Learning Outcomes

- define the valuation and reporting of current liabilities, estimated liabilities, and other contingencies.

- interpret company solvency through selection and application of appropriate financial analysis tools.

Example

Follow through this example for McDonald's from reporting year ended 2018 to help you to understand how to write your post for the current year 10-K form 2020. Access the December 31, 2018 annual 10-K report of McDonalds Corporation (ticker: MCD), which is available at this link: McDonalds Corporation 10-K for 2018 (Links to an external site.).

The Financial Statements begin on page 32, have a look. The first challenge is to list the names of the current liabilities. To do this you need to look at the Consolidated Balance Sheet. It is on page 34. Under the Liabilities and Shareholders Equity section note the Current Liabilities. The current liabilities include for 2018:

- Accounts payable

- Income taxes

- Other taxes

- Accrued interest

- Accrued payroll and other liabilities

Next, to compute the times interest earned ratio for December 31, 2018 first find the formula in our textbook. Write it down. Next find the Consolidated Income Statement in the McDonald's 2018 annual report.

Times interest earned for McDonalds is

| $ millions | 12/31/2018 |

| Net Income......................................................................... | $ 5,924.3 | |

| Plus income taxes.............................................................. | 1,891.8 | |

| Plus interest expense......................................................... | 981.2 | |

| Income before interest and taxes...................................... | $ 8,797.3 | |

| Times interest earned.......................................................... | 8.97 times | |

McDonalds ratio is higher than the industry average of 5.0 in 2018. Accordingly, its times interest earned ratio seems sufficient for McDonalds to cover its interest obligations.

Instructions for your post

Access the December 31, 2020 annual 10-K report of McDonalds Corporation (ticker: MCD), which is available at this link: McDonalds Corporation 10-K (Links to an external site.) for 2020. The Annual Report format available for McDonald's Corporation for 2020 looks slightly different than the 2018 in the example, however the same information is included as mentioned below.

Locate the Financial Statements and Supplementary Data starting on page 37. Notice that the financial statements we have been studying are located starting on page 38 through page 42. Using the information provided on the financial statements to answer the following two questions:

- Identify the current liabilities on McDonalds balance sheet as of December 31, 2020. List each of the current liabilities by name. You do not need to include dollar amounts.

- Use the consolidated statement of income for the year ended December 31, 2020, to compute McDonalds times interest earned ratio. Comment on the result by comparing it to the industry average. Assume an industry average of -1.43 (yes, that is a minus sign, 2020 was a rough year for the eating places industry). Show your calculation to earn the points.

