Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Leach Incorporated experienced the following events for the first two years of its operations: Year 1 : Issued $ 1 0 , 0 0 0

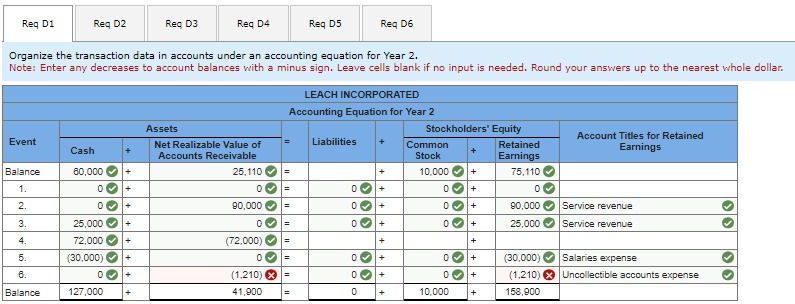

Leach Incorporated experienced the following events for the first two years of its operations: Year : Issued $ of common stock for cash. Provided $ of services on account. Provided $ of services and received cash. Collected $ cash from accounts receivable. Paid $ of salaries expense for the year. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that percent of the ending accounts receivable balance will be uncollectible. Year : Wrote off an uncollectible account for $ Provided $ of services on account. Provided $ of services and collected cash. Collected $ cash from accounts receivable. Paid $ of salaries expense for the year. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that percent of the ending accounts receivable balance will be uncollectible.tableReq DReq DReq DReq D Organize the transaction data in accounts under an accounting equation for Year Note: Enter any decreases to account balances with a minus sign. Leave cells blank if no input is needed. Round your answers up to the nearest whole dollar. Pictured is what i have so far.. IDK how to calculate step

Leach Incorporated experienced the following events for the first two years of its operations:

Year :

Issued $ of common stock for cash.

Provided $ of services on account.

Provided $ of services and received cash.

Collected $ cash from accounts receivable.

Paid $ of salaries expense for the year.

Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that percent of the ending accounts receivable balance will be uncollectible.

Year :

Wrote off an uncollectible account for $

Provided $ of services on account.

Provided $ of services and collected cash.

Collected $ cash from accounts receivable.

Paid $ of salaries expense for the year.

Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that percent of the ending accounts receivable balance will be uncollectible.tableReq DReq DReq DReq D

Organize the transaction data in accounts under an accounting equation for Year

Note: Enter any decreases to account balances with a minus sign. Leave cells blank if no input is needed. Round your answers up to the nearest whole dollar.

Pictured is what i have so far.. IDK how to calculate step

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started