Answered step by step

Verified Expert Solution

Question

1 Approved Answer

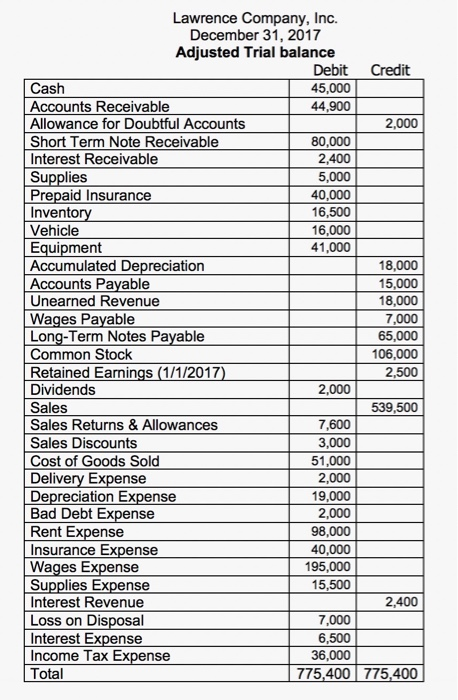

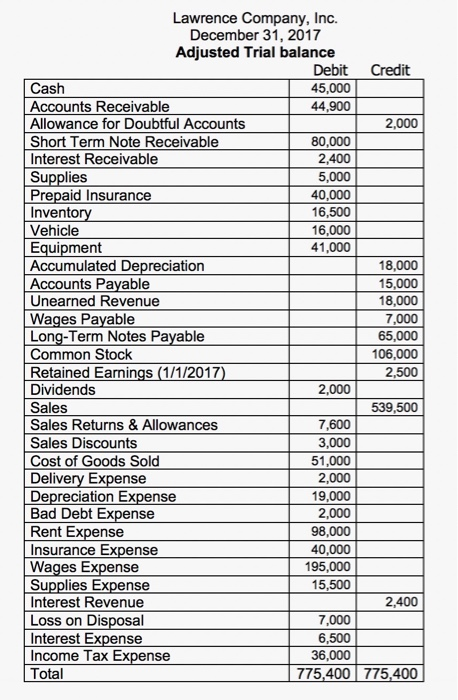

Lawrence Company, Inc. December 31, 2017 Adjusted Trial balance Debit Credit Cash 45,000 Accounts Receivable 44,900 Allowance for Doubtful Accounts 2,000 Short Term Note Receivable