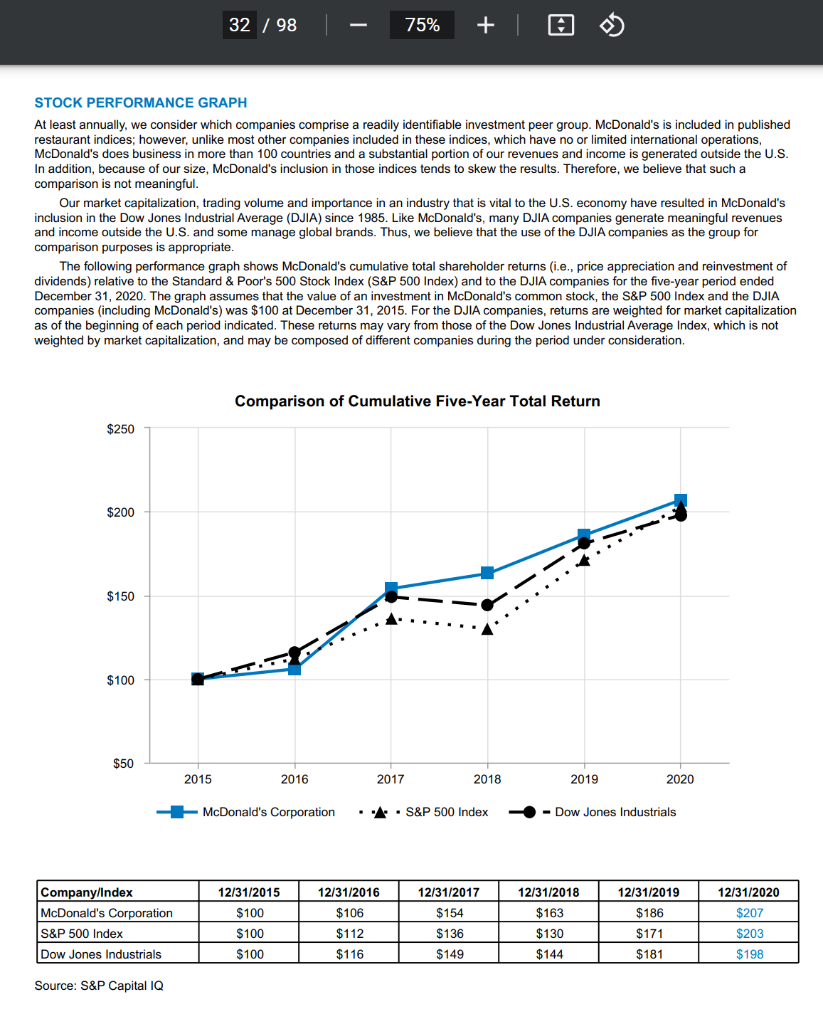

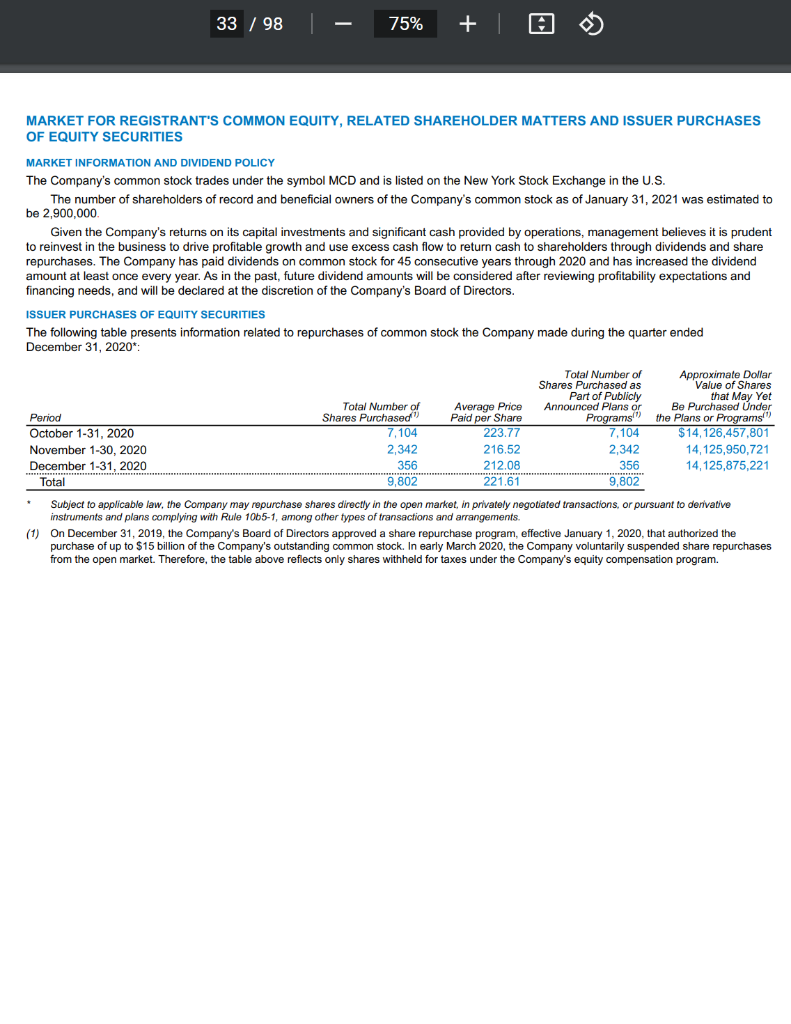

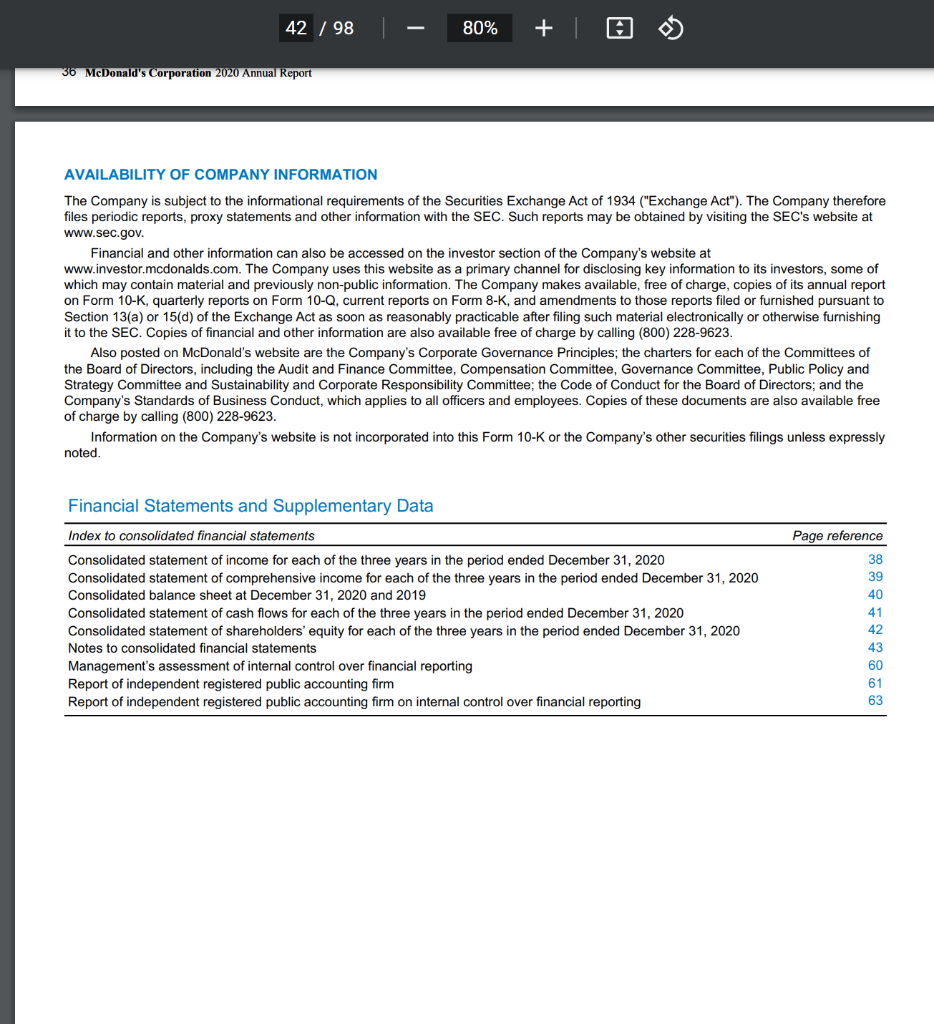

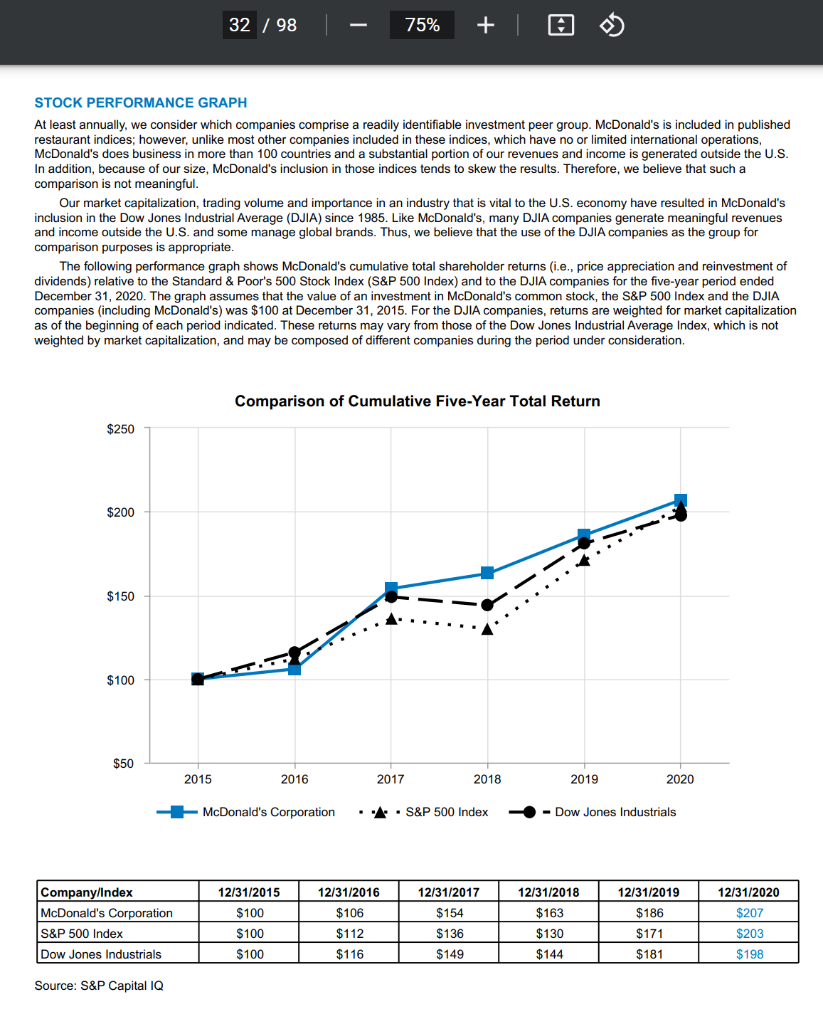

32 / 98 75% + STOCK PERFORMANCE GRAPH At least annually, we consider which companies comprise a readily identifiable investment peer group. McDonald's is included in published restaurant indices; however, unlike most other companies included in these indices, which have no or limited international operations, McDonald's does business in more than 100 countries and a substantial portion of our revenues and income is generated outside the U.S. In addition, because of our size, McDonald's inclusion in those indices tends to skew the results. Therefore, we believe that such a comparison is not meaningful. market capitalization, trading volume and importance in an industry that is vital to the U.S. economy have resulted in McDonald's inclusion and income outside the U.S. and some manage global brands. Thus, we believe that the use of the DJIA companies as the group for comparison purposes is appropriate. The following performance graph shows McDonald's cumulative total shareholder returns (i.e., price appreciation and reinvestment of dividends) relative to the Standard & Poor's 500 Stock Index (S&P 500 Index) and to the DJIA companies for the five-year period ended December 31, 2020. The graph assumes that the value of an investment in McDonald's common stock, the S&P 500 index and the DJIA companies (including McDonald's) was $100 at December 31, 2015. For the DJIA companies, returns are weighted for market capitalization as of the beginning of each period indicated. These returns may vary from those of the Dow Jones Industrial Average Index, which is not weighted by market capitalization, and may be composed of different companies during the period under consideration Comparison of Cumulative Five-Year Total Return $250 $200 $150 $100 $50 2015 2016 2017 2018 2019 2020 McDonald's Corporation . S&P 500 Index - Dow Jones Industrials Company/Index McDonald's Corporation S&P 500 Index Dow Jones Industrials 12/31/2015 $100 $100 $100 12/31/2016 $106 $112 $116 12/31/2017 $154 $136 $149 12/31/2018 $163 $130 $144 12/31/2019 $186 $171 $181 12/31/2020 $207 $203 $198 Source: S&P Capital IQ 33 / 98 - 75% + a MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES MARKET INFORMATION AND DIVIDEND POLICY The Company's common stock trades under the symbol MCD and is listed on the New York Stock Exchange in the U.S. The number of shareholders of record and beneficial owners of the Company's common stock as of January 31, 2021 was estimated to be 2.900,000 Given the Company's returns on its capital investments and significant cash provided by operations, management believes it is prudent to reinvest in the business to drive profitable growth and use excess cash flow to return cash to shareholders through dividends and share repurchases. The Company has paid dividends on common stock for 45 consecutive years through 2020 and has increased the dividend amount at least once every year. As in the past, future dividend amounts will be considered after reviewing profitability expectations and financing needs, and will be declared at the discretion of the Company's Board of Directors. ISSUER PURCHASES OF EQUITY SECURITIES The following table presents information related to repurchases of common stock the Company made during the quarter ended December 31, 2020*: Total Number of AP Value Dollar Shares Purchased as of Shares Part of Publicly that May Yet Total Number of Announced Plans or Be Purchased Under Period Average Price Shares Purchased Paid per Share Programs the Plans or Programs October 1-31, 2020 7,104 223.77 7.104 $14,126,457,801 November 1-30, 2020 2,342 216.52 2,342 14,125,950,721 December 1-31, 2020 356 212.08 356 14,125,875,221 Total 9.802 221.61 9.802 Subject to applicable law, the Company may repurchase shares directly in the open market, in privately negotiated transactions, or pursuant to derivative instruments and plans complying with Rule 1065-1, among other types of transactions and arrangements. (1) On December 31, 2019, the Company's Board of Directors approved a share repurchase program, effective January 1, 2020, that authorized the purchase of up to $15 billion of the Company's outstanding common stock. In early March 2020, the Company voluntarily suspended share repurchases from the open market. Therefore, the table above reflects only shares withheld for taxes under the Company's equity compensation program. 34 / 98 75% + a RISK FACTORS GLOBAL PANDEMIC The COVID-19 pandemic has adversely affected and is expected to continue to adversely affect our financial results, condition and outlook. Health epidemics or pandemics can adversely affect consumer spending and confidence levels and supply availability and costs, as well as the local operations in impacted markets, all of which can affect our financial results, condition and outlook. Importantly, the global pandemic resulting from COVID-19 has disrupted global health, economic and market conditions, consumer behavior and McDonald's global restaurant operations beginning in early 2020. Local and national governmental mandates or recommendations and public perceptions of the risks associated with the COVID-19 pandemic have caused, and we expect will continue to cause, consumer behavior to change and worsening or volatile economic conditions, each of which could continue to adversely affect our business. In addition, our global operations have been disrupted to varying degrees and may continue to be disrupted given the unpredictability of the virus, its resurgences and government responses thereto as well as potentially permanent changes to the industry we operate in. While we cannot predict the duration or scope of the COVID-19 pandemic, the resurgence of infections in one or more markets, or the impact of vaccines across the globe, the COVID-19 pandemic has negatively impacted our business and is expected to continue to impact our financial results, condition and outlook in a way that may be material. The COVID-19 pandemic may also heighten other risks disclosed in these Risk Factors, such as, but not limited to, those related to consumer behavior, consumer perceptions of our brand, supply chain interruptions, commodity costs and labor availability and cost. STRATEGY AND BRAND If we do not successfully evolve and execute against our business strategies, including the new Accelerating the Arches strategy, we may not be able to drive business growth. To drive Systemwide sales, operating income and free cash flow growth, our business strategies must be effective in maintaining and strengthening customer appeal and capturing additional market share. Whether these strategies are successful depends mainly on our System's ability to: Capitalize on our global scale, iconic brand and local market presence to build upon our historic strengths and competitive advantages, such as our marketing, core menu items and digital, delivery and drive thru; Continue to innovate and differentiate the McDonald's experience, including by preparing and serving our food in a way that balances value and convenience to our customers with profitability Accelerate digital innovation for a fast and easy customer experience; Continue to run great restaurants by driving efficiencies and expanding capacities while continuing prioritize health and safety: Identify and develop restaurant sites consistent with our plans for net growth of Systemwide restaurants; Accelerate our existing strategies, including through growth opportunities and potential acquisitions, investments and partnerships; and Evolve and adjust our business strategies in response to, among other things, changing consumer behavior, operational restrictions and impacts to our results of operations and liquidity, including as a result of the COVID-19 pandemic. If we are delayed or unsuccessful in executing our strategies, or if our strategies do not yield the desired results, our business, financial condition and results of operations may suffer. Failure to preserve the value and relevance of our brand could have an adverse impact on our financial results. To be successful the future, we believe we must preserve, enhance and leverage the value of our brand, including our corporate purpose, mission and values. Brand value is based in part on consumer perceptions. Those perceptions are affected by a variety of factors, including the nutritional