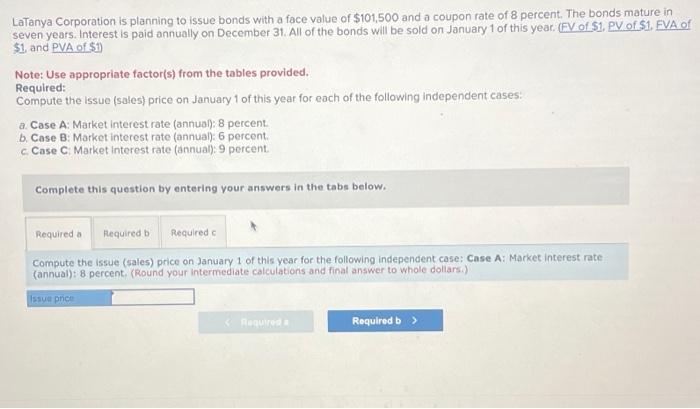

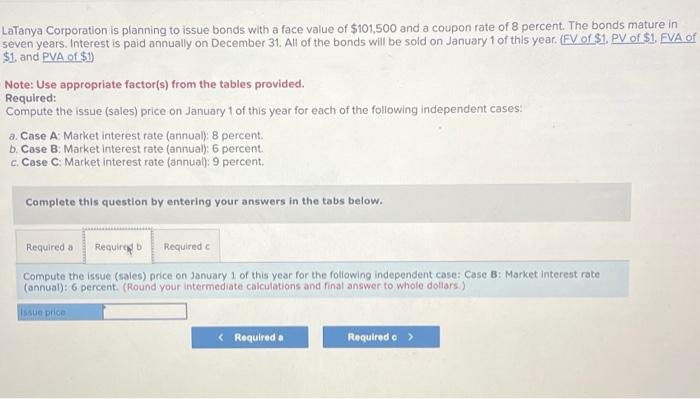

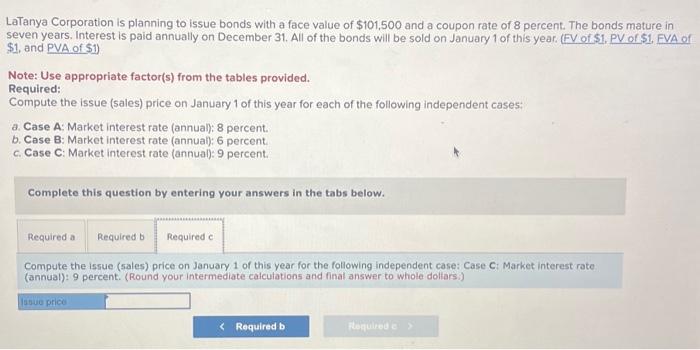

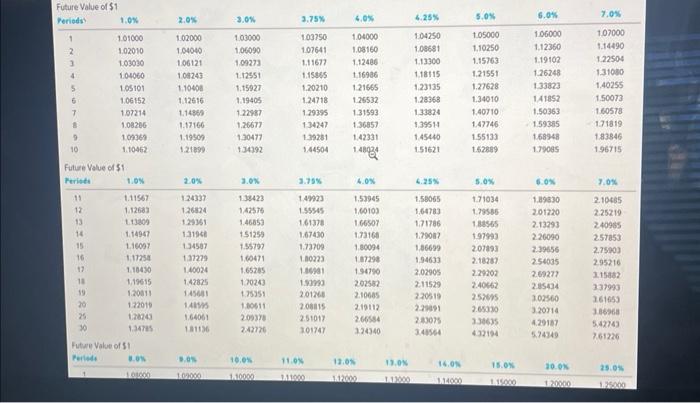

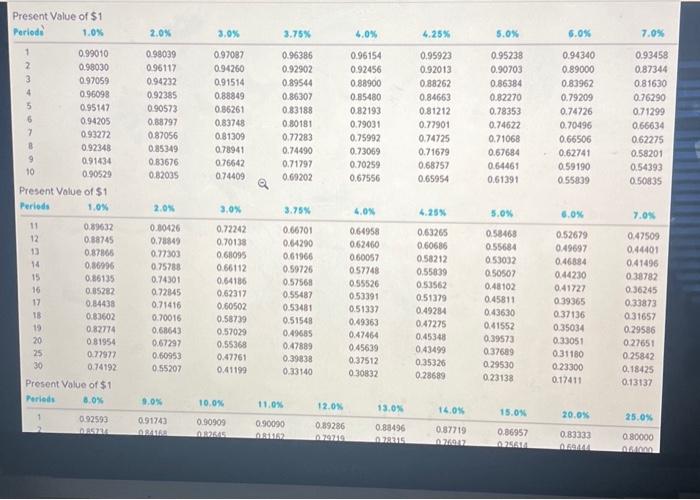

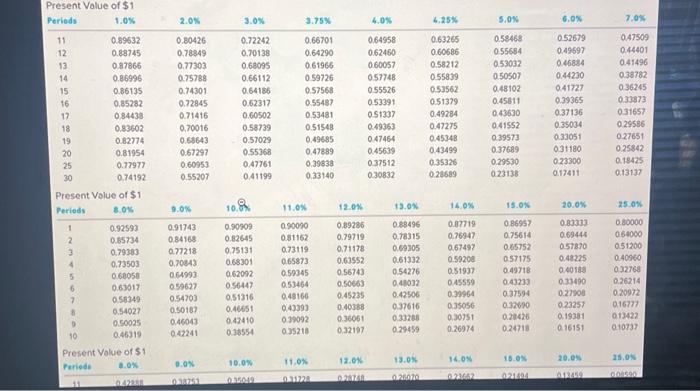

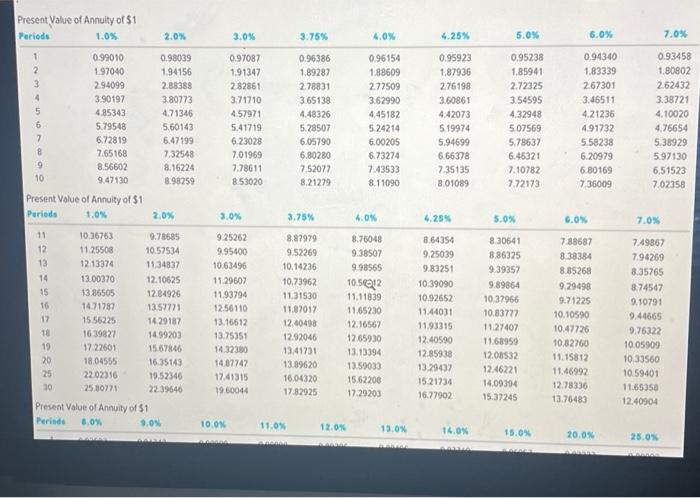

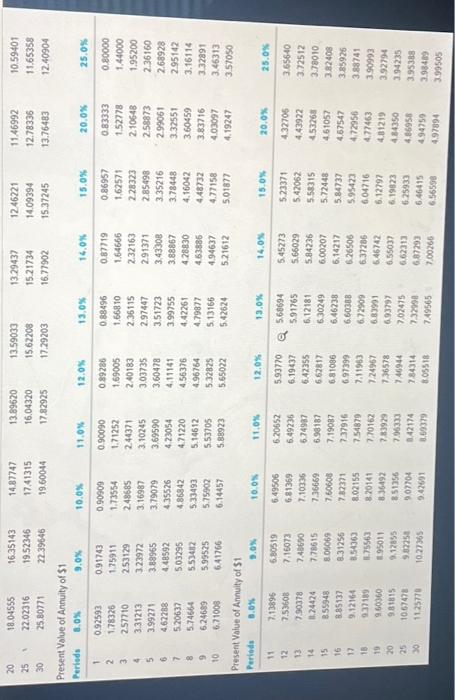

LaTanya Corporation is planning to issue bonds with a face value of $101,500 and a coupon rate of 8 percent. The bonds mature in seven years. Interest is paid annually on December 31. All of the bonds will be sold on January 1 of this year. (EV of \$1, PV of \$1. EVA of $1 and PVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annual): 8 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual): 9 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case A: Market interest rate (annual): 8 percent. (Round your intermediate calculations and final answer to whole doliarsi) LaTanya Corporation is planning to issue bonds with a face value of $101,500 and a coupon rate of 8 percent. The bonds mature in seven years. Interest is paid annually on December 31. All of the bonds will be sold on January 1 of thls year. (FV of \$1. PV of \$1. FVA of \$1, and PVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annual): 8 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual): 9 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case B: Market interest rate (annual): 6 percent. (Round your intermediate calculations and final answer to whole dollars). LaTanya Corporation is planning to issue bonds with a face value of $101,500 and a coupon rate of 8 percent. The bonds mature in seven years. Interest