Answered step by step

Verified Expert Solution

Question

1 Approved Answer

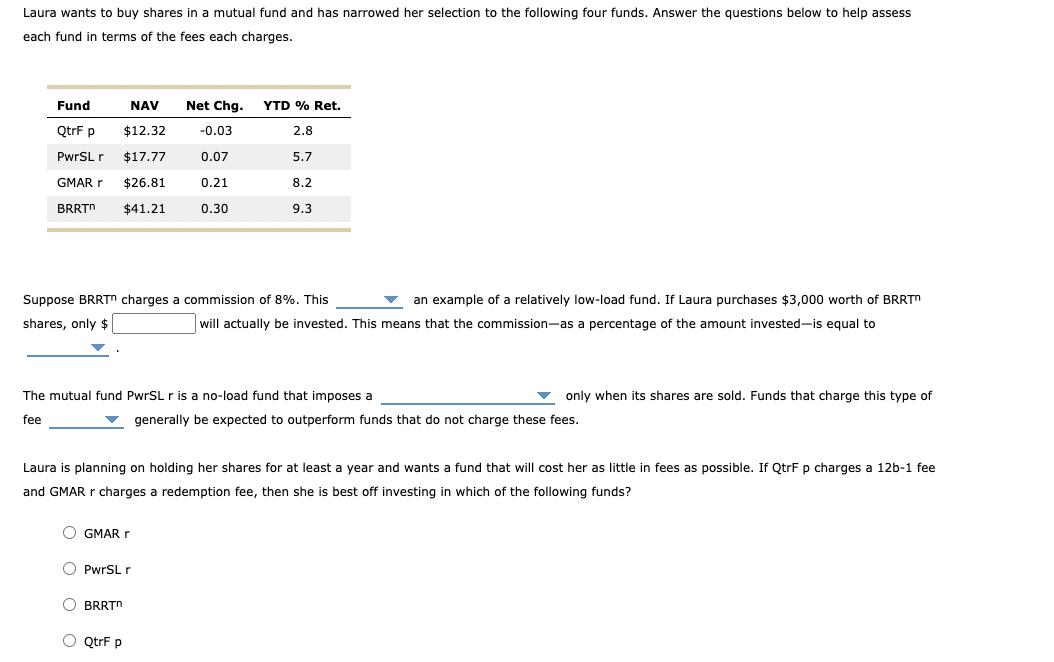

Laura wants to buy shares in a mutual fund and has narrowed her selection to the following four funds. Answer the questions below to

Laura wants to buy shares in a mutual fund and has narrowed her selection to the following four funds. Answer the questions below to help assess each fund in terms of the fees each charges. Fund NAV Net Chg. YTD % Ret. QtrF p $12.32 -0.03 2.8 PwrSL r $17.77 0.07 5.7 GMAR r $26.81 0.21 8.2 BRRTn $41.21 0.30 9.3 Suppose BRRT charges a commission of 8%. This shares, only $ an example of a relatively low-load fund. If Laura purchases $3,000 worth of BRRT" will actually be invested. This means that the commission-as a percentage of the amount invested-is equal to The mutual fund PwrSL r is a no-load fund that imposes a only when its shares are sold. Funds that charge this type of fee generally be expected to outperform funds that do not charge these fees. Laura is planning on holding her shares for at least a year and wants a fund that will cost her as little in fees as possible. If QtrF p charges a 12b-1 fee and GMAR r charges a redemption fee, then she is best off investing in which of the following funds? GMAR r PwrSL r BRRTn QtrF p O O O O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started