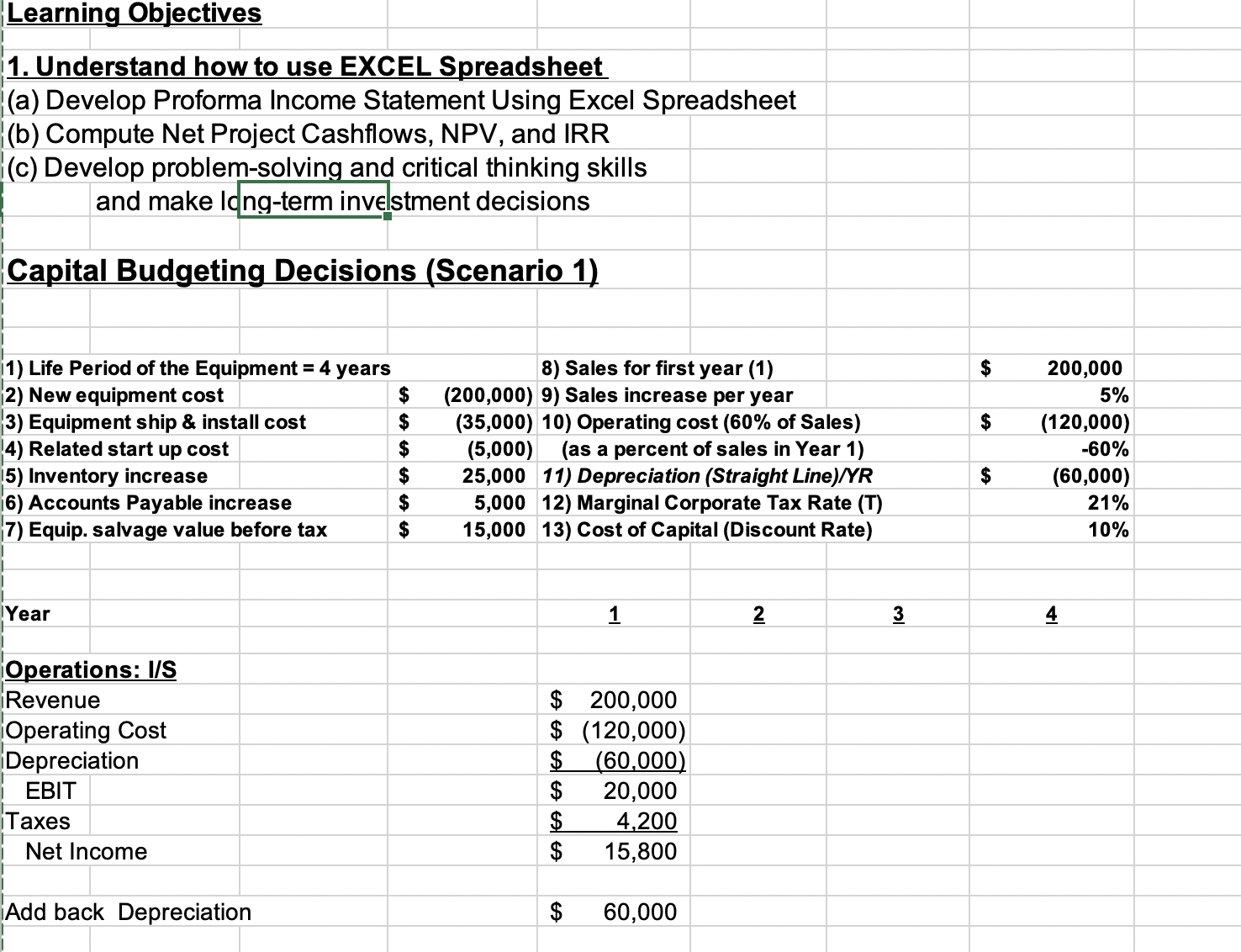

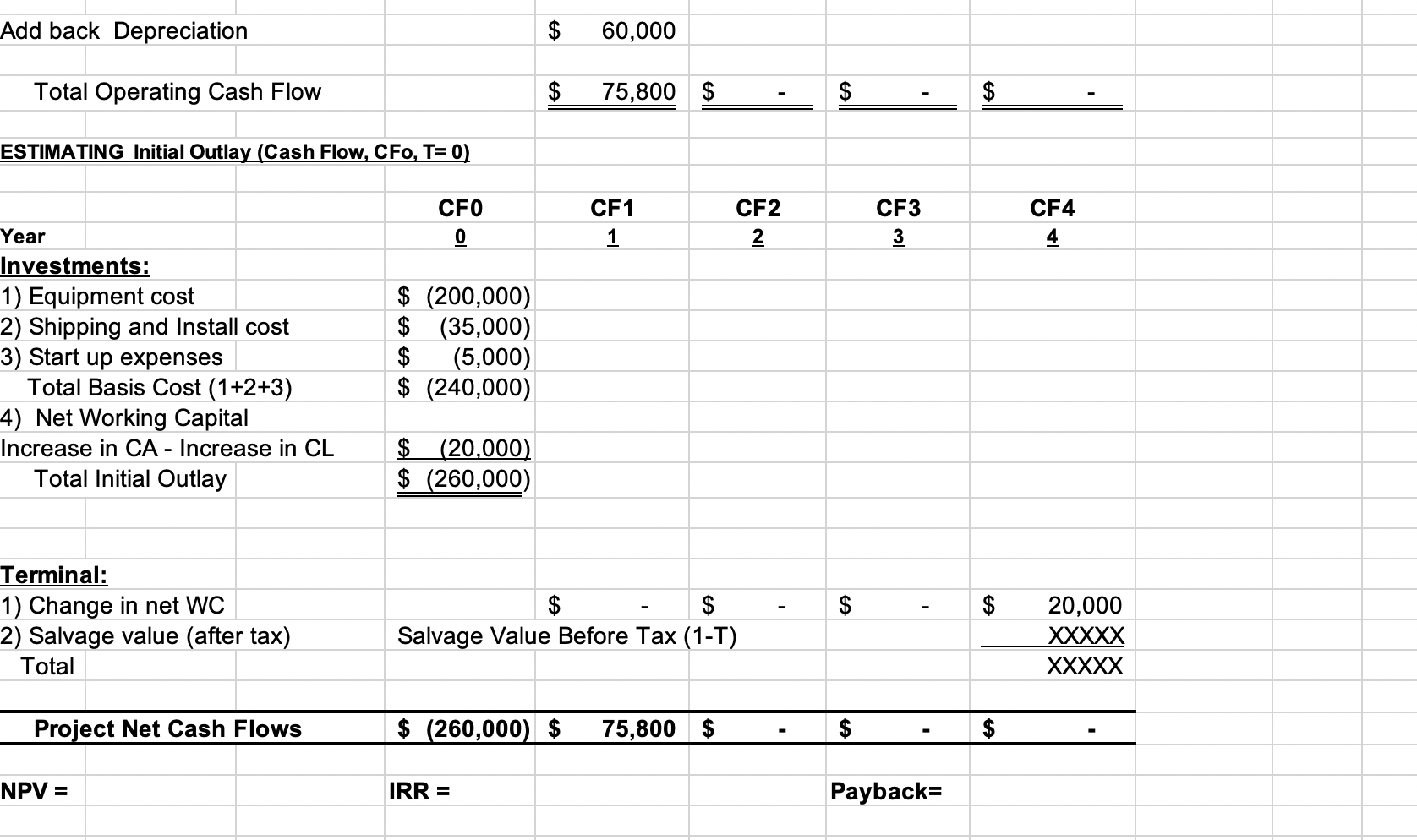

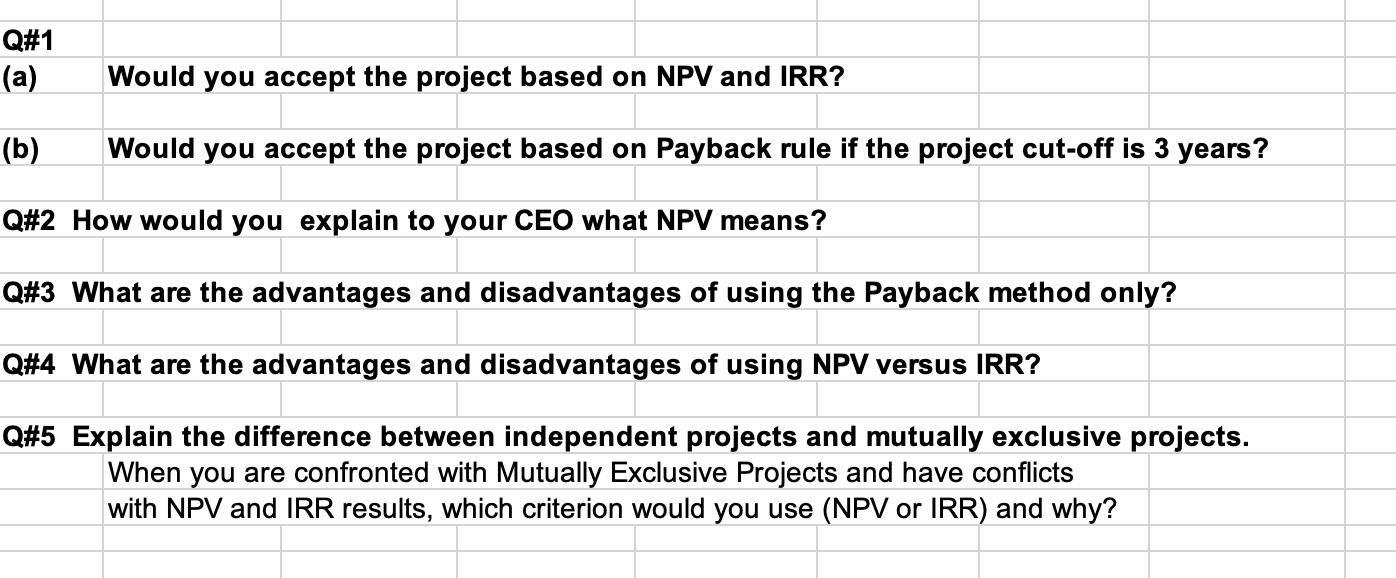

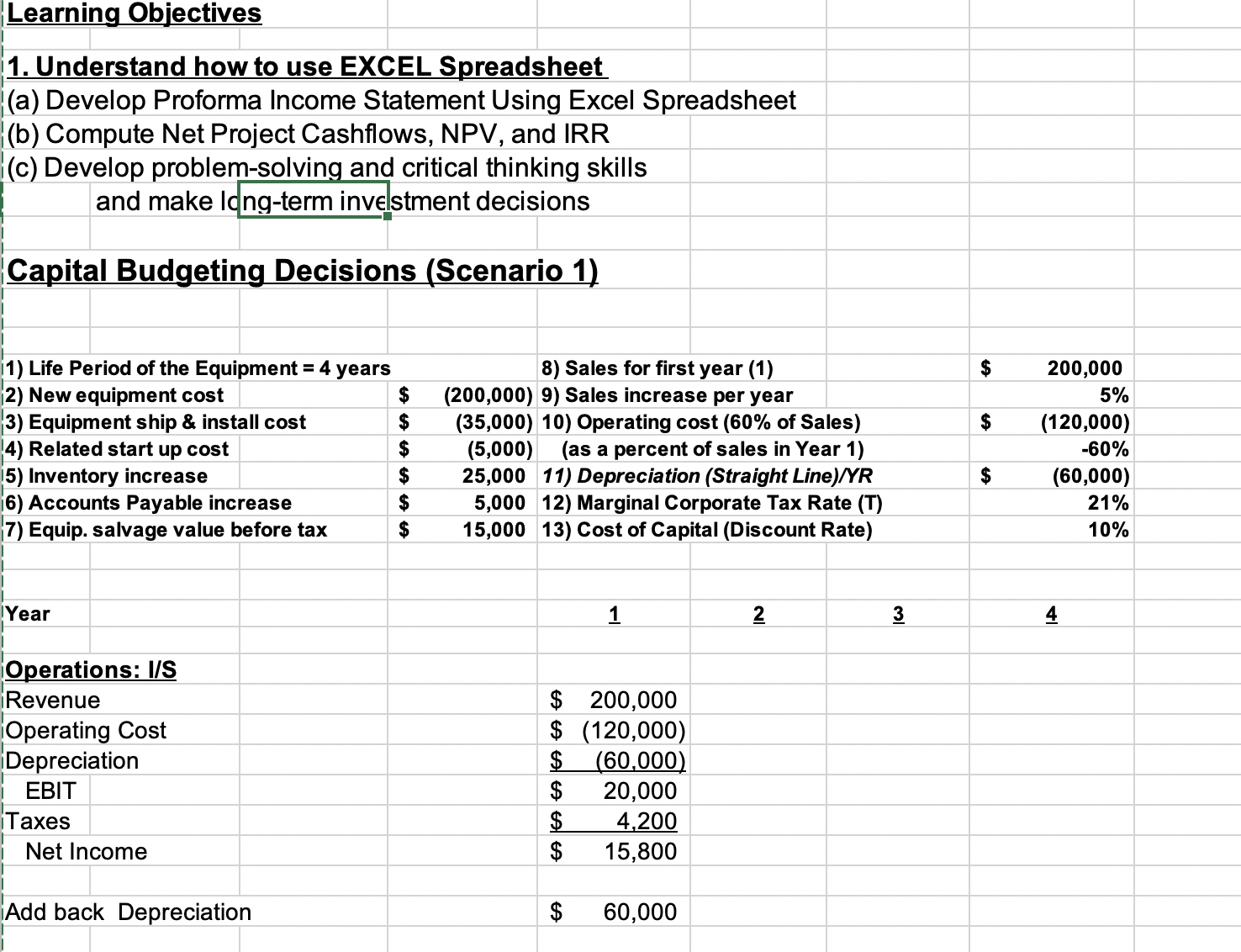

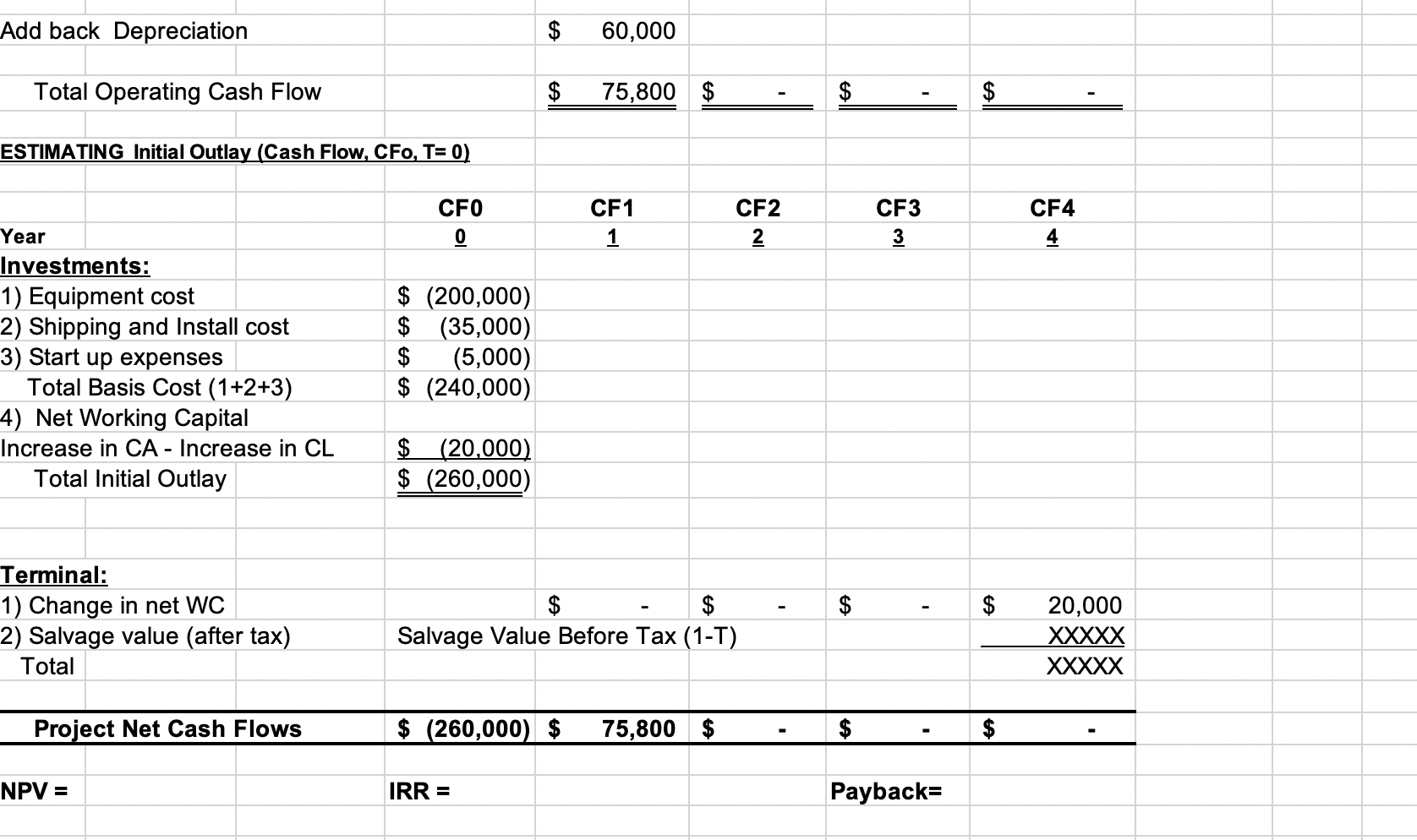

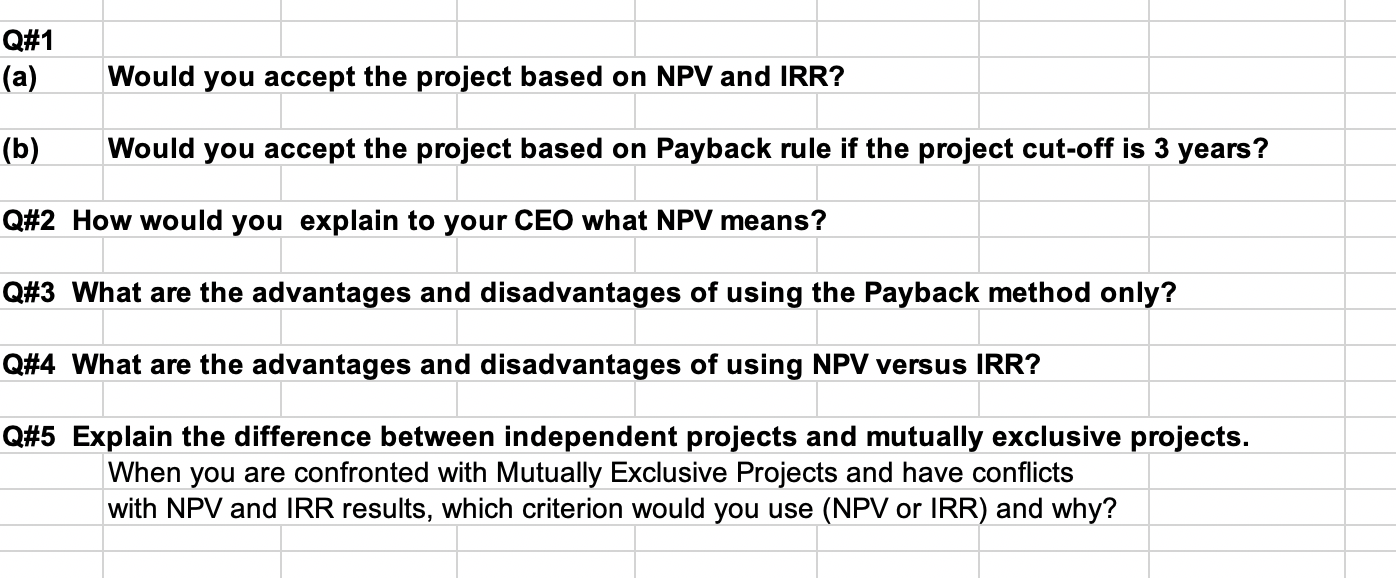

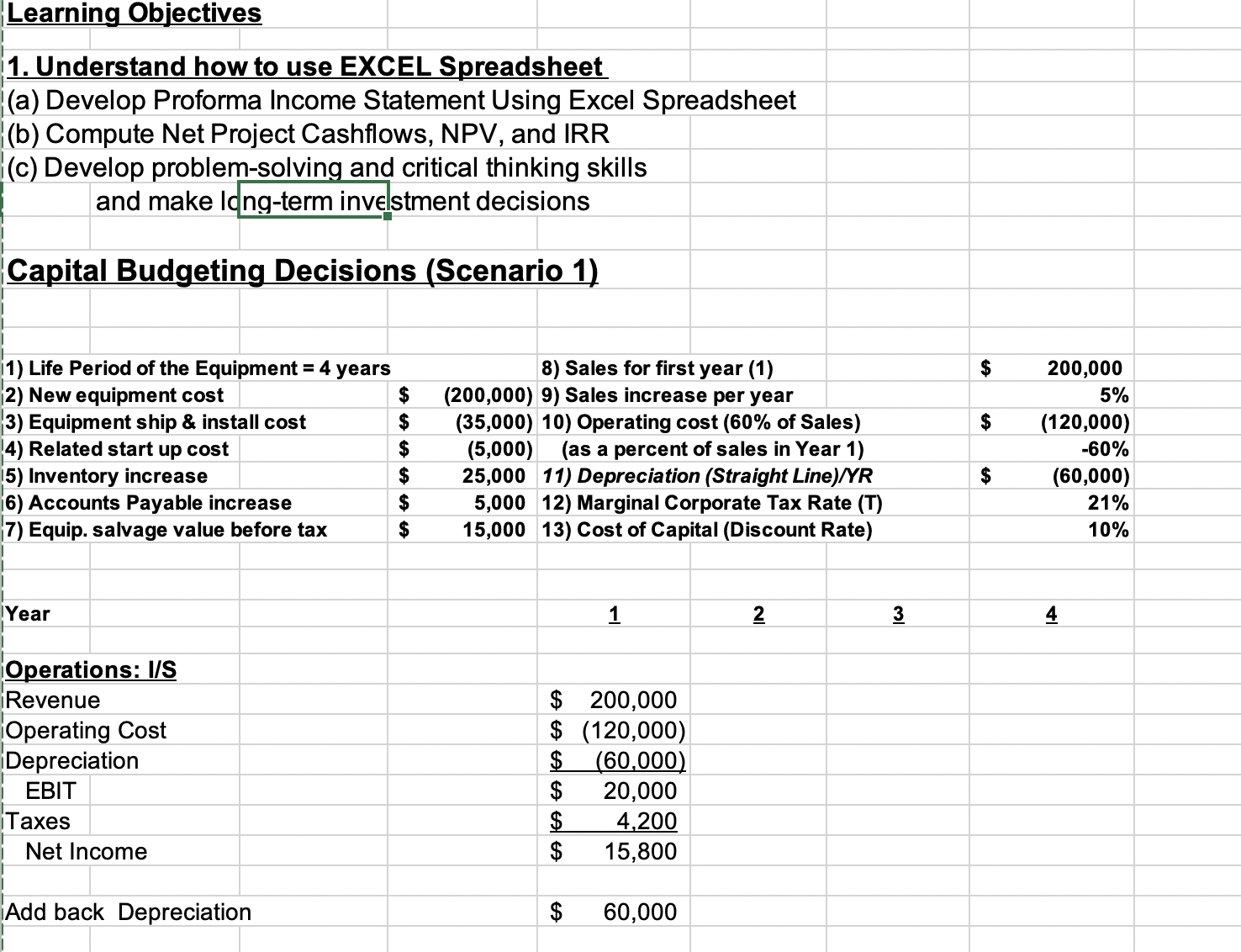

