Answered step by step

Verified Expert Solution

Question

1 Approved Answer

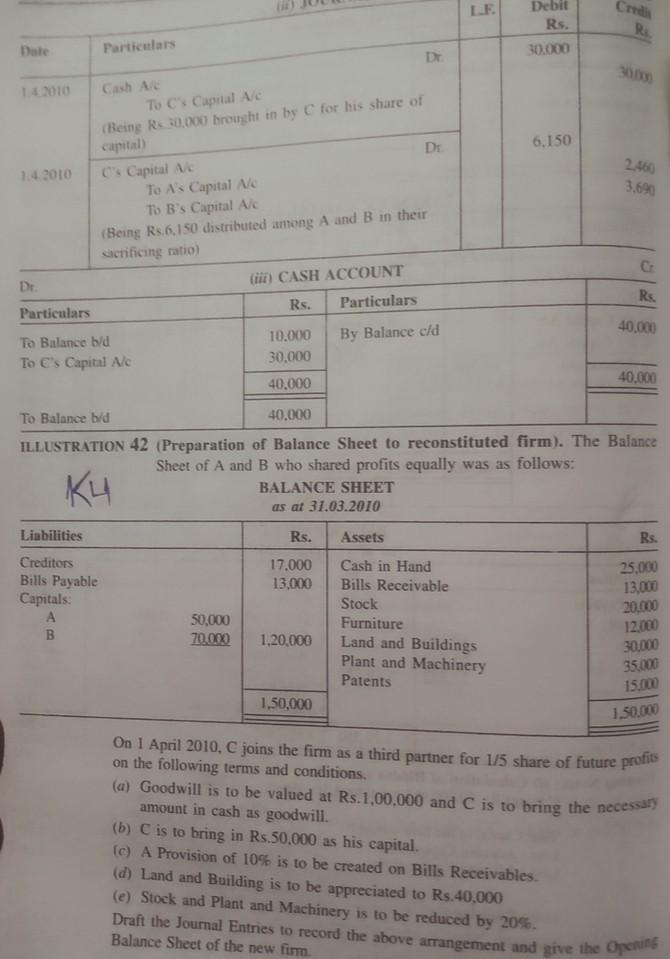

LE Debit Rs. Cri Ri Date Particulars 30.000 6,150 1.4 2010 Dr Cash An To cs Capital we Being Rs 30,000 brought in by C

LE Debit Rs. Cri Ri Date Particulars 30.000 6,150 1.4 2010 Dr Cash An To cs Capital we Being Rs 30,000 brought in by C for his share of capital) C's Capital A Di To A's Capital Ne To B's Capital Alc (Being Rs.6.150 distributed among A and B in their sicrificing ratio) 2460 3.690 C (iii) CASH ACCOUNT De Rs. Particulars Rs. Particulars 40.000 By Balance cld To Balance bd To C's Capital Alc 10.000 30,000 40.000 40.000 To Balance bid 40.000 ILLUSTRATION 42 (Preparation of Balance Sheet to reconstituted firm). The Balance Sheet of A and B who shared profits equally was as follows: BALANCE SHEET as at 31.03.2010 K4 Liabilities Rs. Assets Rs. 17.000 13,000 Creditors Bills Payable Capitals B Cash in Hand Bills Receivable Stock Furniture Land and Buildings Plant and Machinery Patents 25,000 13,000 20.000 12.000 30,000 50,000 70.000 1.20,000 35.000 15.000 1,50,000 1.50.000 On 1 April 2010. C joins the firm as a third partner for 1/5 share of future profits on the following terms and conditions. (a) Goodwill is to be valued at Rs.1,00.000 and C is to bring the necessary amount in cash as goodwill. (b) C is to bring in Rs.50,000 as his capital. (c) A Provision of 10% is to be created on Bills Receivables. (d) Land and Building is to be appreciated to Rs.40.000 (e) Stock and Plant and Machinery is to be reduced by 20%. Draft the Journal Entries to record the above arrangement and give the Opening Balance Sheet of the new firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started