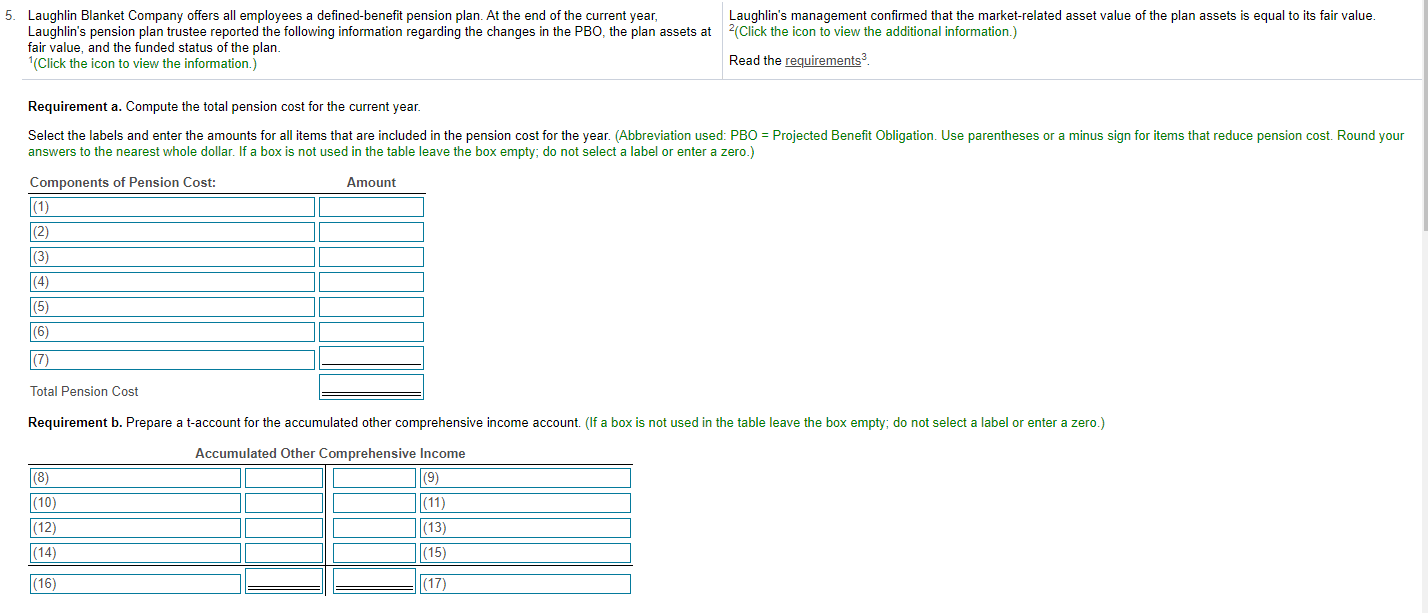

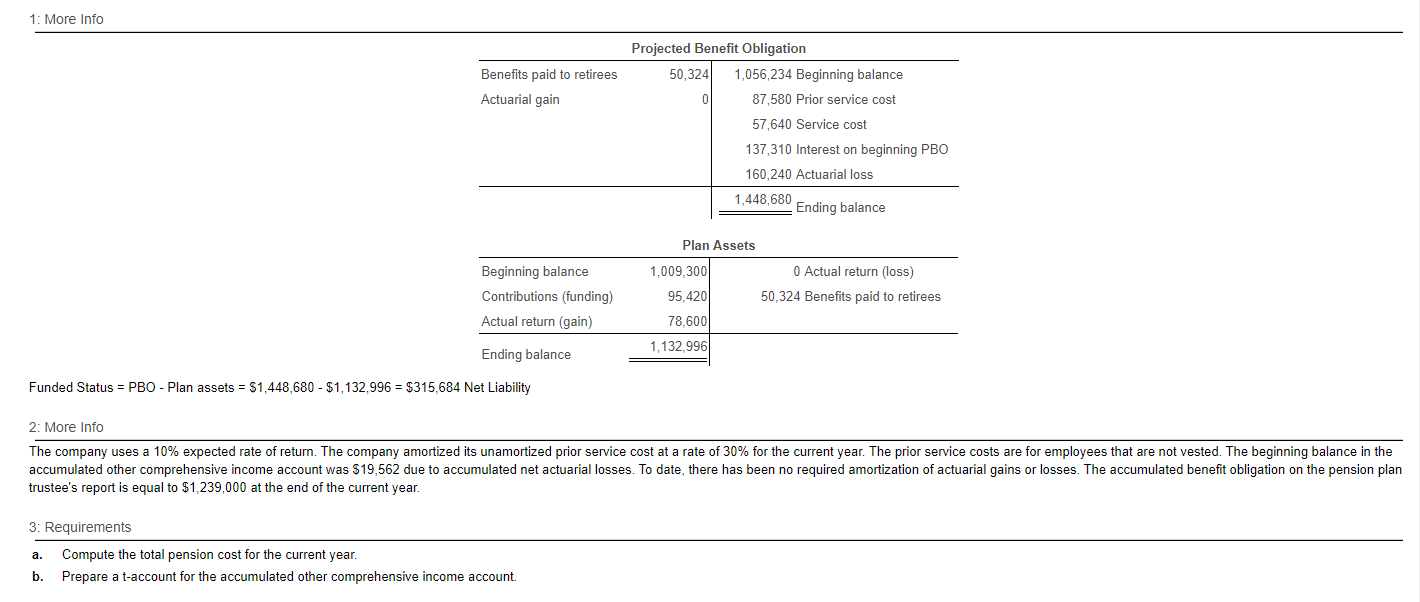

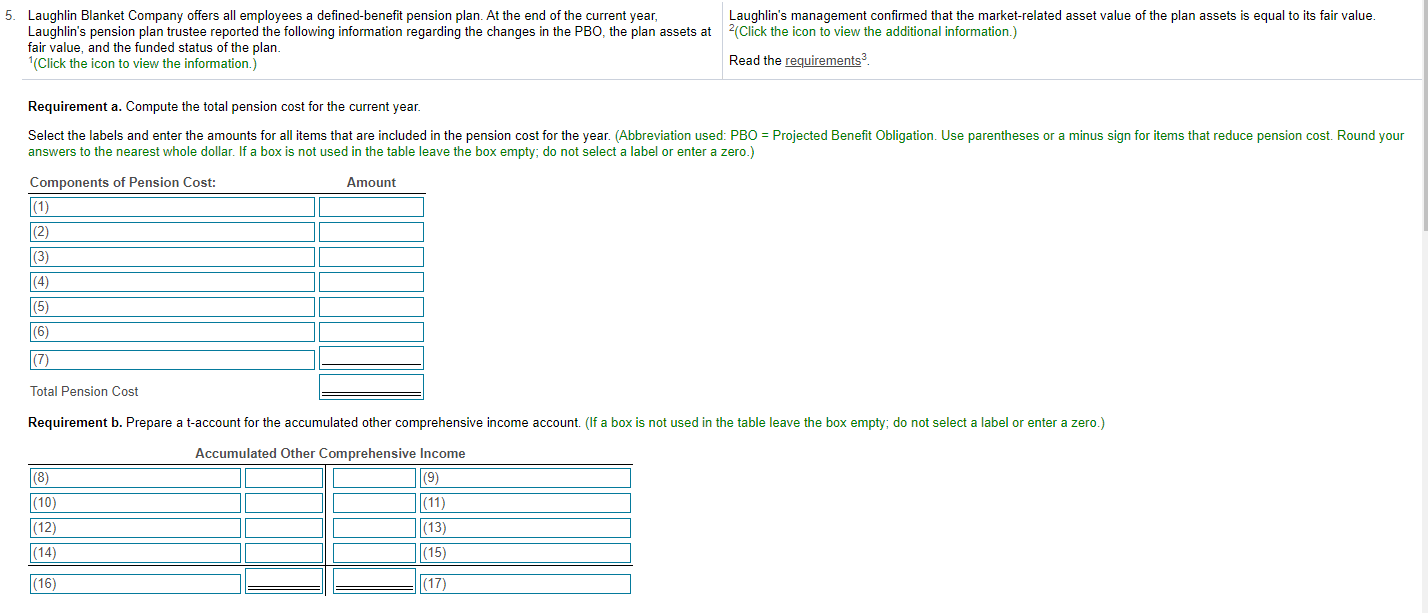

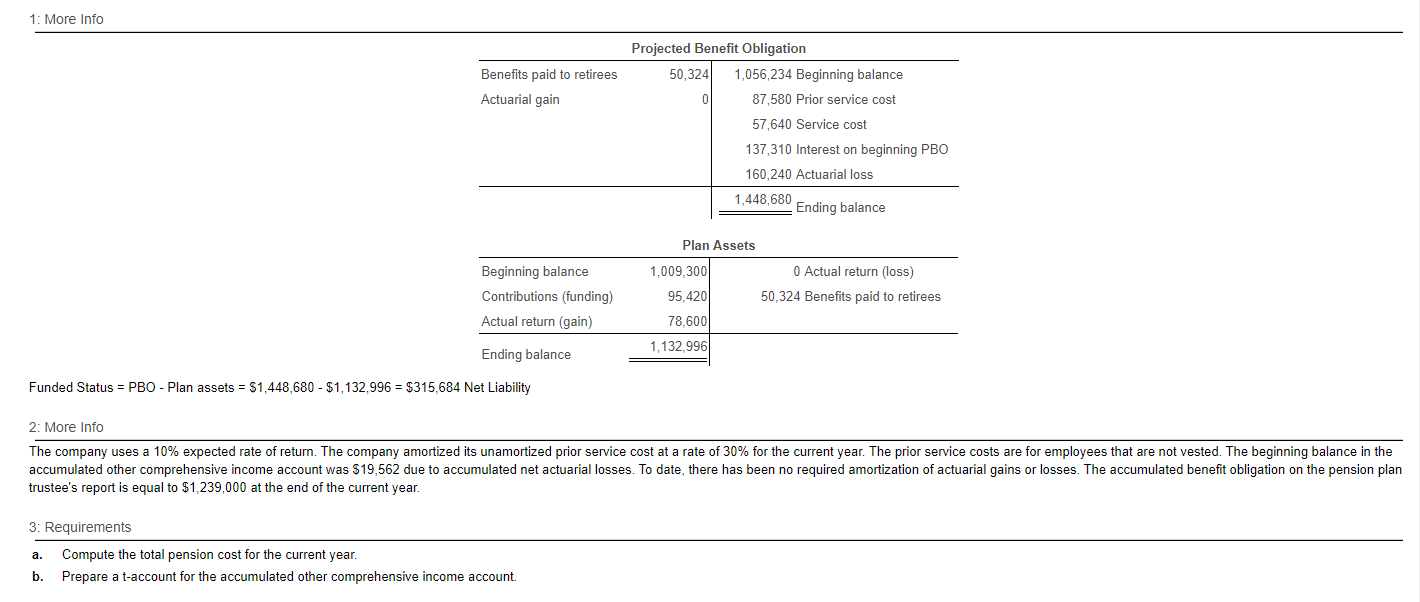

Laughlin's management confirmed that the market-related asset value of the plan assets is equal to its fair value. 2(Click the icon to view the additional information.) 5. Laughlin Blanket Company offers all employees a defined benefit pension plan. At the end of the current year, Laughlin's pension plan trustee reported the following information regarding the changes in the PBO, the plan assets at fair value, and the funded status of the plan. (Click the icon to view the information.) Read the requirements Requirement a. Compute the total pension cost for the current year. Select the labels and enter the amounts for all items that are included in the pension cost for the year. (Abbreviation used: PBO = Projected Benefit Obligation. Use parentheses or a minus sign for items that reduce pension cost. Round your answers to the nearest whole dollar. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Amount Components of Pension Cost: |(1) (2) (3) (5) (6) (7) Total Pension Cost Requirement b. Prepare a t-account for the accumulated other comprehensive income