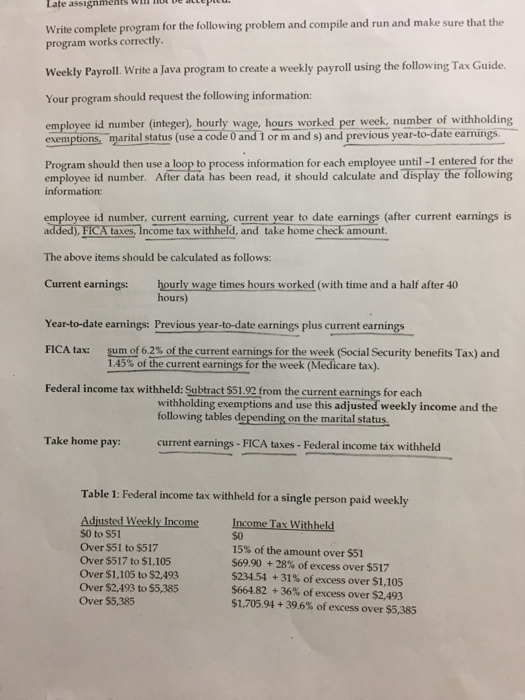

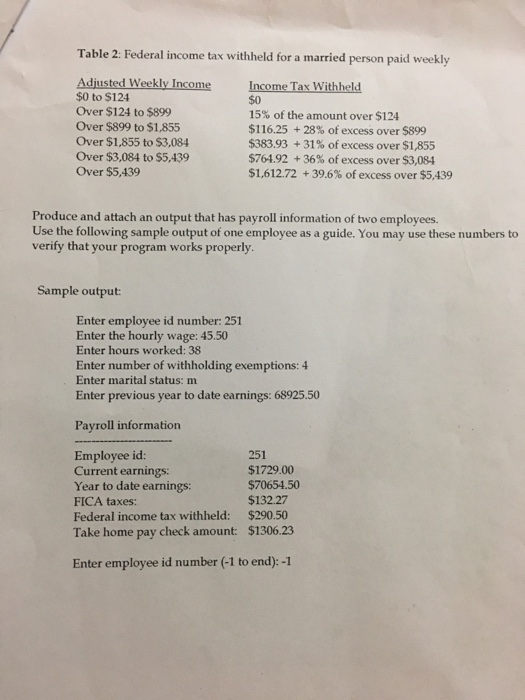

Late assignments w Write complete program for the following problem and compile and run and make sure that the program works correctly. Weekly Payroll. Write a Java program to create a weekly payroll using the following Tax Guide. Your program should request the following information: exemptions, marital status (use a code 0 and 1 or m and s) and previous year-to-date earnings. Program should then use a loop to process information for each employee until -1 entered for the employee id number (integer), hourly wage, hours worked per week, number of withholding employee id number. After data has been read, it should calculate and display the following information: employee id number, current earning, current year to date earnings (after current earnings is added), FICA taxes, Income tax withheld, and take home check amount. The above items should be calculated as follows: Current earnings: hourly wage times hours worked (with time and a half after 40 Year-to-date earnings: Previous year-to-date earnings plus current earnings FICA tax: sum of 6.2% of the current earnings for the week (Social Security benefits Tax) and Federal income tax withheld: Subtract $51.92 from the current earnings for each hours) 1.45% of the current earnings for the week (Medicare tax) withholding exemptions and use this adjusted weekly income and the following tables depending on the marital status Take home pay: current earnings FICA taxes- Federal income tax withheld Table 1: Federal income tax withheld for a single person paid weekly Weekly Income Adjusted S0 to $51 Over $51 to $517 Over $517 to $1,105 Over $1,105 to $2,493 Over $2,493 to $5,385 Over $5,385 Income Tax Withheld $0 15% of the amount over S51 $69.90 + 28% of excess over $517 $234.54 + 31% of excess over $1,105 $664.82 + 36% of excess over S2.493 $1,705.94 + 39.6% of excess over S5385 Late assignments w Write complete program for the following problem and compile and run and make sure that the program works correctly. Weekly Payroll. Write a Java program to create a weekly payroll using the following Tax Guide. Your program should request the following information: exemptions, marital status (use a code 0 and 1 or m and s) and previous year-to-date earnings. Program should then use a loop to process information for each employee until -1 entered for the employee id number (integer), hourly wage, hours worked per week, number of withholding employee id number. After data has been read, it should calculate and display the following information: employee id number, current earning, current year to date earnings (after current earnings is added), FICA taxes, Income tax withheld, and take home check amount. The above items should be calculated as follows: Current earnings: hourly wage times hours worked (with time and a half after 40 Year-to-date earnings: Previous year-to-date earnings plus current earnings FICA tax: sum of 6.2% of the current earnings for the week (Social Security benefits Tax) and Federal income tax withheld: Subtract $51.92 from the current earnings for each hours) 1.45% of the current earnings for the week (Medicare tax) withholding exemptions and use this adjusted weekly income and the following tables depending on the marital status Take home pay: current earnings FICA taxes- Federal income tax withheld Table 1: Federal income tax withheld for a single person paid weekly Weekly Income Adjusted S0 to $51 Over $51 to $517 Over $517 to $1,105 Over $1,105 to $2,493 Over $2,493 to $5,385 Over $5,385 Income Tax Withheld $0 15% of the amount over S51 $69.90 + 28% of excess over $517 $234.54 + 31% of excess over $1,105 $664.82 + 36% of excess over S2.493 $1,705.94 + 39.6% of excess over S5385