content and preparation of our food, the ingredients we use, the manner in which we source commodities and our general business practices. Consumer acceptance of our offerings is subject to change for a variety of reasons, and some changes can occur rapidly. For example, nutritional, health, environmental and other scientific studies and conclusions, which constantly evolve and may have contradictory implications, drive popular opinion, litigation and regulation (including initiatives intended to drive consumer behavior) in ways that affect the informal eating out" ("NEO") segment or perceptions of our brand, generally or relative to available alternatives. Consumer perceptions may also be affected by adverse commentary from third parties, including through social media or conventional media outlets, regarding the quick-service category of the IEO segment, our brand, our culture, our operations, our suppliers, or our franchisees. If we are unsuccessful in addressing adverse commentary or perceptions, whether or not accurate, our brand and our financial results may suffer. Additionally, the ongoing relevance of our brand may depend on the success of our sustainability initiatives, which require Systemwide coordination and alignment. We are working to manage any risks and costs to us, our franchisees and our supply chain of any effects of climate change, greenhouse gases, and diminishing energy and water resources. These risks include any increased public focus, including by governmental and nongovernmental organizations, on these and other environmental sustainability matters, such as packaging and waste, animal health and welfare, deforestation and land use. These risks also include any increased pressure to make commitments, set targets or establish additional goals and take actions to meet them. These risks could expose us to market, operational and execution costs or risks. 35 / 98 - 75% + If we are not effective in addressing social and environmental responsibility matters or achieving relevant sustainability goals, consumer trust in our brand may suffer. In particular, business incidents or practices, whether actual or perceived, that erode consumer trust or confidence, particularly if such incidents or practices receive considerable publicity or result in litigation, can significantly reduce brand value and have a negative impact on our financial results. If we do not anticipate and address evolving consumer preferences and effectively execute our pricing, promotional and marketing plans, our business could suffer. Our continued success depends on our System's ability to build upon our historic strengths and competitive advantages. In order to do so, we need to anticipate and respond effectively to continuously shifting consumer demographics and trends in food sourcing, food preparation, food offerings and consumer preferences and behaviors in the IEO segment. If we are not able to predict, or quickly and effectively respond to these changes, or our competitors predict or respond more effectively, our financial results could be adversely impacted. Our ability to build upon our strengths and advantages also depends on the impact of pricing, promotional and marketing plans across the System, and the ability to adjust these plans to respond quickly and effectively to evolving customer preferences, as well as shifting economic and competitive conditions. Existing or future pricing strategies, marketing plans, and the value proposition they represent, are expected to continue to be important components of our business strategy; however, they may not be successful, or may not be as successful as the efforts of our competitors, and could negatively impact sales, guest counts and market share. Additionally, we operate in a complex and costly advertising environment. Our marketing and advertising programs may not be successful in reaching our customers in the way we intend. Our success depends in part on whether the allocation of our advertising and marketing resources across different channels, including digital marketing, allows us to reach our customers effectively and efficiently, and in ways that are meaningful to them. If the advertising and marketing programs are not successful, or are not as successful as those of our competitors, our sales, guest counts and market share could decrease. Our investments to enhance the customer experience, including through technology, may not generate the expected returns. Our long-term business objectives depend on the successful Systemwide execution of our strategies. We continue to build upon ou investments in technology and modernization, digital engagement and delivery, in order to transform the customer experience. As part of these investments, we are placing renewed emphasis on improving our service model and strengthening relationships with customers, in part through digital channels and loyalty initiatives, mobile ordering and payment systems, and enhancing our drive thru technologies, which may not generate expected returns. We also continue to offer and refine our delivery initiatives, including through growing awareness and trial. Utilizing a third-party delivery service may not have the same level of profitability as a non-delivery transaction, and may introduce additional food quality and customer satisfaction risks. If these customer experience initiatives are not well executed, or if we do not fully realize the intended benefits f these significant investments, our business results may suffer. We face intense competition in our markets, which could hurt our business. We compete primarily in the IEO segment, which is highly competitive. We also face sustained, intense competition from traditional, fast casual and other competitors, which may include many non-traditional market participants such as convenience stores, grocery stores and coffee shops well as online retailers. We expect our environment to continue to be highly competitive, and our results in any particular reporting period may be impacted by a contracting IEO segment or by new or continuing actions, product offerings or consolidation of our competitors and third party partners, which may have a short- or long-term impact on our results. We compete on the basis of product choice, quality, affordability, service and location. In particular, we believe our ability to compete successfully in the current market environment depends on our ability to improve existing products, successfully develop and introduce new products, price our products appropriately, deliver a relevant customer experience, manage the complexity of our restaurant operations, manage our investments in technology and modernization, and respond effectively to our competitors' actions or offerings or to unforeseen disruptive actions. There can be no assurance these strategies will be effective, and some strategies may be effective at improving some metrics while adversely affecting other metrics, which could have the overall effect of harming our business. We may not be able to adequately protect our intellectual property or adequately ensure that we are not infringing the intellectual property of others, which could harm the value of the McDonald's brand and our business. The success of our business depends on our continued ability to use our existing trademarks and service marks in order to increase brand awareness and further develop our branded products in both domestic and international markets. We rely on a combination of trademarks, copyrights, service marks, trade secrets, patents and other intellectual property rights to protect our brand and branded products. We have registered certain trademarks and have other trademark registrations pending in the U.S. and certain foreign jurisdictions The trademarks that we currently use have not been registered in all of the countries outside J.S. in which we do business or may do business in the future and may never be registered in all of these countries. It may be costly and time consuming to protect our intellectual property, and the steps we have taken to protect our intellectual property in the U.S. and foreign countries may not be adequate. addition, the steps we have taken may not adequately ensure that we do not infringe the intellectual property of others, and third parties may claim infringement by us in the future. In particular, we may be involved in intellectual property claims, including often aggressive or opportunistic attempts to enforce patents used in information technology systems, which might affect our operations and results. Any claim of infringement, whether or not it has merit, could be time-consuming, result in costly litigation and harm our business. We cannot ensure that franchisees and other third parties who hold licenses to our intellectual property will not take actions that hurt the value of our intellectual property. 