is paid annually on December 31. All of the bonds will be sold on January 1 of this year. (FV of S1. PV or S1. FVA of \$1, and PVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annual); 8 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual): 9 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case C : Market interest rate (annual): 9 percent. (Round your intermediate calcutations and final answer to whole dollarsi) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Future Value of \$1 } \\ \hline Ferieds? & 1.0% & 2.0% & 3.0% & 2.75% & 4.05 & 4.25% & 5.04 & 6.0% & 7,0% \\ \hline 1 & 101000 & 1.02000 & 1.03000 & 103750 & 1.04000 & 1.04250 & 105000 & 1.06000 & 1.07000 \\ \hline 2 & 1.02010 & 1.04040 & 1.06090 & 107641 & 1.08160 & 1.00681 & 1,10250 & 1.12360 & 1.14490 \\ \hline 3 & 103030 & 106121 & 10927 & 1,11677 & 1,12486 & 1.13300 & 1.15763 & 1.19102 & 1.22504 \\ \hline 4 & 1.04060 & 104243 & 1.12551 & 1.1545 & 1,16936 & 1.18115 & 1.21551 & 1.26248 & 1.31040 \\ \hline 5 & 105101 & 1.1040e & 1.15927 & 1.20210 & 1.21665 & 1.23135 & 1.27628 & 1.33823 & 1,40255 \\ \hline 6 & 1.06152 & 1.12616 & 1.19405 & 1.24718 & 1.25532 & 1.28363 & 1.34010 & 1.4185? & 1.50073 \\ \hline 7 & 1.97214 & 1,14359 & 1.2258 & 1.29355 & 131593 & 1,33824 & 1.40710 & 1.50363 & 100578 \\ \hline B & 1.08286 & 1.17166 & 1.2667 & 134247 & 1.36857 & 1.39514 & 1.47746 & 1.59365 & 171619 \\ \hline 9 & 100369 & 1.19509 & 130477 & 139281 & 1.42331 & 1.45440 & 1.55133 & 1.68248 & 1.83846 \\ \hline 10 & 1.10462 & 1.21es & +34292 & 1.44504 & 1.48024 & 151621 & 1.52889 & 179085 & 196715 \\ \hline \multicolumn{10}{|c|}{ Future Value of \$1 } \\ \hline Periste & 1.0x & 2.0% & 3.0x & 3.75% & 4.0x & 6.25% & 5.0x & 6.0x & 3.00 \\ \hline 11 & 1.11967 & 124337 & 130423 & 1.4923 & 1.53945 & 1,58065 & 1.71034 & 1. 