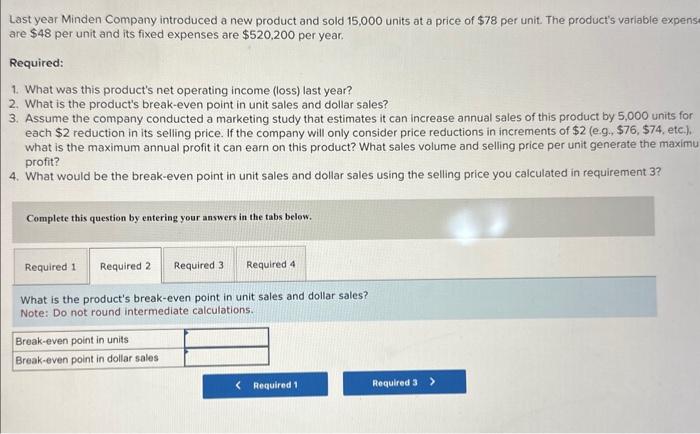

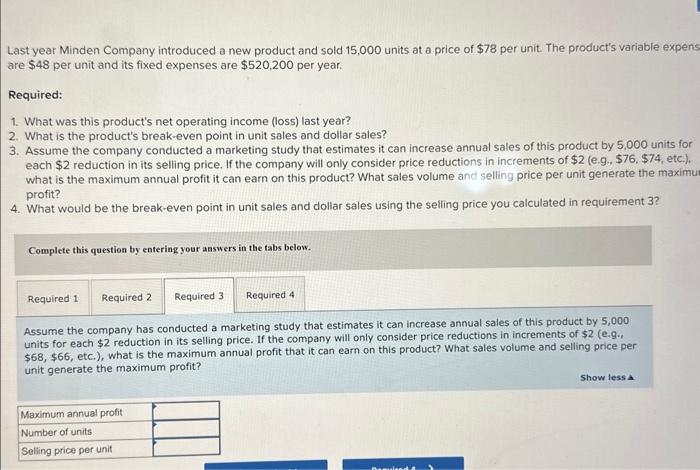

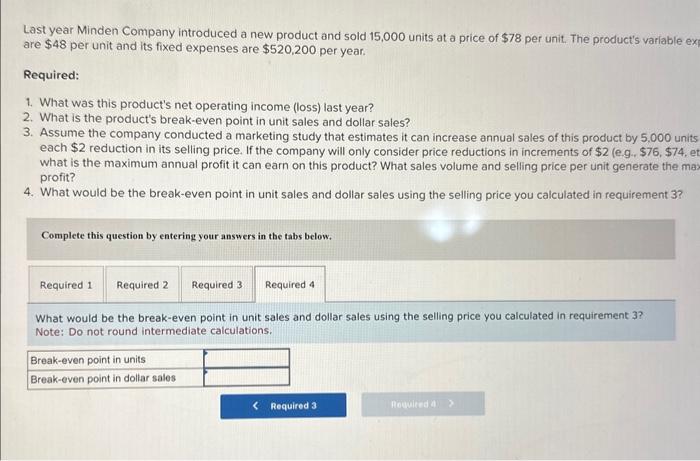

Last year Minden Company introduced a new product and sold 15,000 units at a price of $78 per unit. The product's variable expens are $48 per unit and its fixed expenses are $520,200 per year. Required: 1. What was this product's net operating income (loss) last year? 2. What is the product's break-even point in unit sales and dollar sales? 3. Assume the company conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g., $76,$74, etc). what is the maximum annual profit it can earn on this product? What sales volume and selling price per unit generate the maximu profit? 4. What would be the break-even point in unit sales and dollar sales using the selling price you calculated in requirement 3 ? Complete this question by entering your answers in the tabs below. What is the product's break-even point in unit sales and dollar sales? Note: Do not round intermediate calculations. Last year Minden Company introduced a new product and sold 15,000 units at a price of $78 per unit. The product's variable expenses are $48 per unit and its fixed expenses are $520,200 per year. Required: 1. What was this product's net operating income (loss) last year? 2. What is the product's break-even point in unit sales and dollar sales? 3. Assume the company conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g. $76,$74, etc). What is the maximum annual profit it can earn on this product? What sales volume and selling price per unit generate the maximum profit? 4. What would be the break-even point in unit sales and dollar sales using the selling price you calculated in requirement 3 ? Complete this question by entering your answers in the tabs below. What was this product's net operating income (loss) last year? Last year Minden Company introduced a new product and sold 15,000 units at a price of $78 per unit. The product's varlable ex are $48 per unit and its fixed expenses are $520,200 per year. Required: 1. What was this product's net operating income (loss) last year? 2. What is the product's break-even point in unit sales and dollar sales? 3. Assume the company conducted a marketing study that estimates it can increase annual sales of this product by 5.000 units each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g. $76,$74. what is the maximum annual profit it can earn on this product? What sales volume and selling price per unit generate the ma: profit? 4. What would be the break-even point in unit sales and dollar sales using the selling price you calculated in requirement 3 ? Complete this question by entering your answers in the tabs below. What would be the break-even point in unit sales and dollar sales using the selling price you calculated in requirement 3 ? Note: Do not round intermediate calculations. Last year Minden Company introduced a new product and sold 15,000 units at a price of $78 per unit. The product's variable expens are $48 per unit and its fixed expenses are $520,200 per year. Required: 1. What was this product's net operating income (loss) last year? 2. What is the product's break-even point in unit sales and dollar sales? 3. Assume the company conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g., \$76. \$74, etc). what is the maximum annual profit it can earn on this product? What sales volume and selling price per unit generate the maximu profit? 4. What would be the break-even point in unit sales and dollar sales using the selling price you calculated in requirement 3 ? Complete this question by entering your answers in the tabs below. Assume the company has conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.9., $68,$66, etc.), what is the maximum annual profit that it can earn on this product? What sales volume and selling price per unit generate the maximum profit