38 / 98 75% + Furthermore, security incidents or breaches have from time to time occurred and may in the future occur involving our systems, the systems of the parties we communicate collaborate with (including franchisees), or those of third party providers. These may include such things as unauthorized access, phishing attacks, account takeovers, denial of service, computer viruses, introduction of malware or ransomware and other disruptive problems caused by hackers. Our technology systems contain personal, financial and other information that is entrusted to us by our customers, our employees, our franchisees, our business customers and other third parties, as well as financial, proprietary and other confidential information related to our business. An actual or alleged security breach could result in disruptions, shutdowns, theft or unauthorized disclosure of personal, financial, proprietary or other confidential information. The occurrence of any of these incidents could result in reputational damage, adverse publicity, loss of consumer confidence, reduced sales and profits, complications in executing our growth initiatives and regulatory and legal risk, including criminal penalties or civil liabilities. LEGAL AND REGULATORY Increasing regulatory and legal complexity may adversely affect our business and financial results. Our regulatory and legal environment worldwide exposes us to complex compliance, litigation and similar risks that could affect our operations and results in material ways. Many of our markets are subject to increasing, conflicting and highly prescriptive regulations involving, among other matters, restaurant operations, product packaging, marketing, the nutritional and allergen content and safety of our food and other products, labeling and other disclosure practices. Compliance efforts with those regulations may be affected by ordinary variations in food preparation among our own restaurants and the need to rely on the accuracy and completeness of information from third- party suppliers. Our success depends in part on our ability to manage the impact of regulations that can affect our business plans and operations, and have increased our costs of doing business and exposure to litigation, governmental investigations or other proceedings. We are also subject to legal proceedings that may adversely affect our business, including class actions, administrative proceedings, government investigations and proceedings, shareholder proceedings, employment and personal injury claims, landlord/ tenant disputes, supplier related disputes, and claims by current or former franchisees. Regardless of whether claims against us are valid or whether we are found to be liable, claims may be expensive to defend and may divert management's attention away from operations. Litigation and regulatory action concerning our relationship with franchisees and the legal distinction between our franchisees and us for employment law purposes, if determined adversely, could increase costs, negatively impact our business operations and the business prospects of our franchisees and subject us to incremental liability for their actions. Similarly, although our commercial relationships with our suppliers remain independent, there may be attempts to challenge that independence, which, if determined adversely, could also increase costs, negatively impact the business prospects of our suppliers, and subject us to incremental liability for their actions. Our results could also be affected by the following: The relative level of our defense costs, which vary from period to period depending on the number, nature and procedural status of pending proceedings: The cost and other effects of settlements, judgments or consent decrees, which may require us to make disclosures or take other actions that may affect perceptions of our brand and products; and Adverse results of pending or future litigation, including litigation challenging the composition and preparation of our products, or the appropriateness or accuracy of our marketing other communication practices. A judgment significantly in excess of any applicable insurance coverage or third party indemnity could materially adversely affect our financial condition or results of operations. Further, adverse publicity resulting from claims may hurt our business. If we are unable to effectively manage the risks associated with our complex regulatory and legal environment, it could have a material adverse effect on our business and financial condition. Changes in tax laws and unanticipated tax liabilities could adversely affect the taxes we pay and our profitability. We are subject to income and other taxes in the U.S. and foreign jurisdictions, and our operations, plans and results are affected by tax and other initiatives around the world. In particular, we are affected by the impact of changes to tax laws or policy or related authoritative interpretations. We are also impacted by settlements of pending or any future adjustments proposed by taxing and governmental authorities inside and outside of the U.S. in connection with our tax audits, all of which will depend on their timing, nature and scope. Any significant increases income tax rates, changes in income tax laws or unfavorable resolution of tax matters could have a material adverse impact on our financial results. Changes accounting standards or the recognition of impairment or other charges may adversely affect our future operations and results. New accounting standards changes in financial reporting requirements, accounting principles or practices, including with respect to our critical accounting estimates, could adversely affect our future results. We may also be affected by the nature and timing of decisions about underperforming markets or assets, including decisions that result in impairment or other charges that reduce our earnings. In assessing the recoverability of our long-lived assets, we consider changes in economic conditions and make assumptions regarding estimated future cash flows and other factors. These estimates are highly subjective and can be significantly impacted by many factors such as global and local business and economic conditions, operating costs, inflation, competition, consumer and demographic trends, and our restructuring activities. If our estimates or underlying assumptions change in the future, we may be required to record impairment charges. If we experience any such changes, they could have a significant adverse effect on our reported results for the affected periods. . 39 / 98 - 75% + If we fail to comply with privacy and data collection laws, we could be subject to legal proceedings and penalties, which could negatively affect our financial results or brand perceptions. We are subject to legal and compliance risks and associated liability related to privacy and data collection, protection and management, as it relates to information associated with our technology-related services and platforms made available to business partners, customers, employees, franchisees or other third parties. For example, the General Data Protection Regulation ("GDPR") requires entities processing the personal data of individuals in the European Union to meet certain requirements regarding the handling of that data. We are also subject to U.S. federal and state and foreign laws and regulations in this area such as the California Consumer Privacy Act ("CCPA"). These regulations have been subject to frequent change, and there may be markets or jurisdictions that propose or enact new or emerging data privacy requirements in the future. Failure to comply with GDPR, CCPA or other privacy and data collection laws could result in legal proceedings and substantial penalties, and materially adversely impact our financial results or brand perceptions. MACROECONOMIC AND MARKET CONDITIONS Unfavorable general economic conditions could adversely affect our business and financial results. Our results of operations are substantially affected by economic conditions, which can vary significantly by market and