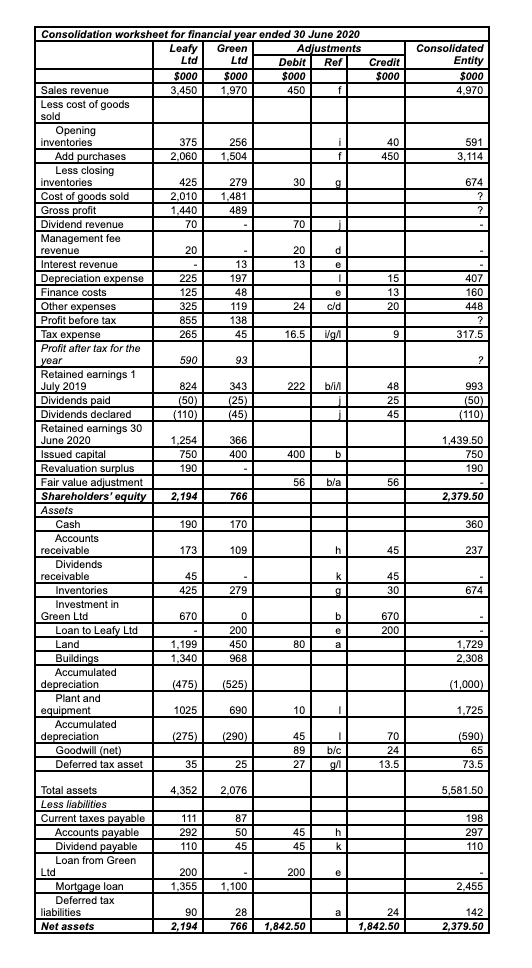

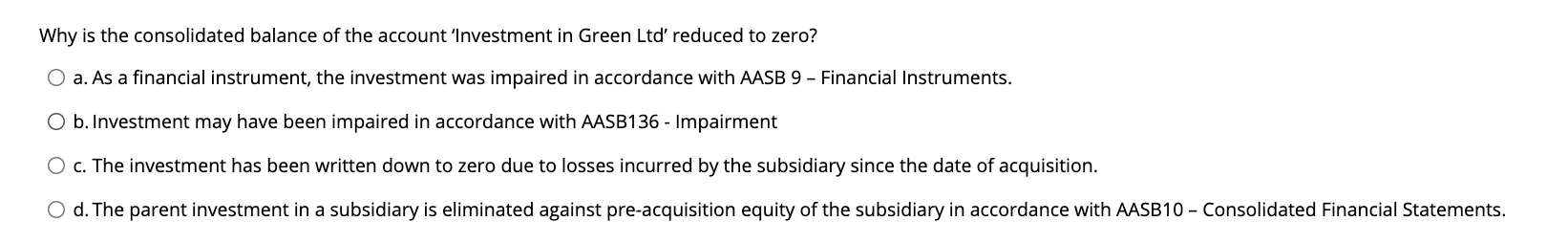

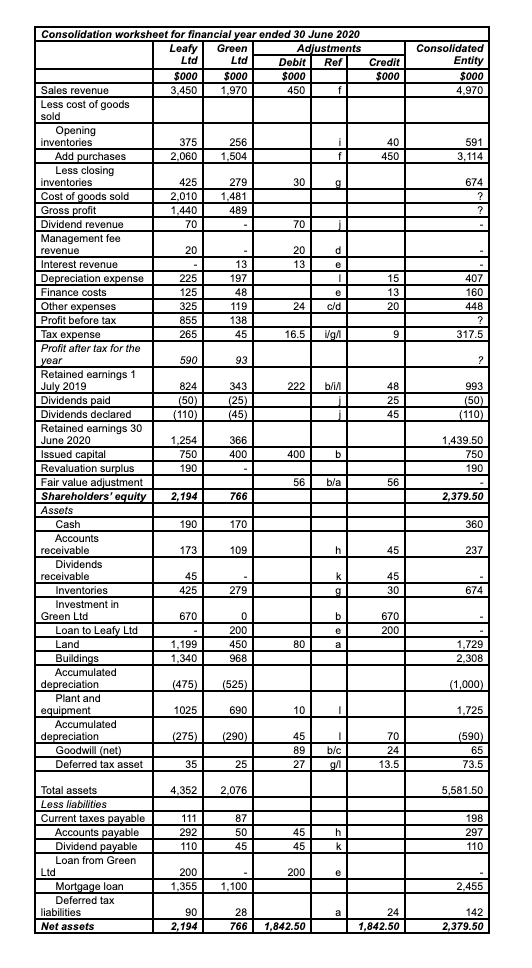

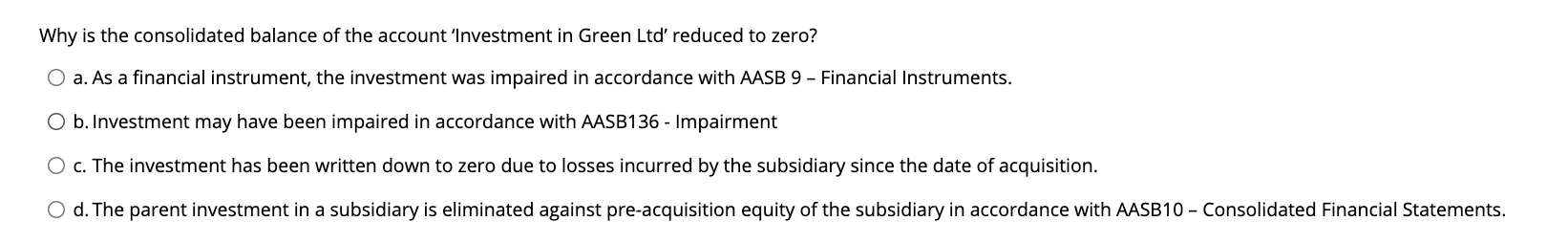

Leafy Credit $000 Consolidated Entity $000 4,970 40 450 591 3,114 674 ? ? 15 13 20 407 160 448 ? 317.5 9 ? Consolidation worksheet for financial year ended 30 June 2020 Green Adjustments Ltd Ltd Debit Ref $000 $000 $000 Sales revenue 3,450 1,970 450 f Less cost of goods sold Opening inventories 375 256 Add purchases 2,060 1,504 f Less closing Inventories 425 279 30 Cost of goods sold 2,010 1,481 Gross profit 1,440 489 Dividend revenue 70 70 Management fee revenue 20 20 d Interest revenue 13 13 e Depreciation expense 225 197 1 Finance costs 125 48 Other expenses 325 119 24 cld Profit before tax 855 138 Tax expense 265 45 16.5 ig/l Profit after tax for the year 590 93 Retained earnings 1 July 2019 824 343 222 b/i Dividends paid (50) (25) Dividends declared (110) (45) i Retained earnings 30 June 2020 1,254 366 Issued capital 750 400 400 b Revaluation surplus 190 Fair value adjustment 56 bla Shareholders' equity 2,194 766 Assets Cash 190 170 Accounts receivable 173 109 h Dividends receivable 45 k Inventories 425 279 g Investment in Green Ltd 670 0 b