Answered step by step

Verified Expert Solution

Question

1 Approved Answer

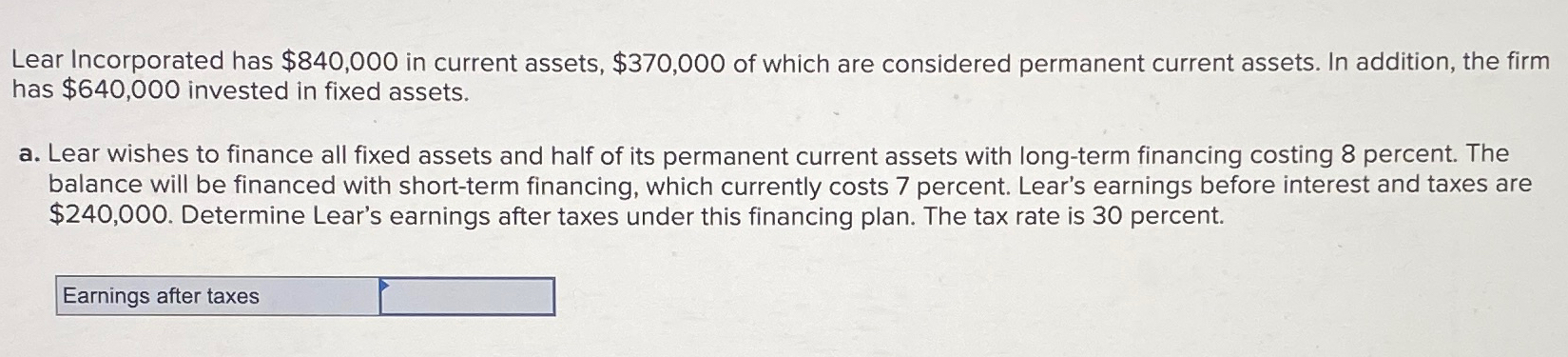

Lear Incorporated has $ 8 4 0 , 0 0 0 in current assets, $ 3 7 0 , 0 0 0 of which are

Lear Incorporated has $ in current assets, $ of which are considered permanent current assets. In addition, the firm has $ invested in fixed assets.

a Lear wishes to finance all fixed assets and half of its permanent current assets with longterm financing costing percent. The balance will be financed with shortterm financing, which currently costs percent. Lear's earnings before interest and taxes are $ Determine Lear's earnings after taxes under this financing plan. The tax rate is percent.

Earnings after taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started