can impact consumer disposable income levels and spending habits. Economic conditions can also be impacted by a variety of factors including hostilities, epidemics, pandemics and actions taken by governments to manage national and international economic matters, whether through austerity, stimulus measures or trade measures, and initiatives intended to control wages, unemployment, credit availability, inflation, taxation and other economic drivers. Sustained adverse economic conditions or periodic adverse changes in economic conditions in our markets could pressure our operating performance and our business continuity disruption planning, and our business and financial results may suffer. Our results of operations are also affected by fluctuations in currency exchange rates and unfavorable currency fluctuations could adversely affect reported earnings. Changes in commodity and other operating costs could adversely affect our results of operations. The profitability of our Company-operated restaurants depends in part on our ability to anticipate and react to changes in commodity costs, including food, paper, supplies, fuel, utilities and distribution, and other operating costs, including labor. Any volatility in certain commodity prices or fluctuation in labor costs could adversely affect our operating results by impacting restaurant profitability. The commodity markets for some of the ingredients we use, such as beef and chicken, are particularly volatile due to factors such as seasonal shifts, climate conditions, industry demand, international commodity markets, food safety concerns, product recalls and government regulation, all of which are beyond our control and, in many instances, unpredictable. We can only partially address future price risk through hedging and other activities, and therefore increases in commodity costs could have an adverse impact on our profitability. A decrease in our credit ratings or an increase in our funding costs could adversely affect our profitability Our credit ratings may be negatively affected by our results of operations or changes in our debt levels. As a result, our interest expense, the availability of acceptable counterparties, our ability to obtain funding on favorable terms, collateral requirements and our operating or financial flexibility could all be negatively affected, especially if lenders impose new operating financial covenants. Our operations may also be impacted by regulations affecting capital flows, financial markets or financial institutions, which can limit our ability to manage and deploy our liquidity or increase our funding costs. If any of these events were to occur, they could have a material adverse effect on our business and financial condition. Trading volatility and the price of our common stock may be adversely affected by many factors. Many factors affect the volatility and price of our common stock in addition to our operating results and prospects. The most important of these factors, some of which are outside our control, are the following: The unpredictable nature of global economic and market conditions: Governmental action or inaction in light of key indicators of economic activity or events that can significantly influence financial markets, particularly in the U.S., which is the principal trading market for our common stock, and media reports and commentary about economic, trade or other matters, even when the matter in question does not directly relate to our business; Trading activity in our common stock or trading activity in derivative instruments with respect to our common stock or debt securities, which can be affected by market commentary (including commentary that may be unreliable or incomplete); unauthorized disclosures about our performance, plans or expectations about our business; our actual performance and creditworthiness; investor confidence, driven in part by expectations about our performance; actions by shareholders and others seeking to influence our business strategies; portfolio transactions in our stock by significant shareholders; or trading activity that results from the ordinary course rebalancing of stock indices in which McDonald's may be included, such as the S&P 500 Index and the Dow Jones Industrial Average; The impact of our stock repurchase program or dividend rate; and The impact on our results of corporate actions and market and third-party perceptions and assessments of such actions, such as those we may take from time to time as we implement our strategies, including through acquisitions, in light of changing business, legal and tax considerations and evolve our corporate structure. . 40 / 98 80% + A Events such as severe weather conditions, natural disasters, hostilities and social unrest, among others, can adversely affect our results and prospects. Severe weather conditions, natural disasters, hostilities and social unrest, climate change or terrorist activities (or expectations about them) can adversely affect consumer spending and confidence levels and supply availability and costs, as well as the local operations in impacted markets, all of which can affect our results and prospects. Our receipt of proceeds under any insurance we maintain with respect to some of these risks may be delayed or the proceeds may be insufficient to cover our losses fully. LEGAL PROCEEDINGS The Company has pending a number of lawsuits that have been filed in various jurisdictions. These lawsuits cover a broad variety of allegations spanning the Company's entire business. The following is a brief description of the more significant types of claims and lawsuits. In addition, the Company is subject to various national and local laws and regulations that impact various aspects of its business, as discussed below. While the Company does not believe that any such claims, lawsuits or regulations will have a material adverse effect on its financial condition or results of operations, unfavorable rulings could occur. Were an unfavorable ruling to occur, there exists the possibility of a material adverse impact on net income for the period in which the ruling occurs or for future periods. Franchising A substantial number of McDonald's restaurants are franchised to independent owner/operators and developmental licensees under contractual arrangements with the Company. In the course of the franchise relationship, occasional disputes arise between the Company and its current or former franchisees relating to a broad range of subjects including, but not limited to, quality, service and cleanliness issues, menu pricing, contentions regarding grants or terminations of franchises, alleged discrimination, delinquent payments of rents and fees, and franchisee claims for additional franchises or renewals of franchises. Additionally, occasional disputes arise between the Company and individuals who claim they should have been granted a McDonald's franchise or who challenge the legal distinction between the Company and its franchisees for employment law purposes. Suppliers The Company and its affiliates and subsidiaries generally do not supply food, paper or related items to any McDonald's restaurants. The Company relies upon numerous independent suppliers, including service providers, that are required to meet and maintain the Company's high standards and specifications. On occasion, disputes arise between the Company and its suppliers (or former suppliers) which include, for example, compliance with product specifications and the Company's business relationship with suppliers. In addition, disputes occasionally arise on a number of issues between the Company and individuals or entities who claim that they should be (or should have been) granted the opportunity to supply products or services to the Company's restaurants. Employees Hundreds of thousands of people are employed by the Company and in restaurants owned and operated by subsidiaries of the Company. In addition, thousands of people from time to time seek employment in such restaurants. In the ordinary course of business, disputes arise regarding hiring, termination, promotion and pay practices, including wage and hour disputes, alleged discrimination and compliance with labor and employment laws. Customers Restaurants owned by subsidiaries of the Company regularly serve a broad segment of the public as do independent owner/operators and developmental licensees of McDonald's restaurants. In so doing, disputes arise as to products, service, incidents, pricing, advertising, nutritional and other disclosures, as well as other matters common to an extensive restaurant business such as that of the Company. Intellectual Property The Company has registered trademarks and service marks, patents and copyrights, some of which are of material importance to the Company's business. From time to time, the Company may become involved in litigation to protect its intellectual property and defend against the alleged use of third party intellectual property. Government Regulations Local and national governments have adopted laws and regulations involving various aspects of the restaurant business including, but not limited to, advertising, franchising, health, safety, environment, competition, zoning, employment and taxation. The Company is occasionally involved in litigation or other proceedings regarding these matters. The Company strives to comply with all applicable existing statutory and administrative rules and cannot predict the effect on its operations from these matters or the issuance of additional requirements in the future. . 