account. (If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Accumulated Other Comprehensive Income (9) (8) |(10) (12) (11) (13) |(15) (14) (16) (17) 1: More Info Benefits paid to retirees Actuarial gain Projected Benefit Obligation 50,3241 1,056,234 Beginning balance 0 87,580 Prior service cost 57,640 Service cost 137,310 Interest on beginning PBO 160,240 Actuarial loss 1,448,680 Ending balance Plan Assets 1,009.300 Beginning balance Contributions (funding) Actual return (gain) 0 Actual return (loss) 50,324 Benefits paid to retirees 95,420 78,600 1,132.996 Ending balance Funded Status = PBO - Plan assets = $1,448,680 - $1,132,996 = $315,684 Net Liability 2: More Info The company uses a 10% expected rate of return. The company amortized its unamortized prior service cost at a rate of 30% for the current year. The prior service costs are for employees that are not vested. The beginning balance in the accumulated other comprehensive income account was $19,562 due to accumulated net actuarial losses. To date, there has been no required amortization of actuarial gains or losses. The accumulated benefit obligation on the pension plan trustee's report is equal to $1,239,000 at the end of the current year. 3: Requirements a. Compute the total pension cost for the current year. Prepare a t-account for the accumulated other comprehensive income account b. Laughlin's management confirmed that the market-related asset value of the plan assets is equal to its fair value. 2(Click the icon to view the additional information.) 5. Laughlin Blanket Company offers all employees a defined benefit pension plan. At the end of the current year, Laughlin's pension plan trustee reported the following information regarding the changes in the PBO, the plan assets at fair value, and the funded status of the plan. (Click the icon to view the information.) Read the requirements Requirement a. Compute the total pension cost for the current year. Select the labels and enter the amounts for all items that are included in the pension cost for the year. (Abbreviation used: PBO = Projected Benefit Obligation. Use parentheses or a minus sign for items that reduce pension cost. Round your answers to the nearest whole dollar. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Amount Components of Pension Cost: |(1) (2) (3) (5) (6) (7) Total Pension Cost Requirement b. Prepare a t-account for the accumulated other comprehensive income account. (If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Accumulated Other Comprehensive Income (9) (8) |(10) (12) (11) (13) |(15) (14) (16) (17) 1: More Info Benefits paid to retirees Actuarial gain Projected Benefit Obligation 50,3241 1,056,234 Beginning balance 0 87,580 Prior service cost 57,640 Service cost 137,310 Interest on beginning PBO 160,240 Actuarial loss 1,448,680 Ending balance Plan Assets 1,009.300 Beginning balance Contributions (funding) Actual return (gain) 0 Actual return (loss) 50,324 Benefits paid to retirees 95,420 78,600 1,132.996 Ending balance Funded Status = PBO - Plan assets = $1,448,680 - $1,132,996 = $315,684 Net Liability 2: More Info The company uses a 10% expected rate of return. The company amortized its unamortized prior service cost at a rate of 30% for the current year. The prior service costs are for employees that are not vested. The beginning balance in the accumulated other comprehensive income account was $19,562 due to accumulated net actuarial losses. To date, there has been no required amortization of actuarial gains or losses. The accumulated benefit obligation on the pension plan trustee's report is equal to $1,239,000 at the end of the current year. 3: Requirements a. Compute the total pension cost for the current year. Prepare a t-account for the accumulated other comprehensive income account b