Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Latham Tools is considering purchasing a completely computerized production equipment to replace its existing labor-intensive equipment. The existing equipment has a net book value of

Latham Tools is considering purchasing a completely computerized production equipment to replace its existing labor-intensive equipment. The existing equipment has a net book value of $600.000,a remaining useful life of 4 years and a zero salvage value at that time. If the equjpment is sold today, management beleves they would receie $75,000.

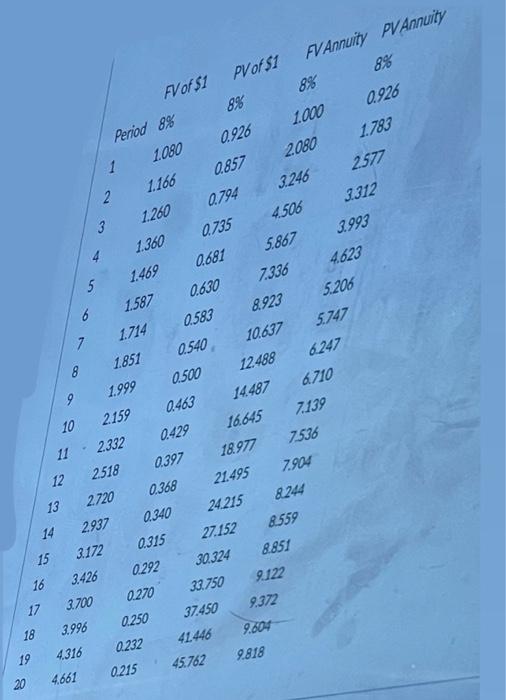

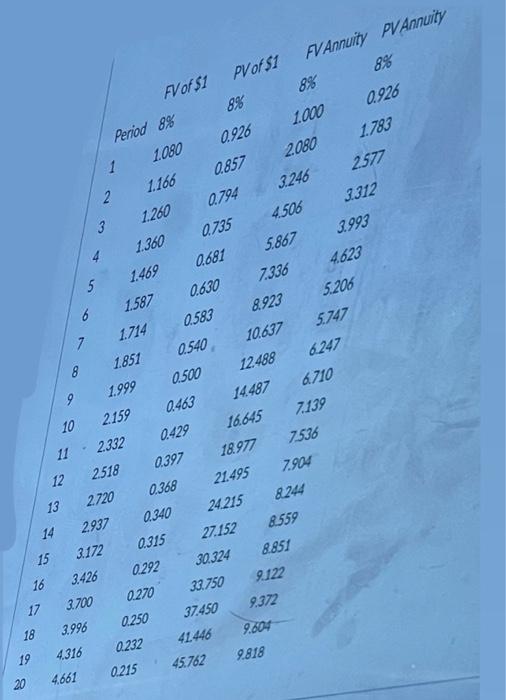

1 2 3 5 FVof1 PV of $1 FV Annuity PV Annuity 8% Period 88 88 0.926 1.080 0.926 1.000 0.857 1.166 1.783 2080 1.260 0794 3.246 2577 1.360 0735 4506 3312 1.469 0.681 5.867 32993 1.587 0.630 7.336 4.623 1.714 0.583 8923 5.206 1.851 10.637 5747 1.999 0.500 12.488 6247 2159 0.463 14.487 6710 0429 16.645 0397 18977 0.368 21.495 7.904 &244 6 7 0.540 8 9 10 7.139 7.536 11 2.332 12 2518 13 2720 14 2.937 0.340 24.215 15 3172 0.315 27.152 8559 16 3.426 0292 30.324 8851 17 3.700 0.270 33.750 9.122 18 3.996 0.250 37.450 9.372 4.316 0.232 41.446 9.601 4.661 0.215 45.762 9.818 19 20 The new equioment is expected to improve quality, be more efficient and reduce annual operating cost by 320,000$ for each of the next four years. The acquisition cost of the equioment is $1,260,000. The equipment is expected to have a zero salvage after its 4 year expected life. The company uses the straight-line method of deprecation for all of its equipment.

Management has determined that the required rate of retum for project of this risk is 8%(minimum accounting return is also 8%) and that the maximum payback period is 3 years. Assume a tar rate of 40%.

1. Analyze the project using each of the following quantitatie approaches: net present value, payback period acual accounting rate of retum and discounted paydack period.

2. Based solely on quantitative factors, should Latham undertake this project? Why or why not ?

3. What qualitative factors should Latham consider in making this decsion?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started