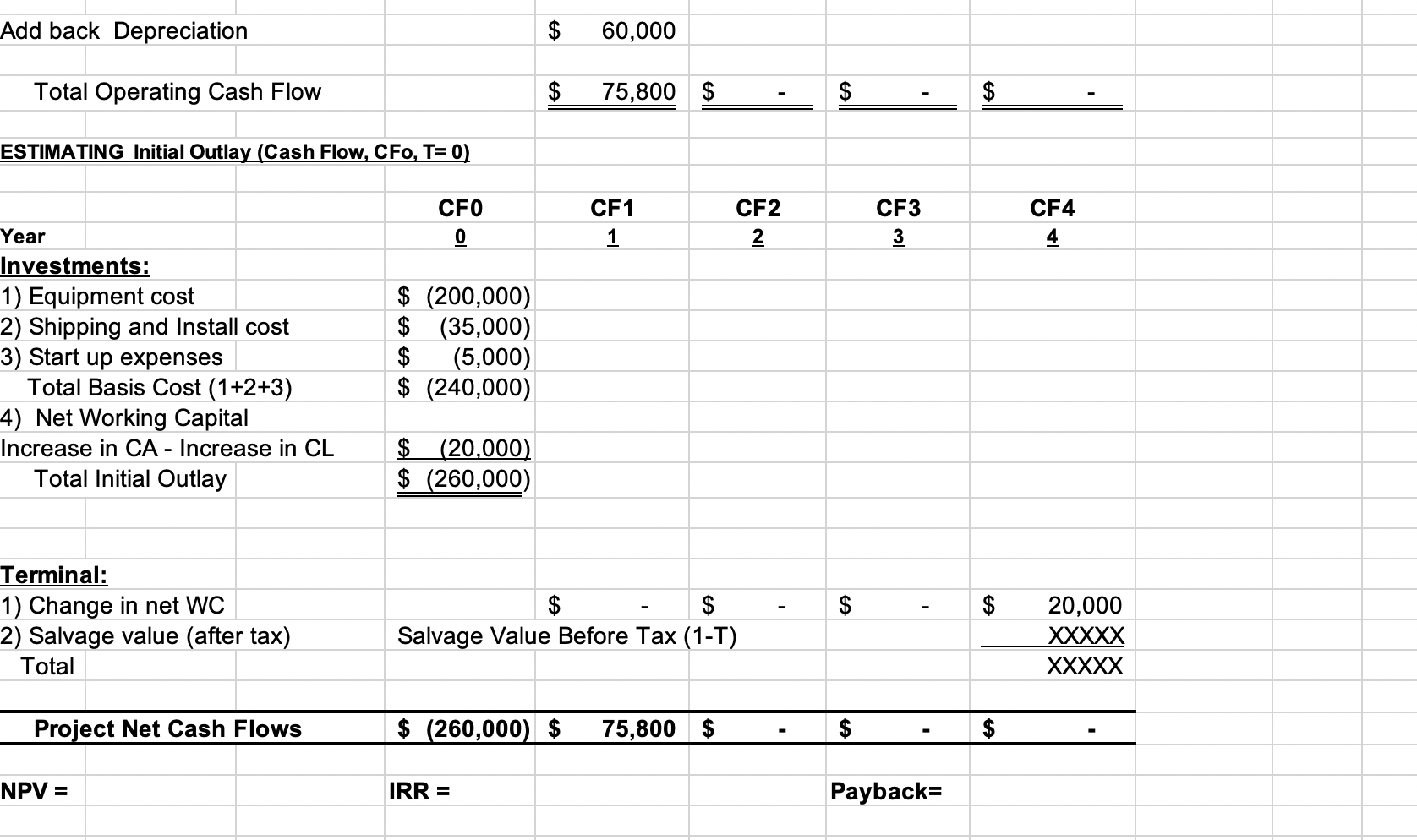

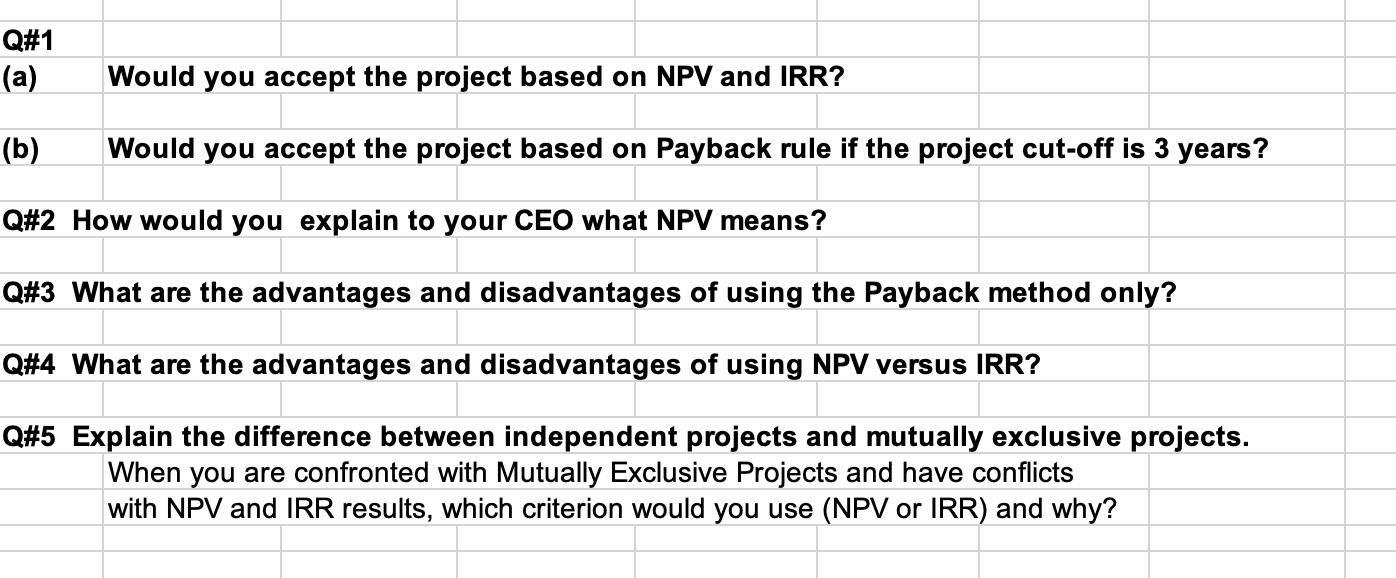

Learning Objectives 1. Understand how to use EXCEL Spreadsheet (a) Develop Proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions Capital Budgeting Decisions (Scenario 1) 1) Life Period of the Equipment = 