41 / 98 - 80% + PROPERTIES The Company owns and leases real estate primarily in connection with its restaurant business. The Company identifies and develops sites that offer convenience to customers and long-term sales and profit potential to the System. To assess potential, the Company analyzes traffic and walking patterns, census data and other relevant data. The Company's experience and access to advanced technology aid in evaluating this information. The Company generally owns or secures a long-term lease on the land and building for conventional franchised and Company-operated restaurant sites, which facilitates long-term occupancy rights and helps control related costs. Restaurant profitability for both the Company and franchisees is important; therefore, ongoing efforts are made to control average development costs through construction and design efficiencies, standardization and by leveraging the Company's global sourcing network. In addition, the Company primarily leases real estate in connection with its corporate headquarters, field and other offices. Additional information about the Company's properties is included in Management's Discussion and Analysis of Financial Condition and Results of Operations on pages 8 through 25 and in Financial Statements and Supplementary Data on pages 38 through 59 of this Form 10- K. INFORMATION ABOUT OUR EXECUTIVE OFFICERS The following are the Executive Officers of our Company (as of the date of this filing): lan Borden, 52, is President, International, a position he has held since January 2020. Prior to that, Mr. Borden served as President International Developmental Licensed Markets, from January 2019 through December 2019. Prior to that, Mr. Borden served as President - Foundational Markets, from July 2015 through December 2018. Mr. Borden has served the Company for 26 years. Heidi Capozzi, 51, is Corporate Executive Vice President - Chief People Officer, a position she has held since April 2020. Prior to joining the Company, Ms. Capozzi served as Senior Vice President of Human Resources for The Boeing Company from 2016 to April 2020. Francesca A. DeBiase, 55, is Corporate Executive Vice President - Global Chief Supply Chain Officer, a position she has held since October 2020. Prior to that, Ms. DeBiase served as Corporate Executive Vice President - Worldwide Supply Chain and Sustainability, from April 2018 through October 2020 and Corporate Senior Vice President - Worldwide Supply Chain and Sustainability, from March 2015 through March 2018. Ms. DeBiase has served the Company for 29 years. Joseph Erlinger, 47, is President, McDonald's USA, a position he has held since November 2019. Prior to that, Mr. Erlinger served as President - International Operated Markets, from January 2019 through October 2019 and President - High Growth Markets, from September 2016 through December 2018. From March 2015 to January 2017, Mr. Erlinger served as Vice President and Chief Financial Officer - High Growth Markets (serving in dual roles from September 2016 through January 2017). Mr. Erlinger has served the Company for nearly 19 years. Katherine Beirne Fallon, 45, is Corporate Executive Vice President - Chief Global Impact Officer, position she has held since October 2020. Prior to joining the Company, Ms. Fallon served as Executive Vice President, Global Corporate Affairs for Hilton. Daniel Henry, 50, is Corporate Executive Vice President - Chief Information Officer, a position he has held since May 2018. From October 2017 through April 2018, Mr. Henry served as Corporate Vice President - Chief Information Officer. Prior to that, Mr. Henry served as Vice President of Customer Technology and Enterprise Architecture at American Airlines from April 2012 to October 2017. Mr. Henry has served the Company for 3 years. Catherine Hoovel, 49, is Corporate Vice President - Chief Accounting Officer, a position she has held since October 2016. Ms. Hoovel served as Controller for the McDonald's restaurants owned and operated by McDonald's USA from April 2014 to September 2016. Ms. Hoovel has served the Company for nearly 25 years. Christopher Kempczinski, 52, is President and Chief Executive Officer, a position he has held since November 2019. Prior to that, Mr. Kempczinski served as President, McDonald's USA from December 2016 through October 2019 and Corporate Executive Vice President - Strategy, Business Development and Innovation, from October 2015 through December 2016. Mr. Kempczinski joined the Company from Kraft Heinz, where he most recently served as Executive Vice President of Growth Initiatives and President of Kraft International from December 2014 to September 2015. Mr. Kempczinski has served the Company for 5 years. Kevin Ozan, 57, is Corporate Executive Vice President and Chief Financial Officer, a position he has held since March 2015. From February 2008 through February 2015, Mr. Ozan served as Corporate Senior Vice President - Controller. Mr. Ozan has served the Company for 23 years. 42 / 98 80% + + 36 McDonald's Corporation 2020 Annual Report AVAILABILITY OF COMPANY INFORMATION The Company is subject to the informational requirements of the Securities Exchange Act of 1934 ("Exchange Act"). The Company therefore files periodic reports, proxy statements and other information with the SEC. Such reports may be obtained by visiting the SEC's website at www.sec.gov. Financial and other information can also be accessed on the investor section of the Company's website at www.investor.mcdonalds.com. The Company uses this website as a primary channel for disclosing key information to its investors, some of which may contain material and previously non-public information. The Company makes available, free of charge, copies of its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC. Copies of financial and other information are also available free of charge by calling (800) 228-9623. Also posted on McDonald's website are the Company's Corporate Governance Principles; the charters for each of the Committees of the Board of Directors, including the Audit and Finance Committee, Compensation Committee, Governance Committee, Public Policy and Strategy Committee and Sustainability and Corporate Responsibility Committee; the Code Conduct for the Board of Directors, and the Company's Standards of Business Conduct, which applies to all officers and employees. Copies of these documents are also available free of charge by calling (800) 228-9623. Information on the Company's website is not incorporated into this Form 10-K or the Company's other securities filings unless expressly noted. Financial Statements and Supplementary Data Page reference Index to consolidated financial statements Consolidated statement of income for each of the three years in the period ended December 31, 2020 Consolidated statement of comprehensive income for each of the three years in the period ended December 31, 2020 Consolidated balance sheet at December 31, 2020 and 2019 Consolidated statement of cash flows for each of the three years in the period ended December 31, 2020 Consolidated statement of shareholders' equity for each of the three years in the period ended December 31, 2020 Notes to consolidated financial statements Management's assessment of internal control over financial reporting Report of independent registered public accounting firm Report of independent registered public accounting firm on internal