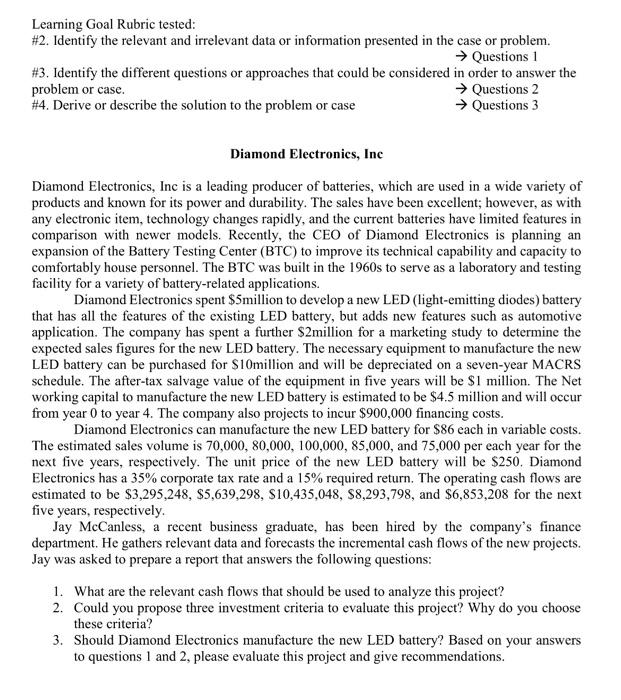

Learning Goal Rubric tested: #2. Identify the relevant and irrelevant data or information presented in the case or problem. Questions 1 #3. Identify the different questions or approaches that could be considered in order to answer the problem or case. Questions 2 #4. Derive or describe the solution to the problem or case Questions 3 Diamond Electronics, Inc Diamond Electronics, Inc is a leading producer of batteries, which are used in a wide variety of products and known for its power and durability. The sales have been excellent; however, as with any electronic item, technology changes rapidly, and the current batteries have limited features in comparison with newer models. Recently, the CEO of Diamond Electronics is planning an expansion of the Battery Testing Center (BTC) to improve its technical capability and capacity to comfortably house personnel. The BTC was built in the 1960s to serve as a laboratory and testing facility for a variety of battery-related applications. Diamond Electronics spent $5million to develop a new LED (light-emitting diodes) battery that has all the features of the existing LED battery, but adds new features such as automotive application. The company has spent a further $2million for a marketing study to determine the expected sales figures for the new LED battery. The necessary equipment to manufacture the new LED battery can be purchased for $10million and will be depreciated on a seven-year MACRS schedule. The after-tax salvage value of the equipment in five years will be $1 million. The Net working capital to manufacture the new LED battery is estimated to be $4.5 million and will occur from year 0 to year 4. The company also projects to incur $900,000 financing costs. Diamond Electronics can manufacture the new LED battery for $86 each in variable costs. The estimated sales volume is 70,000, 80,000, 100,000, 85,000, and 75,000 per each year for the next five years, respectively. The unit price of the new LED battery will be $250. Diamond Electronics has a 35% corporate tax rate and a 15% required return. The operating cash flows are estimated to be $3,295,248, $5,639,298, S10,435,048, S8,293,798, and $6,853,208 for the next five years, respectively. Jay McCanless, a recent business graduate, has been hired by the company's finance department. He gathers relevant data and forecasts the incremental cash flows of the new projects. Jay was asked to prepare a report that answers the following questions: 1. What are the relevant cash flows that should be used to analyze this project? 2. Could you propose three investment criteria to evaluate this project? Why do you choose these criteria? 3. Should Diamond Electronics manufacture the new LED battery? Based on your answers to questions 1 and 2, please evaluate this project and give recommendations