Answered step by step

Verified Expert Solution

Question

1 Approved Answer

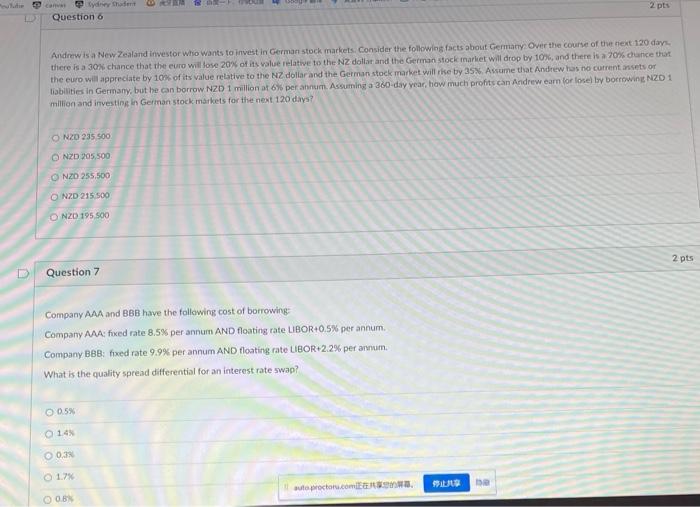

LD Question 6 O NZD 235,500 O NZD 205,500 ONZD 255,500 O NZD 215,500 O NZD 195,500 Question 7 Andrew is a New Zealand

LD Question 6 O NZD 235,500 O NZD 205,500 ONZD 255,500 O NZD 215,500 O NZD 195,500 Question 7 Andrew is a New Zealand investor who wants to invest in German stock markets. Consider the following facts about Germany: Over the course of the next 120 days. there is a 30% chance that the euro will lose 20% of its value relative to the NZ dollar and the German stock market will drop by 10%, and there is a 70% chance that the euro will appreciate by 10% of its value relative to the NZ dollar and the German stock market will rise by 35%. Assume that Andrew has no current assets or liabilities in Germany, but he can borrow NZD 1 million at 6% per annum. Assuming a 360-day year, how much profits can Andrew earn for lose) by borrowing NZD 1 million and investing in German stock markets for the next 120 days? ATE O 0.5% 120- Company AAA and BBB have the following cost of borrowing: Company AAA: fixed rate 8.5% per annum AND floating rate LIBOR+0.5% per annum. Company BBB: fixed rate 9.9% per annum AND floating rate LIBOR+2.2% per annum. What is the quality spread differential for an interest rate swap? O 14% O 0.3% 0 1.7% - 0.8% autoproctoru.comEGASSYS. 2 pts ba 2 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 6 Andrews German Investment To determine Andrews potential profit or losswe need to analyze ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started