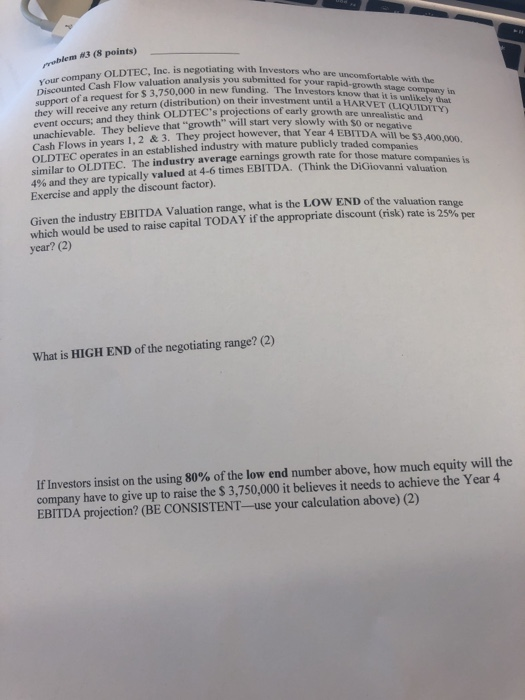

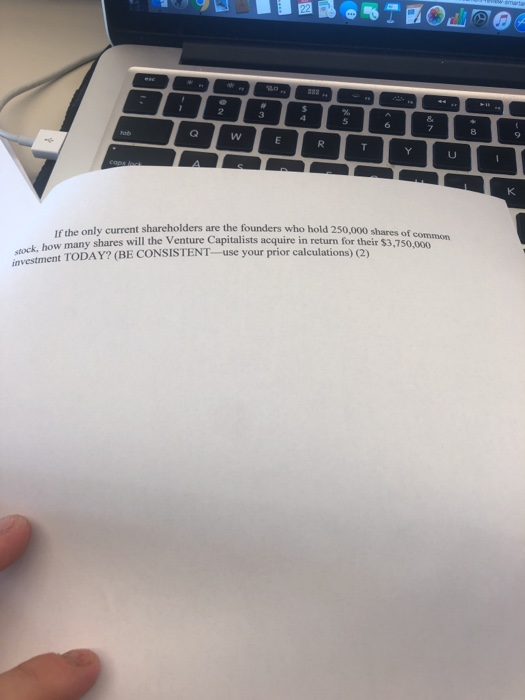

le is negotiating with Investors who are uncomfortable with the analysis you submitted for your rapid-growth stage canin 250 000 in new funding. The Investors know that it is likely distribution) on their investment until a HARVET (LIOMITYS OUDTEC's projections of early growth are unrealistic and blem 3 (8 points) Your company OLDTEC, Inc. is Discounted Cash Flow valuation analysis yo support of a request for $ 3.750,000 in ne they will receive any return (distribution) on their in event occurs; and they think OLDTEC's project achievable. They believe that growth will start very slowly with Cash Flows in years 1, 2 & 3. They project however, that Year 4 ER OLDTEC operates in an established industry with mature publicly traded Hegative similar to OLDTEC. The industry average earnings growth rate for those matu 49% and they are typically valued at 4-6 times EBITDA. (Think the DiGiovanni Exercise and apply the discount factor). ver, that Year 4 EBITDA will be $3.400000 th mature publicly traded companies eines growth rate for those mature companies is BITDA. (Think the DiGiovanni valuation LOW END of the valuation range Given the industry EBITDA Valuation range, what is the LOW END of the value which would be used to raise capital TODAY if the appropriate discount (risk) rate is 250 year? (2) What is HIGH END of the negotiating range? (2) If Investors insist on the using 80% of the low end number above, how much equity will the company have to give up to raise the $3,750,000 it believes it needs to achieve the Year 4 EBITDA projection? (BE CONSISTENT- use your calculation above) (2) QwERTYUI who hold 250,000 shares of common If the only current shareholders are the founders who hold 250,000 shares how many shares will the Venture Capitalists acquire in return for their $3.750.00 investment vestment TODAY? (BE CONSISTENT- use your prior calculations) (2) le is negotiating with Investors who are uncomfortable with the analysis you submitted for your rapid-growth stage canin 250 000 in new funding. The Investors know that it is likely distribution) on their investment until a HARVET (LIOMITYS OUDTEC's projections of early growth are unrealistic and blem 3 (8 points) Your company OLDTEC, Inc. is Discounted Cash Flow valuation analysis yo support of a request for $ 3.750,000 in ne they will receive any return (distribution) on their in event occurs; and they think OLDTEC's project achievable. They believe that growth will start very slowly with Cash Flows in years 1, 2 & 3. They project however, that Year 4 ER OLDTEC operates in an established industry with mature publicly traded Hegative similar to OLDTEC. The industry average earnings growth rate for those matu 49% and they are typically valued at 4-6 times EBITDA. (Think the DiGiovanni Exercise and apply the discount factor). ver, that Year 4 EBITDA will be $3.400000 th mature publicly traded companies eines growth rate for those mature companies is BITDA. (Think the DiGiovanni valuation LOW END of the valuation range Given the industry EBITDA Valuation range, what is the LOW END of the value which would be used to raise capital TODAY if the appropriate discount (risk) rate is 250 year? (2) What is HIGH END of the negotiating range? (2) If Investors insist on the using 80% of the low end number above, how much equity will the company have to give up to raise the $3,750,000 it believes it needs to achieve the Year 4 EBITDA projection? (BE CONSISTENT- use your calculation above) (2) QwERTYUI who hold 250,000 shares of common If the only current shareholders are the founders who hold 250,000 shares how many shares will the Venture Capitalists acquire in return for their $3.750.00 investment vestment TODAY? (BE CONSISTENT- use your prior calculations) (2)