1.9330 & 2.10465 \\ \hline 12 & 1.12683 & 126824 & 1,42575 & 1.S5545 & 1,0010) & 1,64783 & 1.79585 & 201220 & 2.25219 \\ \hline 13 & 1.13809 & 12481 & 1.46053 & 1.61378 & 1.60507 . & 1771786 & 188545 & 2.13793 & 240955 \\ \hline 14 & 1.14947 & 13196t & 151259 & 1.67430 & 17316 & l.7000? & 19753 & 226090 & 2.5 tas3 \\ \hline 15 & 1.16007 & 13407 & 1.55797 & 1.73709 & 1.30094 & 1.8669 & 207193 & 2.39656 & 2.75003 \\ \hline 16 & 1,17254 & 13727 & 1.60471 & I.nop23 & 107298 & 194633 & & 254035 & 295216 \\ \hline 17 & 1.10430 & 1.40024 & 1.65205 & 1.4691 & 1947% & 2.02905 & 27202 & 269277 & 1.5at? \\ \hline 11 & 19615 & 1.42875 & 120243 & 1.50m & 202502 & 211529 & 2.40642 & 2.85434 & 337999 \\ \hline 19 & I.20411 & 1.45691 & 1.75251 & 201248 & 2.10005 & 270619 & 2515 & 102560 & 361659 \\ \hline 20 & inots & talls & 100511 & 200415 & 219112 & & 2.6539 & 3.20914 & 316969 \\ \hline 25 & 120243 & 1.64061 & 200375 & 2.51017 & 2coss4 & 200% & 330635 & 4.29187 & 5.42743 \\ \hline w & 1.3675 & 131136 & 2.4376 & 101747 & 124940 & 341564 & 432154 & 5.74349 & 261226 \\ \hline \multicolumn{10}{|c|}{\begin{tabular}{l} Future Value of \$1 \\ Ferleds \end{tabular}} \\ \hline Perlate & .ow & s.es & 10.0% & 11.0N & 12.0% & 16.0N & is.ox & 20.0K & 25.0% \\ \hline 1 & & 102000 & 140000 & 111000 & 112000 & 14000 & 114000 & 120000 & 1.25000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Present Value of \$1 } & \multirow[b]{2}{*}{2.0%} & \multirow[b]{2}{*}{3.0%} & \multirow[b]{2}{*}{3.75%} & \multirow[b]{2}{*}{4.0%} & \multirow[b]{2}{*}{4.25%} & \multirow[b]{2}{*}{5.0%} & \multirow[b]{2}{*}{6.0%} & \multirow[b]{2}{*}{7.0%} \\ \hline Periedi' & 1.0% & & & & & & & & \\ \hline 1 & 0.99010 & 0.98039 & 097087 & 0.96386 & 0.96154 & 0.95923 & 0.95238 & 0.94340 & 0.93458 \\ \hline 2 & 0.99030 & 096117 & 094260 & 0.92902 & 0.92456 & 0.92013 & 0.90703 & 0.89000 & 0.87344 \\ \hline 3 & 0.97059 & 0.94232 & 0.91514 & 0.89544 & 0.88900 & 0.88262 & 0.86384 & 0.83962 & 0.81630 \\ \hline 4 & 0.96098 & 0.92385 & 0.88849 & 0.86307 & 0.85480 & 0.84663 & 0.82270 & 0.79209 & 0.76290 \\ \hline 5 & 0.95147 & 0.90573 & 0.86261 & 0.83188 & 0.82193 & 0.81212 & 0.78353 & 0.74726 & 0.71299 \\ \hline 6 & 0.94205 & 0.88797 & 0.83748 & 0.80181 & 0.79031 & 0.77901 & 0.74622 & 0.70496 & 0,66634 \\ \hline 7 & 0.93272 & 0.87056 & 0.81309 & 0.77283 & 0.75992 & 0.74725 & 0.71068 & 0.66506 & 0.62275 \\ \hline 8 & 0.92348 & 0.85349 & 0.78941 & 0.74490 & 0.73069 & 0.71679 & 0.67684 & 0.62741 & 0.58201 \\ \hline 9 & 0.91434 & 0.83676 & 076642 & 0.71797 & 0.70259 & 0.68757 & 0.64461 & 0.59190 & 0.54393 \\ \hline 10 & 0.90529 & 0.82035 & 0.74409 & 0.69202 & 0.67556 & 0.65954 & 0.61391 & 0.55839 & 0.50835 \\ \hline \multicolumn{10}{|c|}{\begin{tabular}{l} Present Value of $1 \\ Periods \end{tabular}} \\ \hline Periods & 1.0% & 2.0% & 3.0% & 3.75% & 4,0x & 4.25% & 5.0 & 6.0% & 7.015 \\ \hline 11 & 0.89632 & 0.80426 & 0.72242 & 0.66701 & 0.64958 & 0.63265 & 0.58468 & 0.52679 & 0.47509 \\ \hline 12 & 088745 & 0.78843 & 0.70138 & 0.64290 & 0.62460 & 0.60686 & 0.55684 & 0.49697 & 0.44401 \\ \hline 13 & 0.87865 & 0.7303 & 0.68095 & 0.61966 & 060057 & 0.53212 & 0.53032 & 0.46894 & 0.41496 \\ \hline 14 & 0.86996 & 0.75788 & 0.66112 & 0.59726 & 05778 & 0.55839 & 0.50507 & 0.44230 & 0.38782 \\ \hline 15 & 0.85135 & 0.74301 & 0.64186 & 0.57568 & 055526 & 0.53562 & 0.48102 & 0.41727 & 0.36245 \\ \hline 16 & 0.15282 & 0.72645 & 0.62317 & 0.55487 & 0.53391 & 0.51379 & 0.45811 & 0.39365 & 0.33873 \\ \hline 17 & 0.84438 & 0.71416 & 0.60502 & 0.53481 & 0.51337 & 0.49284 & 0.43630 & 0.37136 & 0.31657 \\ \hline is & 0.83602 & 0.70016 & 0.58739 & 0.51548 & 0.49363 & 0.47275 & 0.41552 & 0.35034 & 0.29586 \\ \hline 19 & 0.82774 & 0.68643 & 0.57029 & 0.49685 & 0.47464 & 0.45348 & 0.39573 & 0.33051 & 0.27651 \\ \hline 20 & 081954 & 0.67297 & 0.55368 & 0.47889 & 0.45639 & 0.43499 & 0.37689 & 0.31180 & 0.25842 \\ \hline 25 & 0.797 & 0.60953 & 0.47761 & 0.39838 & 0.37512 & 0.35326 & 0.29530 & 0.23300 & 0,18425 \\ \hline 30 & 0.74192 & 0.55207 & 0.41199 & 0.33140 & 0.30832 & 0.23689 & 0.23138 & 0.17411 & 0.13137 \\ \hline \multicolumn{10}{|c|}{\begin{tabular}{l} Present Value of $1 \\ Parieds 8.0% \end{tabular}} \\ \hline Porieds & 8.0% & 9.0% & 10.0% & 11.0% & 13.0% & 14.015 & 15.01 & 20.01 & 25.0% \\ \hline \begin{tabular}{l} 1 \\ 2 \end{tabular} & \begin{tabular}{l} 0.92593. \\ nes723. \end{tabular} & \begin{tabular}{l} 0.91743 \\ as446e. \end{tabular} & \begin{tabular}{l} 0.90909 \\ n. 26.25 \end{tabular} & \begin{tabular}{l} 0.90090 \\ n.41152 \end{tabular} & \begin{tabular}{l} 0.85496 \\ 0.78315 \end{tabular} & \begin{tabular}{l} 0.87719 \\ nz6an \end{tabular} & \begin{tabular}{r} 0.86957 \\ 0.25614 \end{tabular} & \begin{tabular}{l} 0.83333 \\ n.6.MAL \end{tabular} & 0.80000 \\ \hline \end{tabular} Pn