Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lear is to become a partner in the WS partnership by paying $80,000 in cash to the business. At present, the capital balance for

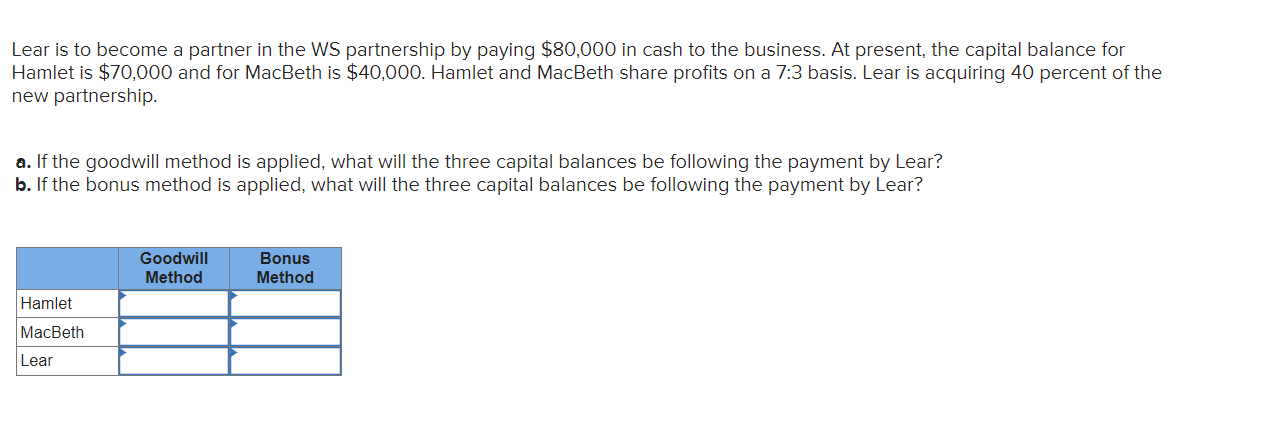

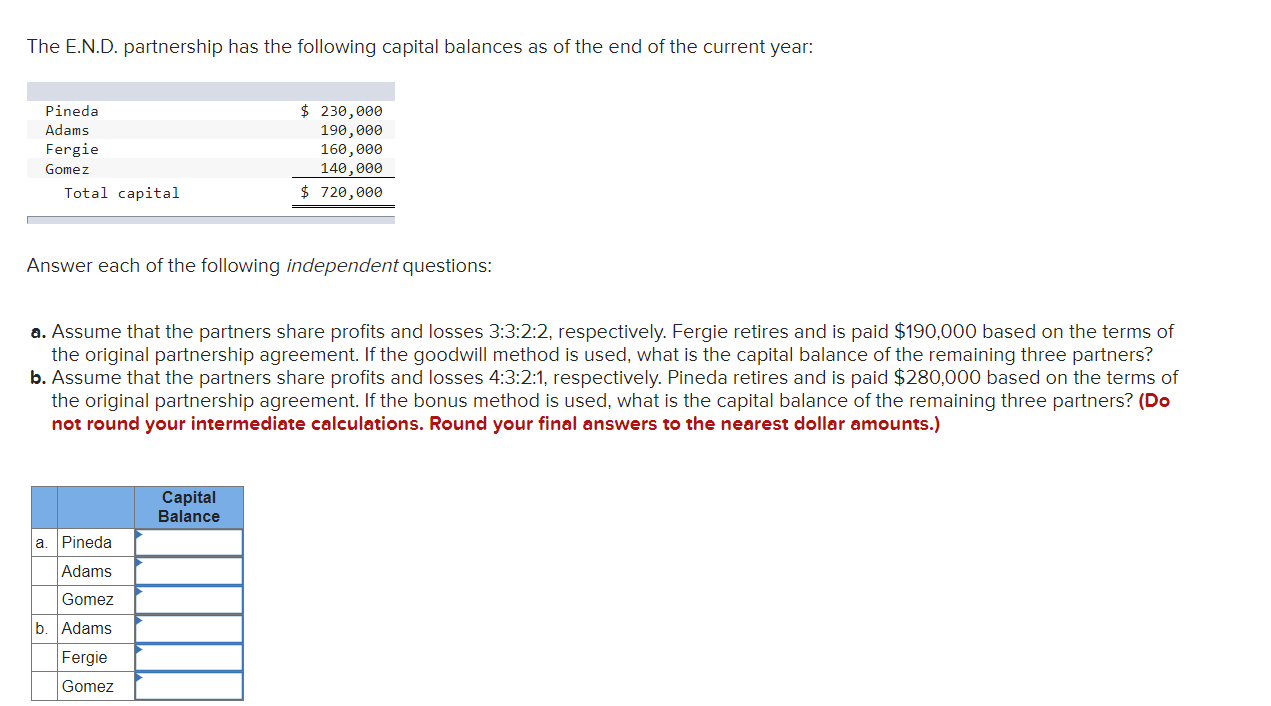

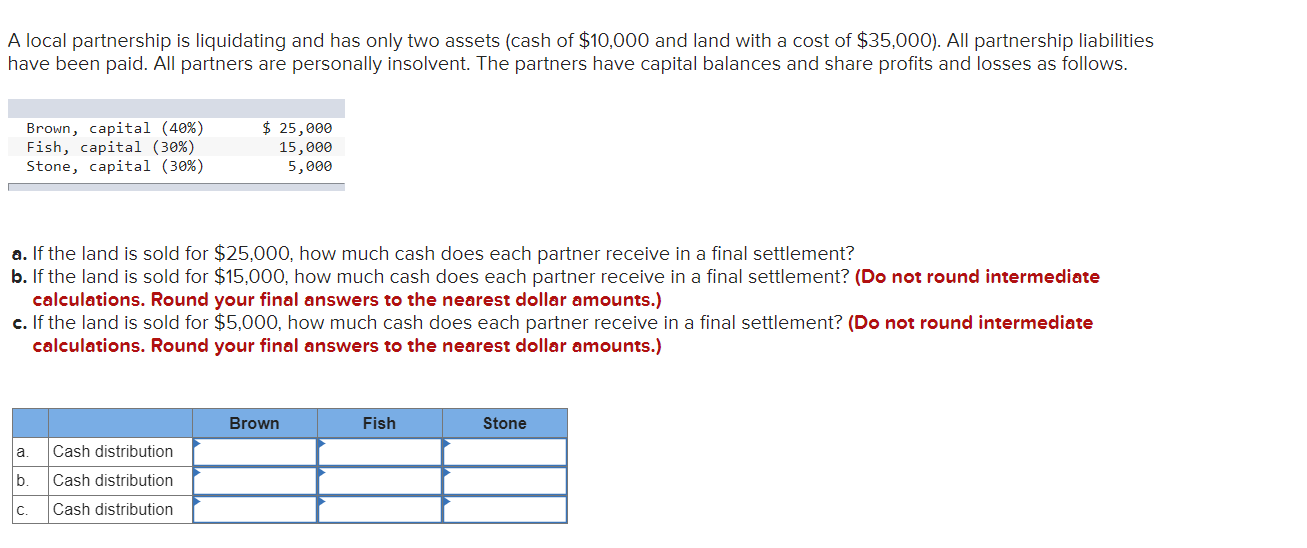

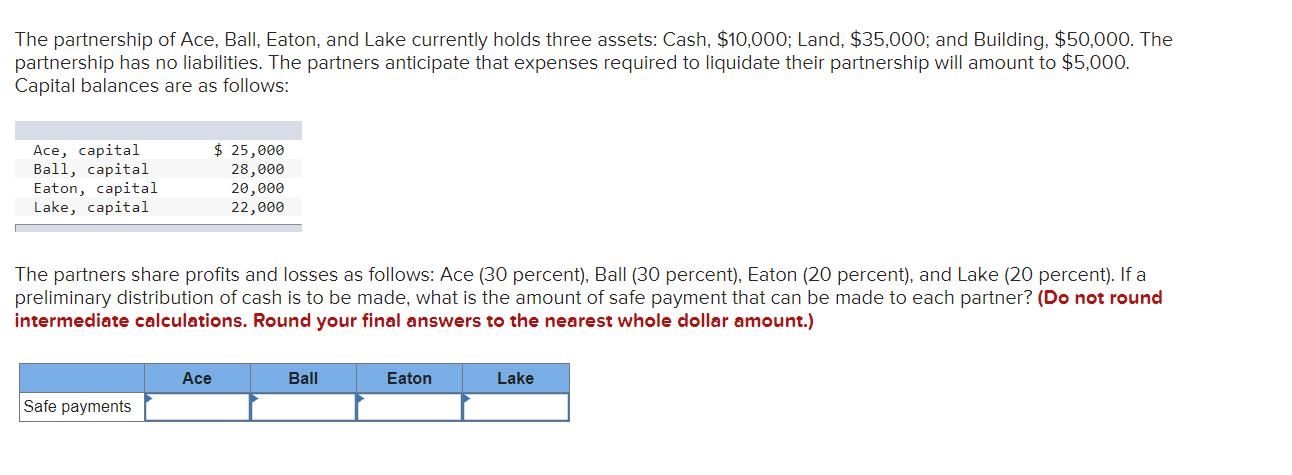

Lear is to become a partner in the WS partnership by paying $80,000 in cash to the business. At present, the capital balance for Hamlet is $70,000 and for MacBeth is $40,000. Hamlet and MacBeth share profits on a 7:3 basis. Lear is acquiring 40 percent of the new partnership. a. If the goodwill method is applied, what will the three capital balances be following the payment by Lear? b. If the bonus method is applied, what will the three capital balances be following the payment by Lear? Goodwill Method Bonus Method Hamlet MacBeth Lear The E.N.D. partnership has the following capital balances as of the end of the current year: Pineda Adams Fergie Gomez Total capital $ 230,000 190,000 160,000 140,000 $ 720,000 Answer each of the following independent questions: a. Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $190,000 based on the terms of the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners? b. Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $280,000 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do not round your intermediate calculations. Round your final answers to the nearest dollar amounts.) a. Pineda Adams Gomez b. Adams Capital Balance Fergie Gomez A local partnership is liquidating and has only two assets (cash of $10,000 and land with a cost of $35,000). All partnership liabilities have been paid. All partners are personally insolvent. The partners have capital balances and share profits and losses as follows. Brown, capital (40%) Fish, capital (30%) Stone, capital (30%) $ 25,000 15,000 5,000 a. If the land is sold for $25,000, how much cash does each partner receive in a final settlement? b. If the land is sold for $15,000, how much cash does each partner receive in a final settlement? (Do not round intermediate calculations. Round your final answers to the nearest dollar amounts.) c. If the land is sold for $5,000, how much cash does each partner receive in a final settlement? (Do not round intermediate calculations. Round your final answers to the nearest dollar amounts.) Brown Fish Stone a Cash distribution b. Cash distribution C. Cash distribution The partnership of Ace, Ball, Eaton, and Lake currently holds three assets: Cash, $10,000; Land, $35,000; and Building, $50,000. The partnership has no liabilities. The partners anticipate that expenses required to liquidate their partnership will amount to $5,000. Capital balances are as follows: Ace, capital Ball, capital Eaton, capital Lake, capital $ 25,000 28,000 20,000 22,000 The partners share profits and losses as follows: Ace (30 percent), Ball (30 percent), Eaton (20 percent), and Lake (20 percent). If a preliminary distribution of cash is to be made, what is the amount of safe payment that can be made to each partner? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Ace Ball Eaton Lake Safe payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It seems there is a significant amount of information provided which pertains to various scenarios involving partnerships goodwill and bonus methods o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started