Question

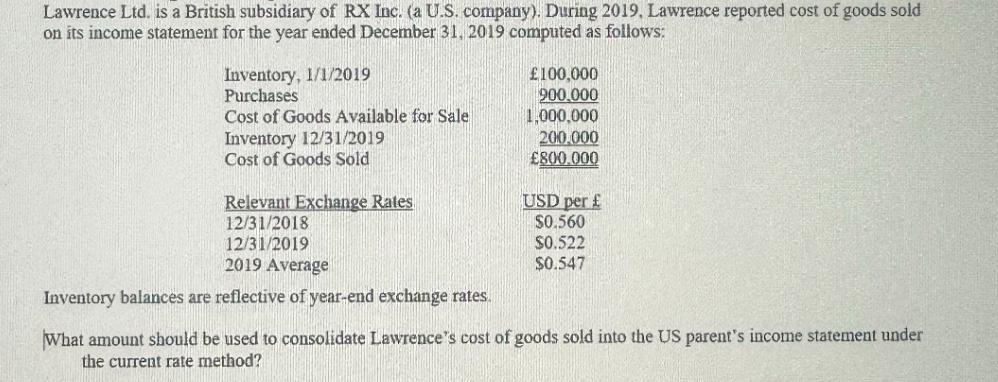

Lawrence Ltd. is a British subsidiary of RX Inc. (a U.S. company). During 2019. Lawrence reported cost of goods sold on its income statement

Lawrence Ltd. is a British subsidiary of RX Inc. (a U.S. company). During 2019. Lawrence reported cost of goods sold on its income statement for the year ended December 31, 2019 computed as follows: Inventory, 1/1/2019 Purchases 100,000 900.000 Cost of Goods Available for Sale 1,000,000 Inventory 12/31/2019 200.000 Cost of Goods Sold 800.000 Relevant Exchange Rates USD per 12/31/2018 $0.560 12/31/2019 $0.522 2019 Average $0.547 Inventory balances are reflective of year-end exchange rates. What amount should be used to consolidate Lawrence's cost of goods sold into the US parent's income statement under the current rate method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

1st edition

978-0133251579, 133251578, 013216230X, 978-0134102313, 134102312, 978-0132162302

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App