Loan to Leafy Ltd 200 e Land 1,199 450 80 a a 1.340 968 Accumulated depreciation (475) (525) Plant and equipment 1025 690 10 . Accumulated depreciation (275) (290) 45 1 Goodwill (net) 89 b/c Deferred tax asset 35 25 27 g/ 48 25 45 993 (50) (110) 1,439.50 750 190 56 2,379.50 360 45 237 45 30 674 670 200 Buildings 1,729 2.308 (1,000) 1,725 70 24 13.5 (590) 65 73.5 4.352 2,076 5,581.50 111 292 110 87 50 45 45 45 h k 198 297 110 Total assets Less liabilities Current taxes payable Accounts payable Dividend payable Loan from Green Ltd Mortgage loan Deferred tax liabilities Net assets 200 e 200 1,355 1.100 2,455 90 2,194 28 766 1,842.50 24 1,842.50 142 2,379.50 Why is the consolidated balance of the account 'Investment in Green Ltd reduced to zero? a. As a financial instrument, the investment was impaired in accordance with AASB 9 - Financial Instruments. O b. Investment may have been impaired in accordance with AASB136 - Impairment O c. The investment has been written down to zero due to losses incurred by the subsidiary since the date of acquisition. O d. The parent investment in a subsidiary is eliminated against pre-acquisition equity of the subsidiary in accordance with AASB10 - Consolidated Financial Statements