Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Learning Objective: Identify and use the tools and ratios of financial statement analysis to assess the liquidity, solvency and profitability of a company Comment on

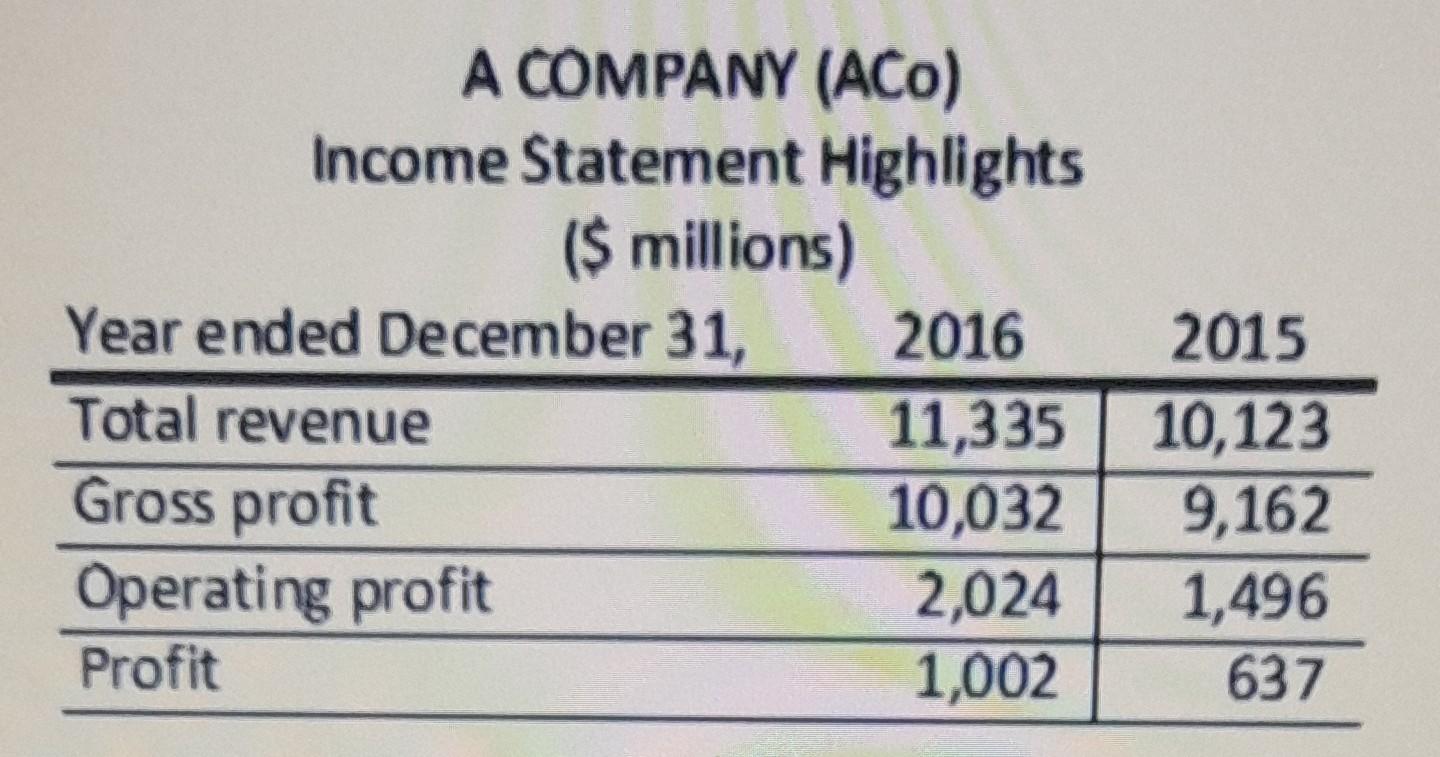

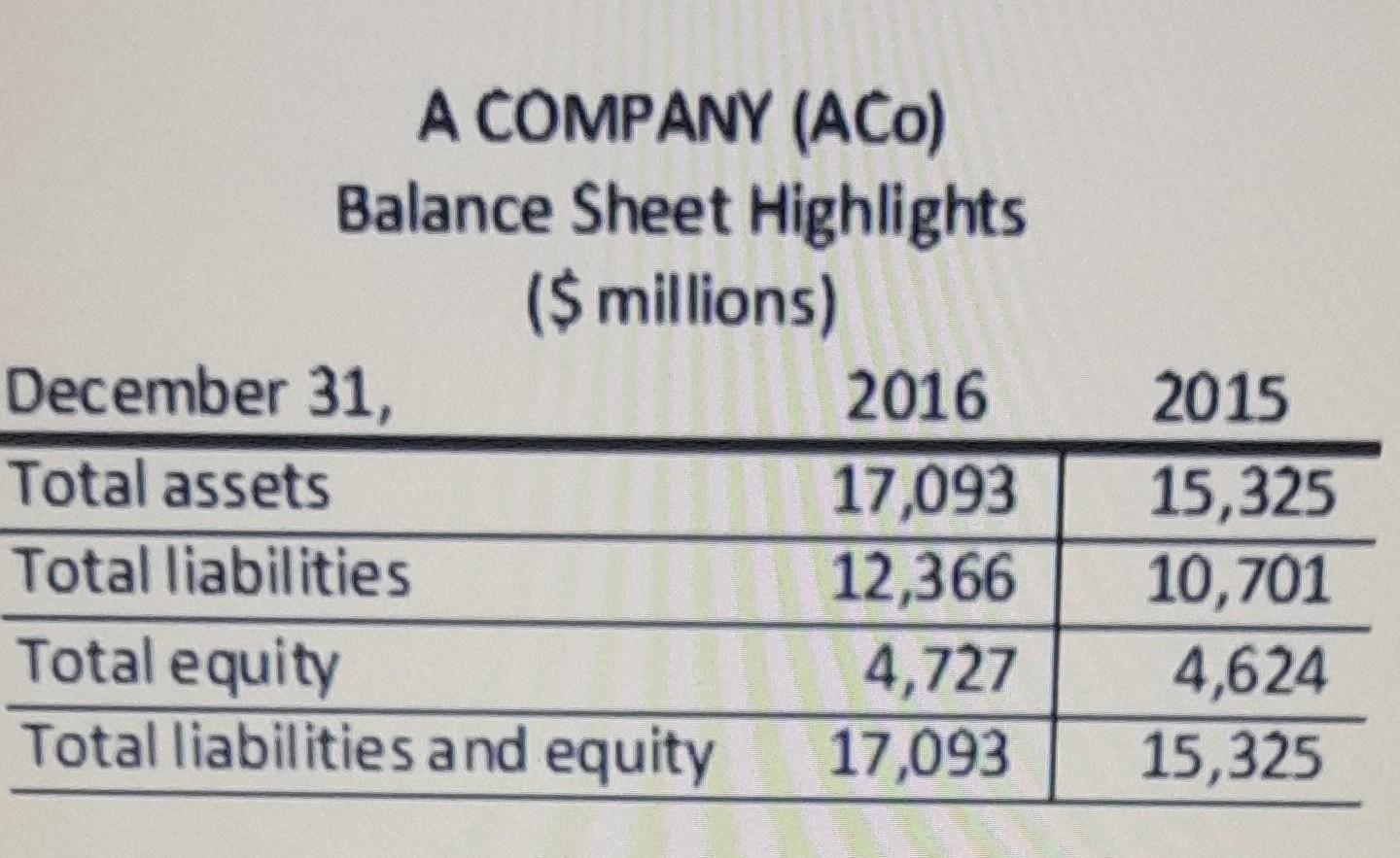

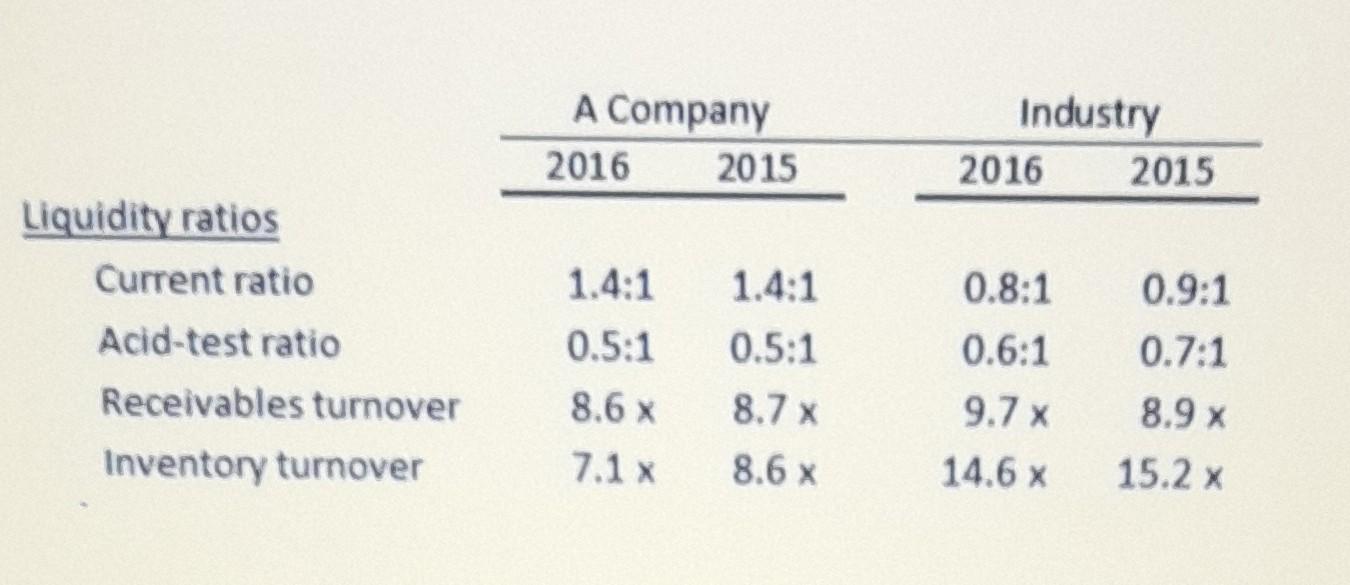

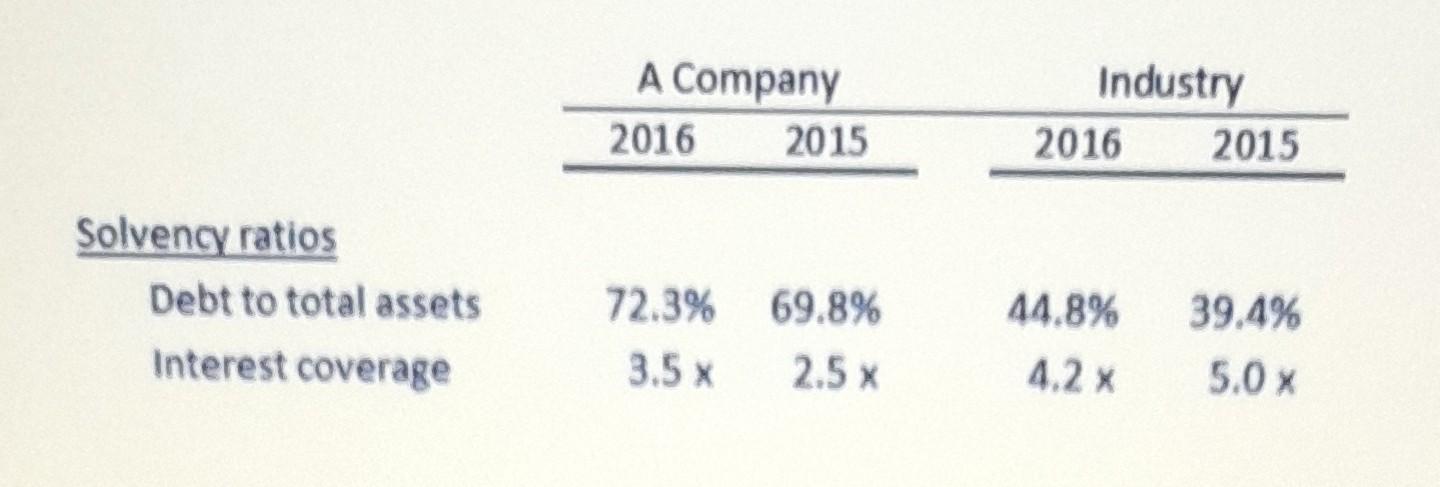

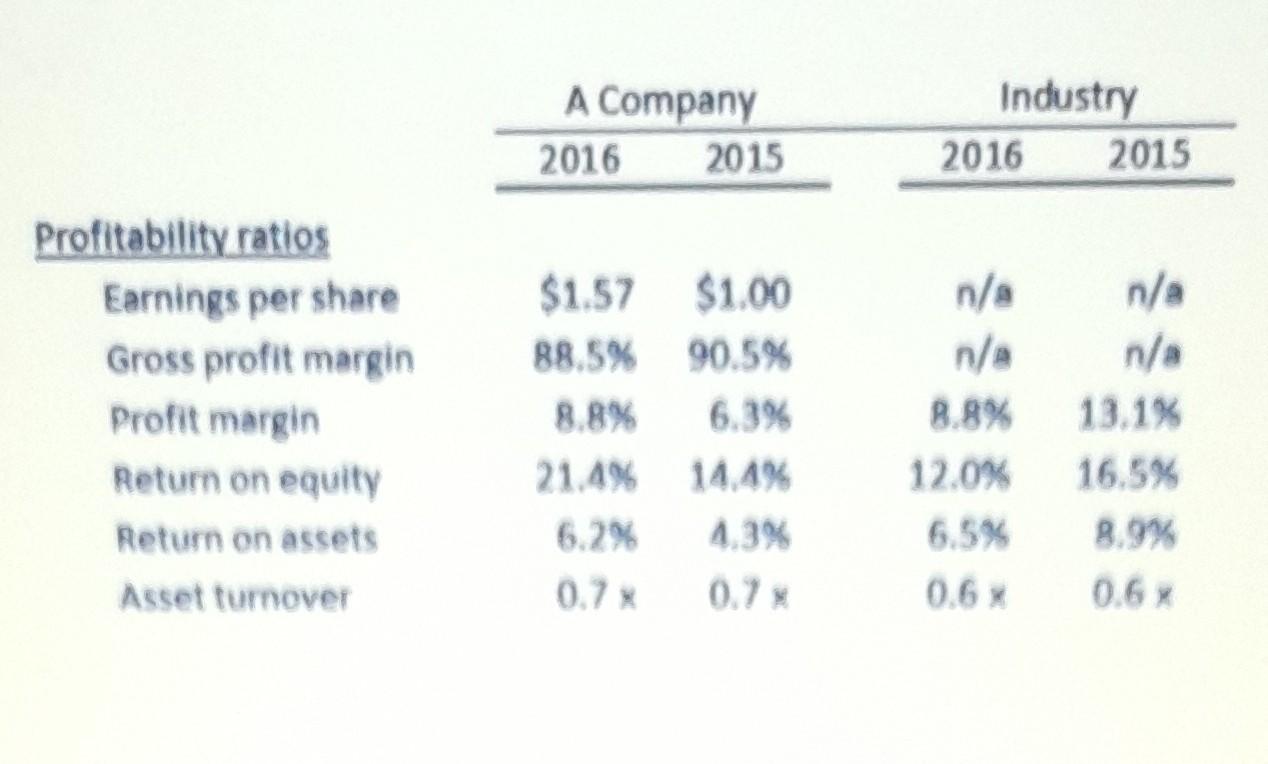

