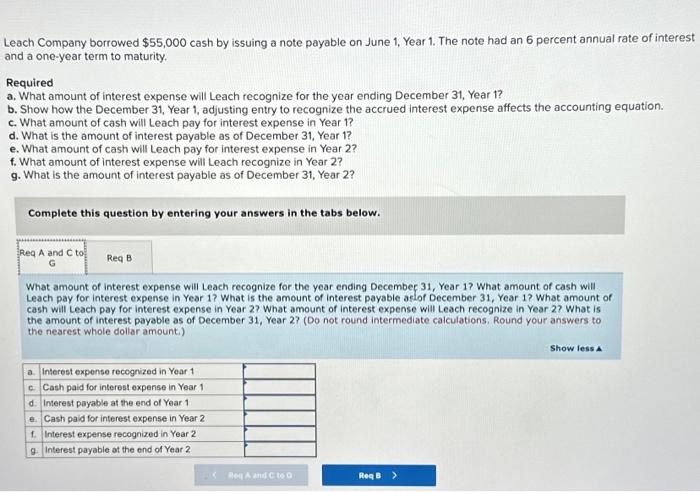

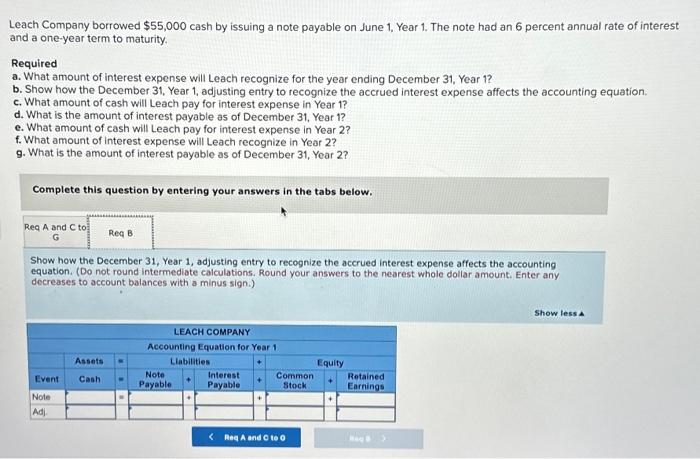

Leach Company borrowed $55,000 cash by issuing a note payable on June 1, Year 1 . The note had an 6 percent annual rate of interes and a one-year term to maturity. Required a. What amount of interest expense will Leach recognize for the year ending December 31 , Year 1 ? b. Show how the December 31 , Year 1 , adjusting entry to recognize the accrued interest expense affects the accounting equation. c. What amount of cash will Leach pay for interest expense in Year 1? d. What is the amount of interest payable as of December 31 , Year 1 ? e. What amount of cash will Leach pay for interest expense in Year 2? f. What amount of interest expense will Leach recognize in Year 2 ? g. What is the amount of interest payable as of December 31, Year 2 ? Complete this question by entering your answers in the tabs below. What amount of interest expense will Leach recognize for the year ending Decembec 31, Year 1 ? What amount of cash will Leach pay for interest expense in Year 1 ? What is the amount of interest payable atlof December 31 , Year 1 ? What amount of cash will Leach pay for interest expense in Year 2 ? What amount of interest expense will Leach recognize in Year 2? What is the amount of interest payable as of December 31 , Year 27 (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Leach Company borrowed $55,000 cash by issuing a note payable on June 1, Year 1 . The note had an 6 percent annual rate of interest and a one-year term to maturity. Required a. What amount of interest expense will Leach recognize for the year ending December 31 , Year 1 ? b. Show how the December 31, Year 1 , adjusting entry to recognize the accrued interest expense affects the accounting equation. c. What amount of cash will Leach pay for interest expense in Year 1 ? d. What is the amount of interest payable as of December 31 , Year 1 ? e. What amount of cash will Leach pay for interest expense in Year 2? f. What amount of interest expense will Leach recognize in Year 2? g. What is the amount of interest payable as of December 31 , Year 2 ? Complete this question by entering your answers in the tabs below. Show how the December 31, Year 1, adjusting entry to recognize the accrued interest expense affects the accounting equation. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Enter any decreases to account balances with a minus sign.)