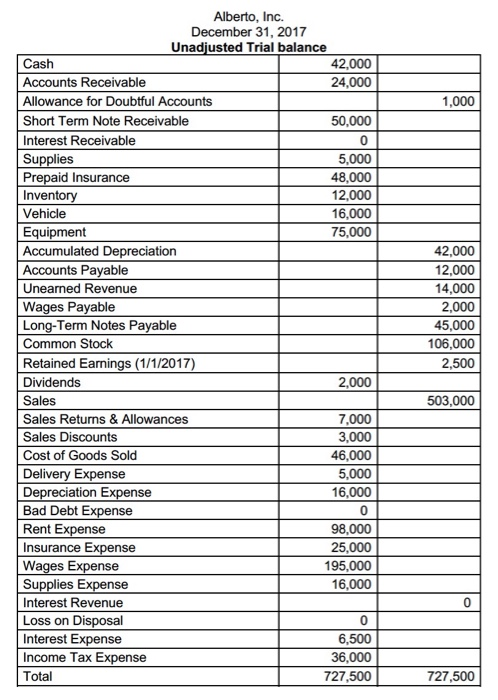

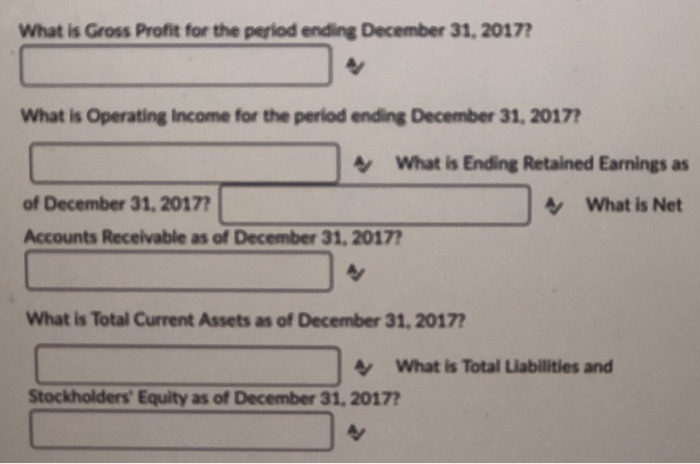

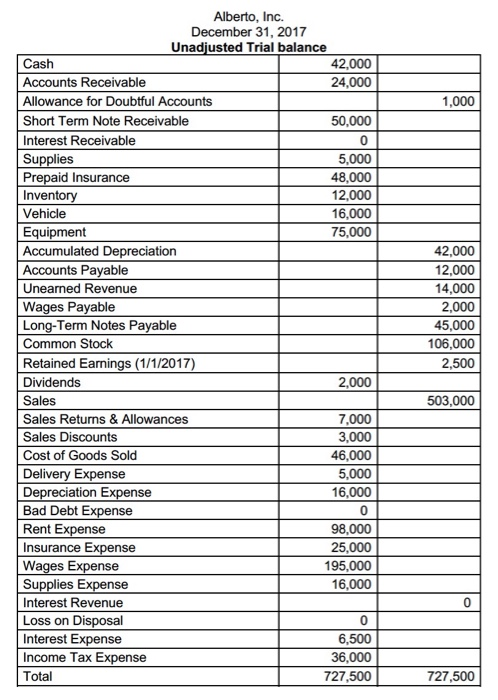

Lawrence Company, Inc. December 31, 2017 Adjusted Trial balance Debit Credit Cash 45,000 Accounts Receivable 44,900 Allowance for Doubtful Accounts 2,000 Short Term Note Receivable 80,000 Interest Receivable 2,400 Supplies 5,000 Prepaid Insurance 40,000 Inventory 16,500 Vehicle 16,000 Equipment 41,000 Accumulated Depreciation 18,000 Accounts Payable 15,000 Unearned Revenue 18,000 Wages Payable 7,000 Long-Term Notes Payable 65,000 Common Stock 106,000 Retained Earnings (1/1/2017) 2,500 Dividends 2,000 Sales 539,500 Sales Returns & Allowances 7,600 Sales Discounts 3,000 Cost of Goods Sold 51,000 Delivery Expense 2,000 Depreciation Expense 19,000 Bad Debt Expense 2,000 Rent Expense 98,000 Insurance Expense 40,000 Wages Expense 195,000 Supplies Expense 15,500 Interest Revenue 2,400 Loss on Disposal 7,000 Interest Expense 6,500 Income Tax Expense 36,000 Total 775,400 | 775,400 1,000 Alberto, Inc. December 31, 2017 Unadjusted Trial balance Cash 42,000 Accounts Receivable 24,000 Allowance for Doubtful Accounts Short Term Note Receivable 50,000 Interest Receivable 0 Supplies 5,000 Prepaid Insurance 48,000 Inventory 12,000 Vehicle 16,000 Equipment 75,000 Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2017) Dividends 2,000 Sales Sales Returns & Allowances 7,000 Sales Discounts 3,000 Cost of Goods Sold 46,000 Delivery Expense 5,000 Depreciation Expense 16,000 Bad Debt Expense 0 Rent Expense 98,000 Insurance Expense 25,000 Wages Expense 195,000 Supplies Expense 16,000 Interest Revenue Loss on Disposal 0 Interest Expense 6,500 Income Tax Expense 36,000 Total 727,500 42,000 12,000 14,000 2,000 45,000 106,000 2,500 503,000 727,500 What is Gross Profit for the period ending December 31, 2017? What is Operating Income for the period ending December 31, 2017? What is Ending Retained Earnings as What is Net of December 31, 2017? Accounts Receivable as of December 31, 2017? What is Total Current Assets as of December 31, 2017? What is Total Liabilities and Stockholders' Equity as of December 31, 2017

Lawrence Company, Inc. December 31, 2017 Adjusted Trial balance Debit Credit Cash 45,000 Accounts Receivable 44,900 Allowance for Doubtful Accounts 2,000 Short Term Note Receivable 80,000 Interest Receivable 2,400 Supplies 5,000 Prepaid Insurance 40,000 Inventory 16,500 Vehicle 16,000 Equipment 41,000 Accumulated Depreciation 18,000 Accounts Payable 15,000 Unearned Revenue 18,000 Wages Payable 7,000 Long-Term Notes Payable 65,000 Common Stock 106,000 Retained Earnings (1/1/2017) 2,500 Dividends 2,000 Sales 539,500 Sales Returns & Allowances 7,600 Sales Discounts 3,000 Cost of Goods Sold 51,000 Delivery Expense 2,000 Depreciation Expense 19,000 Bad Debt Expense 2,000 Rent Expense 98,000 Insurance Expense 40,000 Wages Expense 195,000 Supplies Expense 15,500 Interest Revenue 2,400 Loss on Disposal 7,000 Interest Expense 6,500 Income Tax Expense 36,000 Total 775,400 | 775,400 1,000 Alberto, Inc. December 31, 2017 Unadjusted Trial balance Cash 42,000 Accounts Receivable 24,000 Allowance for Doubtful Accounts Short Term Note Receivable 50,000 Interest Receivable 0 Supplies 5,000 Prepaid Insurance 48,000 Inventory 12,000 Vehicle 16,000 Equipment 75,000 Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2017) Dividends 2,000 Sales Sales Returns & Allowances 7,000 Sales Discounts 3,000 Cost of Goods Sold 46,000 Delivery Expense 5,000 Depreciation Expense 16,000 Bad Debt Expense 0 Rent Expense 98,000 Insurance Expense 25,000 Wages Expense 195,000 Supplies Expense 16,000 Interest Revenue Loss on Disposal 0 Interest Expense 6,500 Income Tax Expense 36,000 Total 727,500 42,000 12,000 14,000 2,000 45,000 106,000 2,500 503,000 727,500 What is Gross Profit for the period ending December 31, 2017? What is Operating Income for the period ending December 31, 2017? What is Ending Retained Earnings as What is Net of December 31, 2017? Accounts Receivable as of December 31, 2017? What is Total Current Assets as of December 31, 2017? What is Total Liabilities and Stockholders' Equity as of December 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started