control over financial reporting 38 39 40 41 42 43 60 61 63 32 / 98 75% + STOCK PERFORMANCE GRAPH At least annually, we consider which companies comprise a readily identifiable investment peer group. McDonald's is included in published restaurant indices; however, unlike most other companies included in these indices, which have no or limited international operations, McDonald's does business in more than 100 countries and a substantial portion of our revenues and income is generated outside the U.S. In addition, because of our size, McDonald's inclusion in those indices tends to skew the results. Therefore, we believe that such a comparison is not meaningful. market capitalization, trading volume and importance in an industry that is vital to the U.S. economy have resulted in McDonald's inclusion and income outside the U.S. and some manage global brands. Thus, we believe that the use of the DJIA companies as the group for comparison purposes is appropriate. The following performance graph shows McDonald's cumulative total shareholder returns (i.e., price appreciation and reinvestment of dividends) relative to the Standard & Poor's 500 Stock Index (S&P 500 Index) and to the DJIA companies for the five-year period ended December 31, 2020. The graph assumes that the value of an investment in McDonald's common stock, the S&P 500 index and the DJIA companies (including McDonald's) was $100 at December 31, 2015. For the DJIA companies, returns are weighted for market capitalization as of the beginning of each period indicated. These returns may vary from those of the Dow Jones Industrial Average Index, which is not weighted by market capitalization, and may be composed of different companies during the period under consideration Comparison of Cumulative Five-Year Total Return $250 $200 $150 $100 $50 2015 2016 2017 2018 2019 2020 McDonald's Corporation . S&P 500 Index - Dow Jones Industrials Company/Index McDonald's Corporation S&P 500 Index Dow Jones Industrials 12/31/2015 $100 $100 $100 12/31/2016 $106 $112 $116 12/31/2017 $154 $136 $149 12/31/2018 $163 $130 $144 12/31/2019 $186 $171 $181 12/31/2020 $207 $203 $198 Source: S&P Capital IQ 33 / 98 - 75% + a MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES MARKET INFORMATION AND DIVIDEND POLICY The Company's common stock trades under the symbol MCD and is listed on the New York Stock Exchange in the U.S. The number of shareholders of record and beneficial owners of the Company's common stock as of January 31, 2021 was estimated to be 2.900,000 Given the Company's returns on its capital investments and significant cash provided by operations, management believes it is prudent to reinvest in the business to drive profitable growth and use excess cash flow to return cash to shareholders through dividends and share repurchases. The Company has paid dividends on common stock for 45 consecutive years through 2020 and has increased the dividend amount at least once every year. As in the past, future dividend amounts will be considered after reviewing profitability expectations and financing needs, and will be declared at the discretion of the Company's Board of Directors. ISSUER PURCHASES OF EQUITY SECURITIES The following table presents information related to repurchases of common stock the Company made during the quarter ended December 31, 2020*: Total Number of AP Value Dollar Shares Purchased as of Shares Part of Publicly that May Yet Total Number of Announced Plans or Be Purchased Under Period Average Price Shares Purchased Paid per Share Programs the Plans or Programs October 1-31, 2020 7,104 223.77 7.104 $14,126,457,801 November 1-30, 2020 2,342 216.52 2,342 14,125,950,721 December 1-31, 2020 356 212.08 356 14,125,875,221 Total 9.802 221.61 9.802 Subject to applicable law, the Company may repurchase shares directly in the open market, in privately negotiated transactions, or pursuant to derivative instruments and plans complying with Rule 1065-1, among other types of transactions and arrangements. (1) On December 31, 2019, the Company's Board of Directors approved a share repurchase program, effective January 1, 2020, that authorized the purchase of up to $15 billion of the Company's outstanding common stock. In early March 2020, the Company voluntarily suspended share repurchases from the open market. Therefore, the table above reflects only shares withheld for taxes under the Company's equity compensation program. 34 / 98 75% + a RISK FACTORS GLOBAL PANDEMIC The COVID-19 pandemic has adversely affected and is expected to continue to adversely affect our financial results, condition and outlook. Health epidemics or pandemics can adversely affect consumer spending and confidence levels and supply availability and costs, as well as the local operations in impacted markets, all of which can affect our financial results, condition and outlook. Importantly, the global pandemic resulting from COVID-19 has disrupted global health, economic and market conditions, consumer behavior and McDonald's global restaurant operations beginning in early 2020. Local and national governmental mandates or recommendations and public perceptions of the risks associated with the COVID-19 pandemic have caused, and we expect will continue to cause, consumer behavior to change and worsening or volatile economic conditions, each of which could continue to adversely affect our business. In addition, our global operations have been disrupted to varying degrees and may continue to be disrupted given the unpredictability of the virus, its resurgences and government responses thereto as well as potentially permanent changes to the industry we operate in. While we cannot predict the duration or scope of the COVID-19 pandemic, the resurgence of infections in one or more markets, or the impact of vaccines across the globe, the COVID-19 pandemic has negatively impacted our business and is expected to continue to impact our financial results, condition and outlook in a way that may be material. The COVID-19 pandemic may also heighten other risks disclosed in these Risk Factors, such as, but not limited to, those related to consumer behavior, consumer perceptions of our brand, supply chain interruptions, commodity costs and labor availability and cost. STRATEGY AND BRAND If we do not successfully evolve and execute against our business strategies, including the new Accelerating the Arches strategy, we may not be able to drive business growth. To drive Systemwide sales, operating income and free cash flow growth, our business strategies must be effective in maintaining and strengthening customer appeal and capturing additional market share. Whether these strategies are successful depends mainly on our System's ability to: Capitalize on our global scale, iconic brand and local market presence to build upon our historic strengths and competitive advantages, such as our marketing, core menu items and digital, delivery and drive thru; Continue to innovate and differentiate the McDonald's experience, including by preparing and serving our food in a way that balances value and convenience to our customers with profitability Accelerate digital innovation for a fast and easy customer experience; Continue to run great restaurants by driving efficiencies and expanding capacities while continuing prioritize health and safety: Identify and develop restaurant sites consistent with our plans for net growth of Systemwide restaurants; Accelerate our existing strategies, including through growth opportunities and potential acquisitions, investments and partnerships; and Evolve and adjust our business strategies in response to, among other things, changing consumer behavior, operational restrictions and impacts to our results of operations and liquidity, including as a result of the COVID-19 pandemic. If we are delayed or unsuccessful in executing our strategies, or if our strategies do not yield the desired results, our business, financial condition and results of operations may suffer. Failure to preserve the value and relevance of our brand could have an adverse impact on our financial results. To be successful the future, we believe we must preserve, enhance and leverage the value of our brand, including our corporate purpose, mission and values. Brand value is based in part on consumer perceptions. Those perceptions are affected by a variety of factors, including the nutritional content and preparation of our food, the ingredients we use, the manner in which we source commodities and our