Answered step by step

Verified Expert Solution

Question

1 Approved Answer

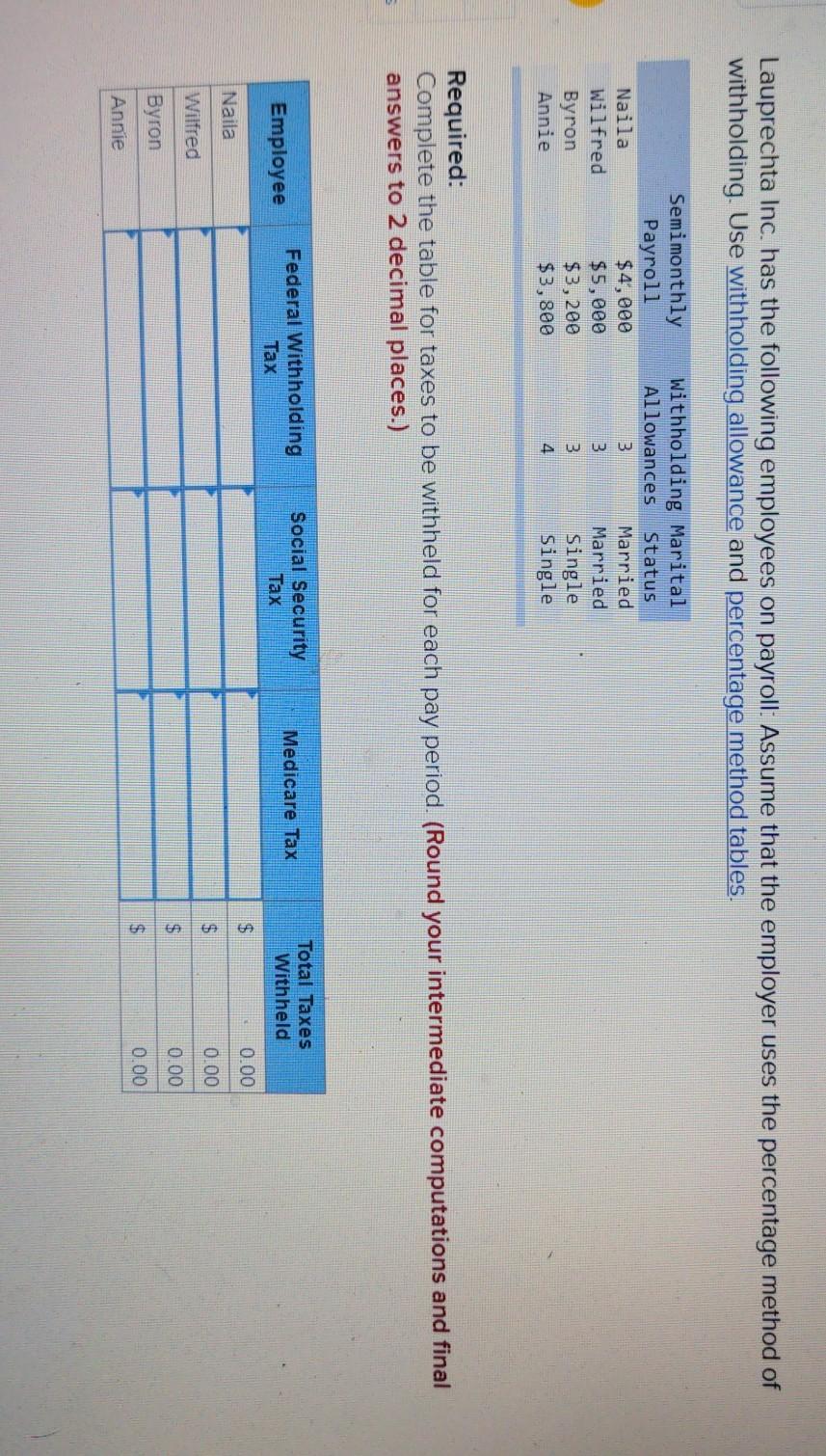

Lauprechta Inc. has the following employees on payroll: Assume that the employer uses the percentage method of withholding. Use withholding allowance and percentage method tables.

