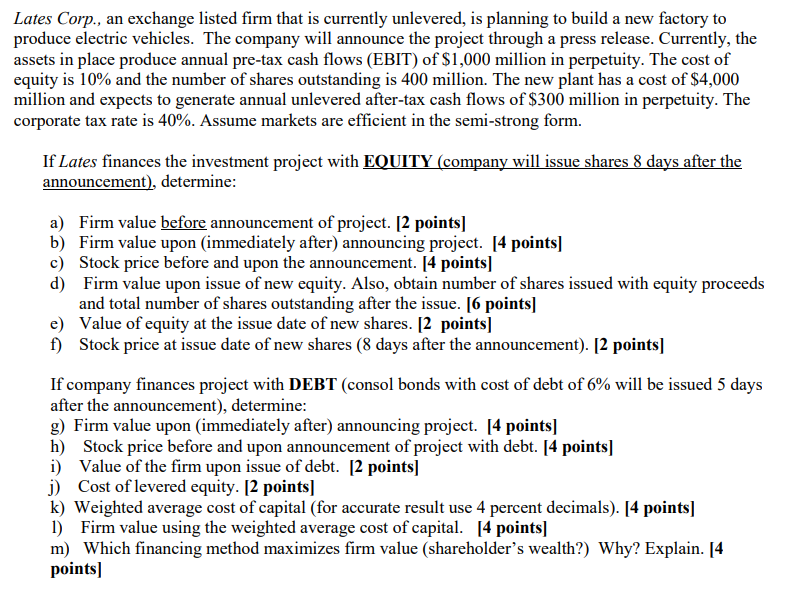

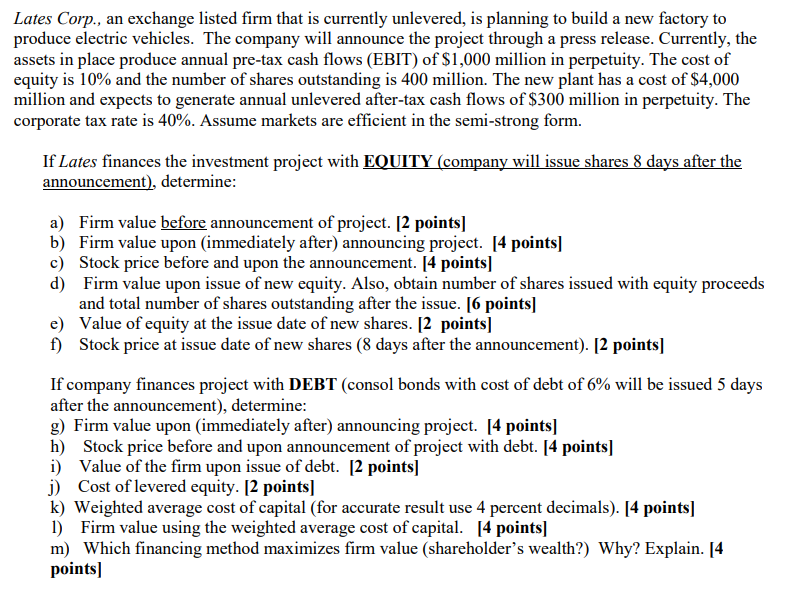

Lates Corp., an exchange listed firm that is currently unlevered, is planning to build a new factory to produce electric vehicles. The company will announce the project through a press release. Currently, the assets in place produce annual pre-tax cash flows (EBIT) of $1,000 million in perpetuity. The cost of equity is 10% and the number of shares outstanding is 400 million. The new plant has a cost of $4,000 million and expects to generate annual unlevered after-tax cash flows of $300 million in perpetuity. The corporate tax rate is 40%. Assume markets are efficient in the semi-strong form. If Lates finances the investment project with EQUITY (company will issue shares 8 days after the announcement), determine: a) Firm value before announcement of project. [2 points] b) Firm value upon (immediately after) announcing project. [4 points] c) Stock price before and upon the announcement. [4 points] d) Firm value upon issue of new equity. Also, obtain number of shares issued with equity proceeds and total number of shares outstanding after the issue. [6 points] e) Value of equity at the issue date of new shares. [2 points] f) Stock price at issue date of new shares ( 8 days after the announcement). [2 points] If company finances project with DEBT (consol bonds with cost of debt of 6% will be issued 5 days after the announcement), determine: g) Firm value upon (immediately after) announcing project. [4 points] h) Stock price before and upon announcement of project with debt. [4 points] i) Value of the firm upon issue of debt. [2 points] j) Cost of levered equity. [2 points] k) Weighted average cost of capital (for accurate result use 4 percent decimals). [4 points] 1) Firm value using the weighted average cost of capital. [4 points] m) Which financing method maximizes firm value (shareholder's wealth?) Why? Explain. [4 points] Lates Corp., an exchange listed firm that is currently unlevered, is planning to build a new factory to produce electric vehicles. The company will announce the project through a press release. Currently, the assets in place produce annual pre-tax cash flows (EBIT) of $1,000 million in perpetuity. The cost of equity is 10% and the number of shares outstanding is 400 million. The new plant has a cost of $4,000 million and expects to generate annual unlevered after-tax cash flows of $300 million in perpetuity. The corporate tax rate is 40%. Assume markets are efficient in the semi-strong form. If Lates finances the investment project with EQUITY (company will issue shares 8 days after the announcement), determine: a) Firm value before announcement of project. [2 points] b) Firm value upon (immediately after) announcing project. [4 points] c) Stock price before and upon the announcement. [4 points] d) Firm value upon issue of new equity. Also, obtain number of shares issued with equity proceeds and total number of shares outstanding after the issue. [6 points] e) Value of equity at the issue date of new shares. [2 points] f) Stock price at issue date of new shares ( 8 days after the announcement). [2 points] If company finances project with DEBT (consol bonds with cost of debt of 6% will be issued 5 days after the announcement), determine: g) Firm value upon (immediately after) announcing project. [4 points] h) Stock price before and upon announcement of project with debt. [4 points] i) Value of the firm upon issue of debt. [2 points] j) Cost of levered equity. [2 points] k) Weighted average cost of capital (for accurate result use 4 percent decimals). [4 points] 1) Firm value using the weighted average cost of capital. [4 points] m) Which financing method maximizes firm value (shareholder's wealth?) Why? Explain. [4 points]