Answered step by step

Verified Expert Solution

Question

1 Approved Answer

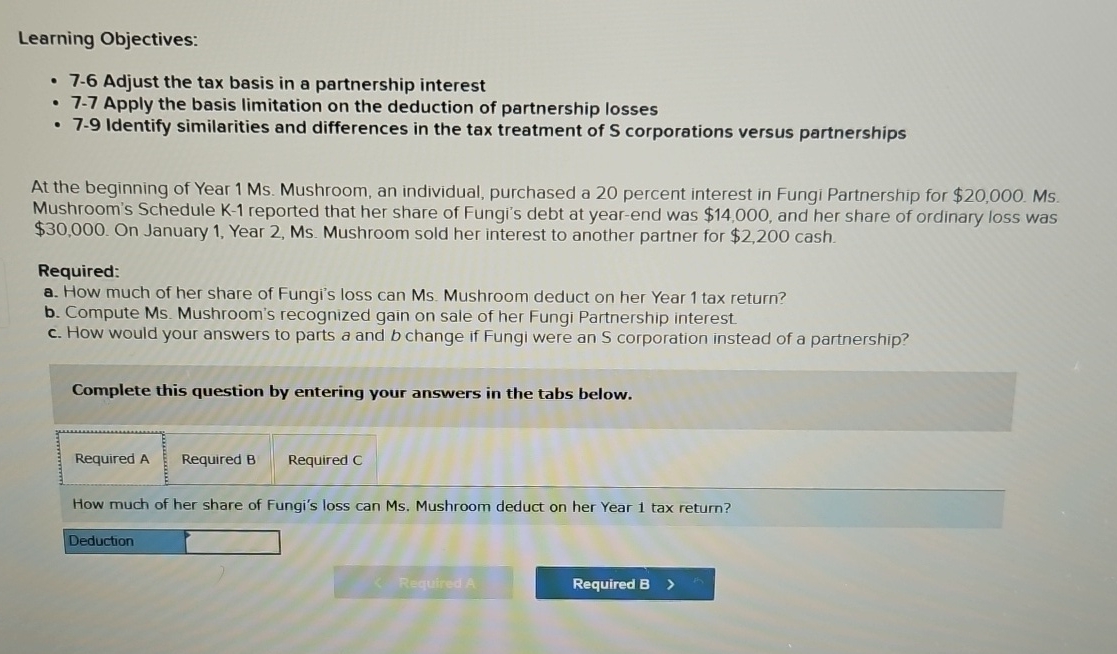

Learning Objectives: 7 - 6 Adjust the tax basis in a partnership interest 7 - 7 Apply the basis limitation on the deduction of partnership

Learning Objectives:

Adjust the tax basis in a partnership interest

Apply the basis limitation on the deduction of partnership losses

Identify similarities and differences in the tax treatment of corporations versus partnerships

At the beginning of Year Mushroom, an individual, purchased a percent interest in Fungi Partnership for $ Ms Mushroom's Schedule K reported that her share of Fungi's debt at yearend was $ and her share of ordinary loss was $ On January Year Ms Mushroom sold her interest to another partner for $ cash.

Required:

a How much of her share of Fungi's loss can Ms Mushroom deduct on her Year tax return?

b Compute Ms Mushroom's recognized gain on sale of her Fungi Partnership interest.

c How would your answers to parts a and change if Fungi were an corporation instead of a partnership?

Complete this question by entering your answers in the tabs below.

Required

Required B

Required C

How much of her share of Fungi's loss can Ms Mushroom deduct on her Year tax return?

Deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started