Learning Objective: Identify and use the tools and ratios of financial statement analysis to assess the liquidity, solvency and profitability of a company Comment on the liquidity, solvency, and profitability of their company and its industry for a two-year period. The A COMPANY (ACO) Income Statement Highlights ($ millions) Year ended December 31, 2016 2015 Total revenue 11,335 10,123 Gross profit 10,032 9,162 Operating profit 2,024 1,496 Profit 1,002 637 A COMPANY (AC) Balance Sheet Highlights ($ millions) December 31, 2016 Total assets 17,093 Total liabilities 12,366 Total equity 4,727 Total liabilities and equity 17,093 2015 15,325 10,701 4,624 15,325 A Company 2016 2015 Industry 2016 2015 1.4:1 Liquidity ratios Current ratio Acid-test ratio Receivables turnover Inventory turnover 0.9:1 0.7:1 0.5:1 8.6 x 7.1 x 1.4:1 0.5:1 8.7 x 8.6 x 0.8:1 0.6:1 9.7 x 14.6 x 8.9 x 15.2 x A Company 2016 2015 Industry 2016 2015 Solvency ratios Debt to total assets 44.8% 39.4% 72.3% 69.8% 3.5 x 2.5 x Interest coverage 4.2 x 5.0 x A Company 2016 2015 Industry 2016 2015 Profitability ratios Earnings per share Gross profit margin Profit margin Return on equity Return on assets Asset turnover $1.57 $1.00 88.5% 90.5% 8.8% 6.3% 21.4% 14.4% 6.2% 4.3% 0.7* 0.7 x n/a n/a 8.8% 12.0% 6.5% 0.6 x n/a n/a 13.1% 16.5% 8.9% 0.6% Comment on the overall Health of A Communications Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started