4 years 8) Sales for first year (1) $ 200,000 2) New equipment cost (200,000) 9) Sales increase per year 5% 3) Equipment ship & install cost (35,000) 10) Operating cost (60% of Sales) $ (120,000) 4) Related start up cost (5,000) (as a percent of sales in Year 1) -60% 5) Inventory increase 25,000 11) Depreciation (Straight Line)/YR $ (60,000) 6) Accounts Payable increase 5,000 12) Marginal Corporate Tax Rate (T) 21% 7) Equip. salvage value before tax 15,000 13) Cost of Capital (Discount Rate) 10% Year 1 2 3 4 Operations: I/S Revenue $ 200,000 Operating Cost $ (120,000) Depreciation (60,000) EBIT 20,000 Taxes 4,200 Net Income 15,800 Add back Depreciation $ 60,000Add back Depreciation $ 60,000 Total Operating Cash Flow $ 75,800 $ $ $ ESTIMATING Initial Outlay (Cash Flow, CFO, T= 0) CFO CF1 CF2 CF3 CF4 Year 1 2 3 4 Investments: 1) Equipment cost $ (200,000) 2) Shipping and Install cost (35,000) 3) Start up expenses (5,000) Total Basis Cost (1+2+3) $ (240,000) 4) Net Working Capital Increase in CA - Increase in CL (20,000) Total Initial Outlay $ (260,000) Terminal: 1) Change in net WC $ $ $ - $ 20,000 2) Salvage value (after tax) Salvage Value Before Tax (1-T) XXXXX Total XXXXX Project Net Cash Flows $ (260,000) $ 75,800 $ $ - NPV = IRR = Payback=Q#1 (a) Would you accept the project based on NPV and IRR? (b) Would you accept the project based on Payback rule if the project cut-off is 3 years? Q#2 How would you explain to your CEO what NPV means? Q#3 What are the advantages and disadvantages of using the Payback method only? Q#4 What are the advantages and disadvantages of using NPV versus IRR? Q#5 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have conflicts with NPV and IRR results, which criterion would you use (NPV or IRR) and why