Answered step by step

Verified Expert Solution

Question

1 Approved Answer

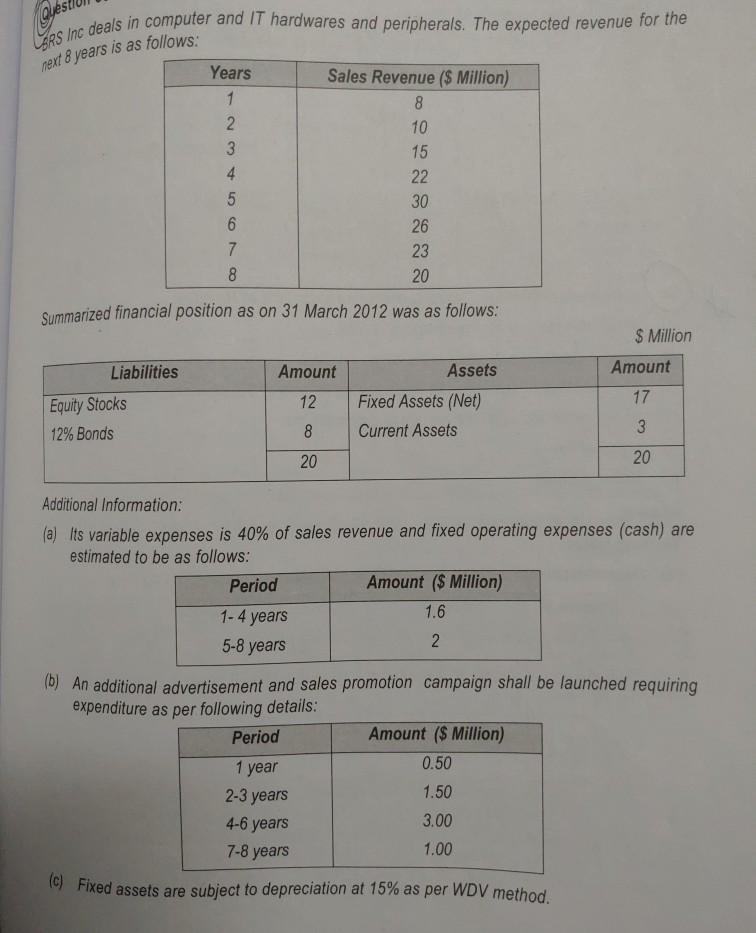

Layes next 8 years is as follows: LARS Inc deals in computer and IT hardwares and peripherals. The expected revenue for the Years 1 2

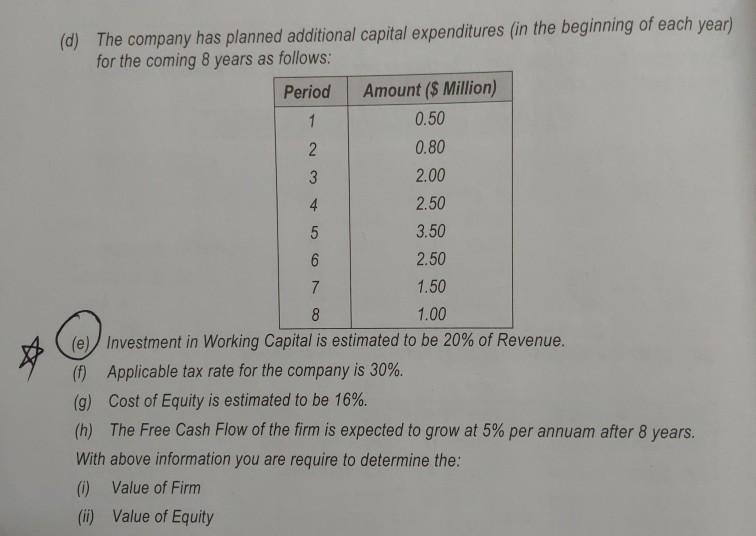

Layes next 8 years is as follows: LARS Inc deals in computer and IT hardwares and peripherals. The expected revenue for the Years 1 2 3 4 5 6 7 8 Sales Revenue ($ Million) 8 10 15 22 30 26 23 20 Summarized financial position as on 31 March 2012 was as follows: $ Million Amount Liabilities Amount 12 Assets Fixed Assets (Net) Current Assets Equity Stocks 12% Bonds 17 8 3 20 20 Additional Information: (a) Its variable expenses is 40% of sales revenue and fixed operating expenses (cash) are estimated to be as follows: Period Amount ($ Million) 1.6 1-4 years 2 5-8 years (b) An additional advertisement and sales promotion campaign shall be launched requiring expenditure as per following details: Period Amount ($ Million) 1 year 0.50 2-3 years 1.50 4-6 years 3.00 7-8 years 1.00 (c) Fixed assets are subject to depreciation at 15% as per WDV method. (d) The company has planned additional capital expenditures (in the beginning of each year) for the coming 8 years as follows: Period Amount ($ Million) 1 0.50 2 0.80 3 2.00 4 2.50 5 3.50 6 2.50 7 1.50 8 1.00 (e) Investment in Working Capital is estimated to be 20% of Revenue. 0 Applicable tax rate for the company is 30%. (9) Cost of Equity is estimated to be 16%. (h) The Free Cash Flow of the firm is expected to grow at 5% per annuam after 8 years. With above information you are require to determine the: (0) Value of Firm (ii) Value of Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started