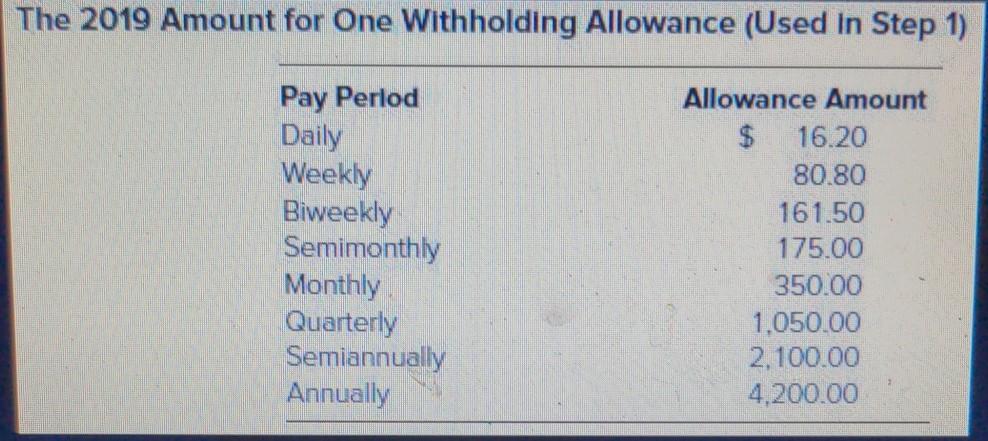

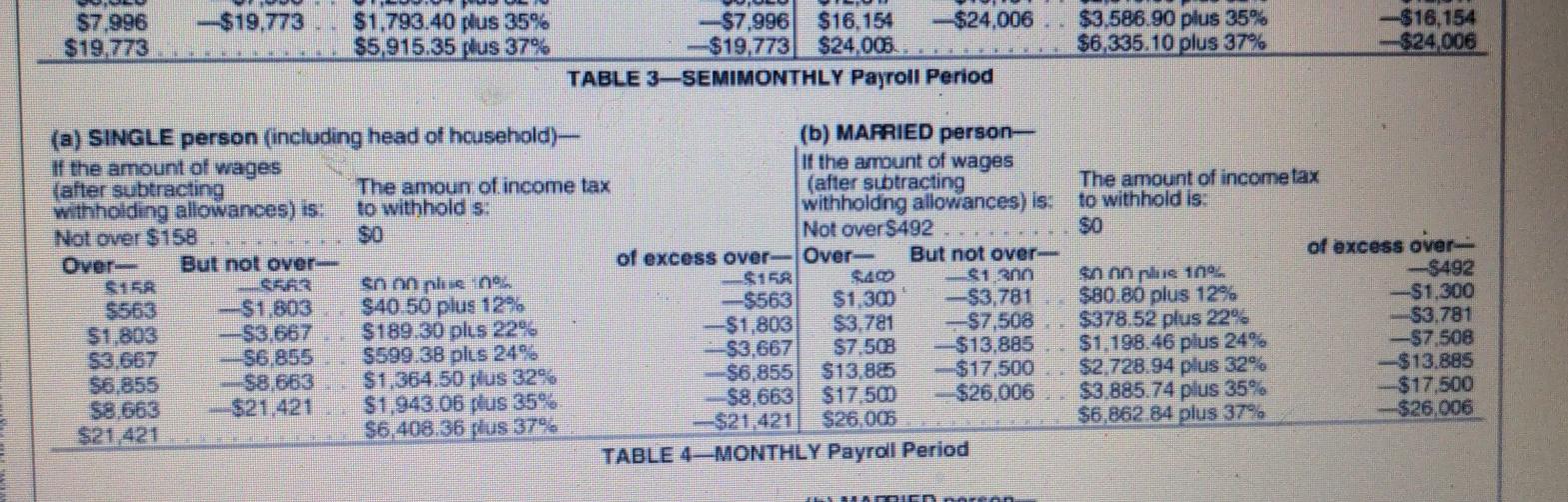

Lauprechta Inc. has the following employees on payroll: Assume that the employer uses the percentage method of withholding. Use withholding allowance and percentage method tables. Naila Wilfred Byron Annie Semimonthly Payroll $4,000 $5,000 $3,200 $3,800 Withholding Marital Allowances Status 3 Married 3 Married 3 Single 4 Single Required: Complete the table for taxes to be withheld for each pay period. (Round your intermediate computations and final answers to 2 decimal places.) Federal Withholding Tax Social Security Tax Medicare Tax Employee Total Taxes Withheld 0.00 Naila $ 0.00 Wilfred $ 0.00 Byron $ $ 0.00 Annie The 2019 Amount for One Withholding Allowance (Used In Step 1) Pay Perlod Daily Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Allowance Amount 16.20 80.80 161.50 175.00 350.00 1.050.00 2,100.00 4,200.00 $19,773 $7.996 $19.773 $1.793.40 plus 35% $5,915.35 plus 37% -$7,996 $16.154 $24,006 -$19,773 $24.005. TABLE 3-SEMIMONTHLY Payroll Period $3.586.90 plus 35% $6,335.10 plus 37% -$16,154 -$24,006 (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amoun of income tax (after subtracting withholding allowances) is: to withhold s: withholdng allowances) is. Not over $158 SO Not over $492 Over- But not over of excess over-Over- But not over- Sn on nie SAO $1.200 $563 -$1.803 $40.50 plus 12% $563 $1,30 $3,781 $1,803 -$3.667 $189.30 plus 22% $1,803 $3,781 -$7,508 53.667 -56.855 $599.38 plus 24% __$3.667 $7.50B $13.885 $6,855 58.663 $1,364.50 plus 32% $6,855 $13,885 $17,500 $8.663 $21,421 $1.943.06 plus 35% _$8,663 $17.500 $26,006 $21.421 $6.408.36 plus 374 $26.005 TABLE 4-MONTHLY Payroll Period The amount of income tax to withhold is: so of excess over sonoplive 100% -$492 $80.80 plus 12% -$1.300 $378.52 plus 22% $3.781 $1.198.46 plus 24% -57,508 $2,728.94 plus 32% -$13.885 $3,885.74 plus 35% --$17,500 $6,862.84 plus 37% $26,006 orean

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started