Question

LBB Bank has experienced the following trends over the past five years (all figures in millions of dollars): Year Total Operating Net Income Total

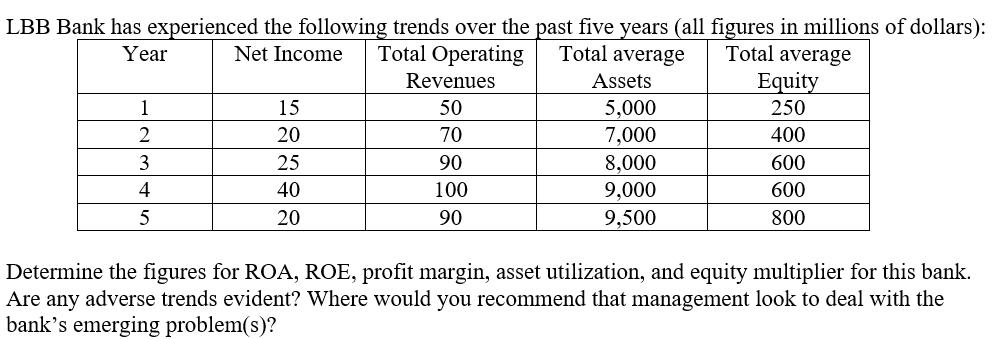

LBB Bank has experienced the following trends over the past five years (all figures in millions of dollars): Year Total Operating Net Income Total average Total average Revenues Assets Equity 1 15 50 5,000 250 2 20 70 7,000 400 3 25 90 8,000 600 4 40 100 9,000 600 5 20 90 9,500 800 Determine the figures for ROA, ROE, profit margin, asset utilization, and equity multiplier for this bank. Are any adverse trends evident? Where would you recommend that management look to deal with the bank's emerging problem(s)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Bank Management and Financial Services

Authors: Peter Rose, Sylvia Hudgins

9th edition

78034671, 978-0078034671

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App