general business practices. Consumer acceptance of our offerings is subject to change for a variety of reasons, and some changes can occur rapidly. For example, nutritional, health, environmental and other scientific studies and conclusions, which constantly evolve and may have contradictory implications, drive popular opinion, litigation and regulation (including initiatives intended to drive consumer behavior) in ways that affect the informal eating out" ("NEO") segment or perceptions of our brand, generally or relative to available alternatives. Consumer perceptions may also be affected by adverse commentary from third parties, including through social media or conventional media outlets, regarding the quick-service category of the IEO segment, our brand, our culture, our operations, our suppliers, or our franchisees. If we are unsuccessful in addressing adverse commentary or perceptions, whether or not accurate, our brand and our financial results may suffer. Additionally, the ongoing relevance of our brand may depend on the success of our sustainability initiatives, which require Systemwide coordination and alignment. We are working to manage any risks and costs to us, our franchisees and our supply chain of any effects of climate change, greenhouse gases, and diminishing energy and water resources. These risks include any increased public focus, including by governmental and nongovernmental organizations, on these and other environmental sustainability matters, such as packaging and waste, animal health and welfare, deforestation and land use. These risks also include any increased pressure to make commitments, set targets or establish additional goals and take actions to meet them. These risks could expose us to market, operational and execution costs or risks. 35 / 98 - 75% + If we are not effective in addressing social and environmental responsibility matters or achieving relevant sustainability goals, consumer trust in our brand may suffer. In particular, business incidents or practices, whether actual or perceived, that erode consumer trust or confidence, particularly if such incidents or practices receive considerable publicity or result in litigation, can significantly reduce brand value and have a negative impact on our financial results. If we do not anticipate and address evolving consumer preferences and effectively execute our pricing, promotional and marketing plans, our business could suffer. Our continued success depends on our System's ability to build upon our historic strengths and competitive advantages. In order to do so, we need to anticipate and respond effectively to continuously shifting consumer demographics and trends in food sourcing, food preparation, food offerings and consumer preferences and behaviors in the IEO segment. If we are not able to predict, or quickly and effectively respond to these changes, or our competitors predict or respond more effectively, our financial results could be adversely impacted. Our ability to build upon our strengths and advantages also depends on the impact of pricing, promotional and marketing plans across the System, and the ability to adjust these plans to respond quickly and effectively to evolving customer preferences, as well as shifting economic and competitive conditions. Existing or future pricing strategies, marketing plans, and the value proposition they represent, are expected to continue to be important components of our business strategy; however, they may not be successful, or may not be as successful as the efforts of our competitors, and could negatively impact sales, guest counts and market share. Additionally, we operate in a complex and costly advertising environment. Our marketing and advertising programs may not be successful in reaching our customers in the way we intend. Our success depends in part on whether the allocation of our advertising and marketing resources across different channels, including digital marketing, allows us to reach our customers effectively and efficiently, and in ways that are meaningful to them. If the advertising and marketing programs are not successful, or are not as successful as those of our competitors, our sales, guest counts and market share could decrease. Our investments to enhance the customer experience, including through technology, may not generate the expected returns. Our long-term business objectives depend on the successful Systemwide execution of our strategies. We continue to build upon ou investments in technology and modernization, digital engagement and delivery, in order to transform the customer experience. As part of these investments, we are placing renewed emphasis on improving our service model and strengthening relationships with customers, in part through digital channels and loyalty initiatives, mobile ordering and payment systems, and enhancing our drive thru technologies, which may not generate expected returns. We also continue to offer and refine our delivery initiatives, including through growing awareness and trial. Utilizing a third-party delivery service may not have the same level of profitability as a non-delivery transaction, and may introduce additional food quality and customer satisfaction risks. If these customer experience initiatives are not well executed, or if we do not fully realize the intended benefits f these significant investments, our business results may suffer. We face intense competition in our markets, which could hurt our business. We compete primarily in the IEO segment, which is highly competitive. We also face sustained, intense competition from traditional, fast casual and other competitors, which may include many non-traditional market participants such as convenience stores, grocery stores and coffee shops well as online retailers. We expect our environment to continue to be highly competitive, and our results in any particular reporting period may be impacted by a contracting IEO segment or by new or continuing actions, product offerings or consolidation of our competitors and third party partners, which may have a short- or long-term impact on our results. We compete on the basis of product choice, quality, affordability, service and location. In particular, we believe our ability to compete successfully in the current market environment depends on our ability to improve existing products, successfully develop and introduce new products, price our products appropriately, deliver a relevant customer experience, manage the complexity of our restaurant operations, manage our investments in technology and modernization, and respond effectively to our competitors' actions or offerings or to unforeseen disruptive actions. There can be no assurance these strategies will be effective, and some strategies may be effective at improving some metrics while adversely affecting other metrics, which could have the overall effect of harming our business. We may not be able to adequately protect our intellectual property or adequately ensure that we are not infringing the intellectual property of others, which could harm the value of the McDonald's brand and our business. The success of our business depends on our continued ability to use our existing trademarks and service marks in order to increase brand awareness and further develop our branded products in both domestic and international markets. We rely on a combination of trademarks, copyrights, service marks, trade secrets, patents and other intellectual property rights to protect our brand and branded products. We have registered certain trademarks and have other trademark registrations pending in the U.S. and certain foreign jurisdictions The trademarks that we currently use have not been registered in all of the countries outside J.S. in which we do business or may do business in the future and may never be registered in all of these countries. It may be costly and time consuming to protect our intellectual property, and the steps we have taken to protect our intellectual property in the U.S. and foreign countries may not be adequate. addition, the steps we have taken may not adequately ensure that we do not infringe the intellectual property of others, and third parties may claim infringement by us in the future. In particular, we may be involved in intellectual property claims, including often aggressive or opportunistic attempts to enforce patents used in information technology systems, which might affect our operations and results. Any claim of infrin