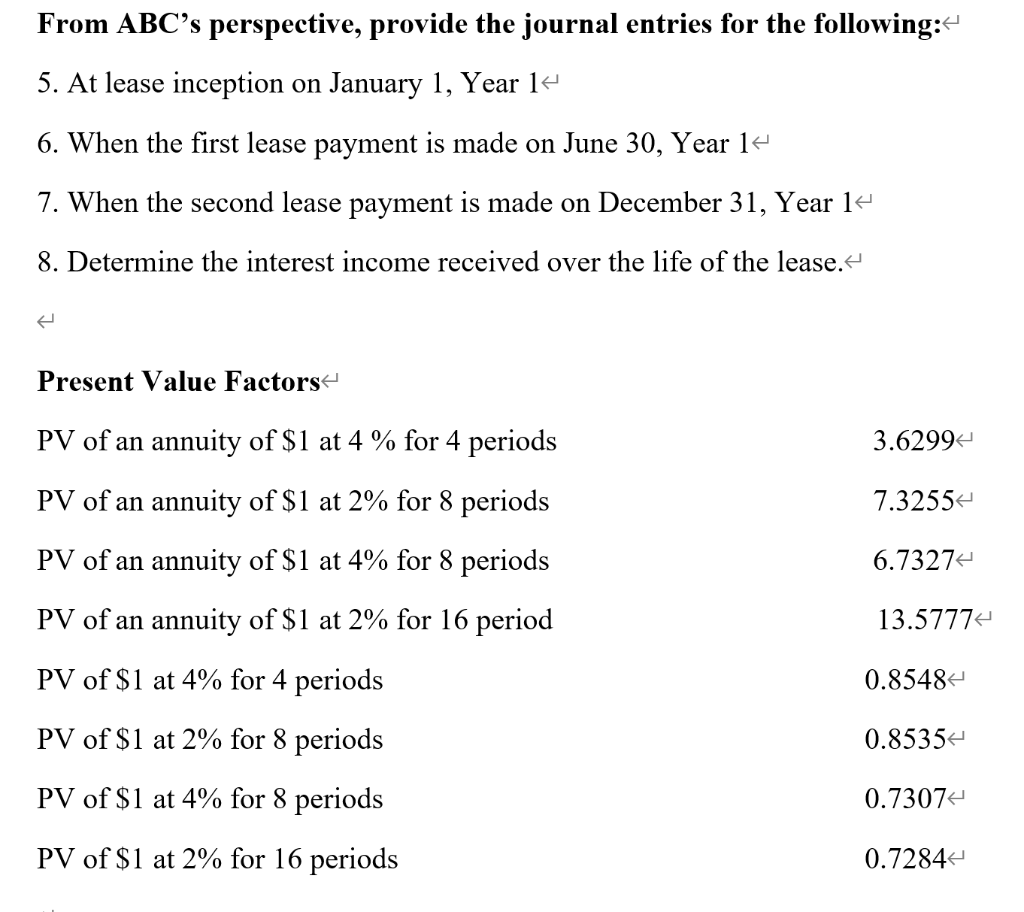

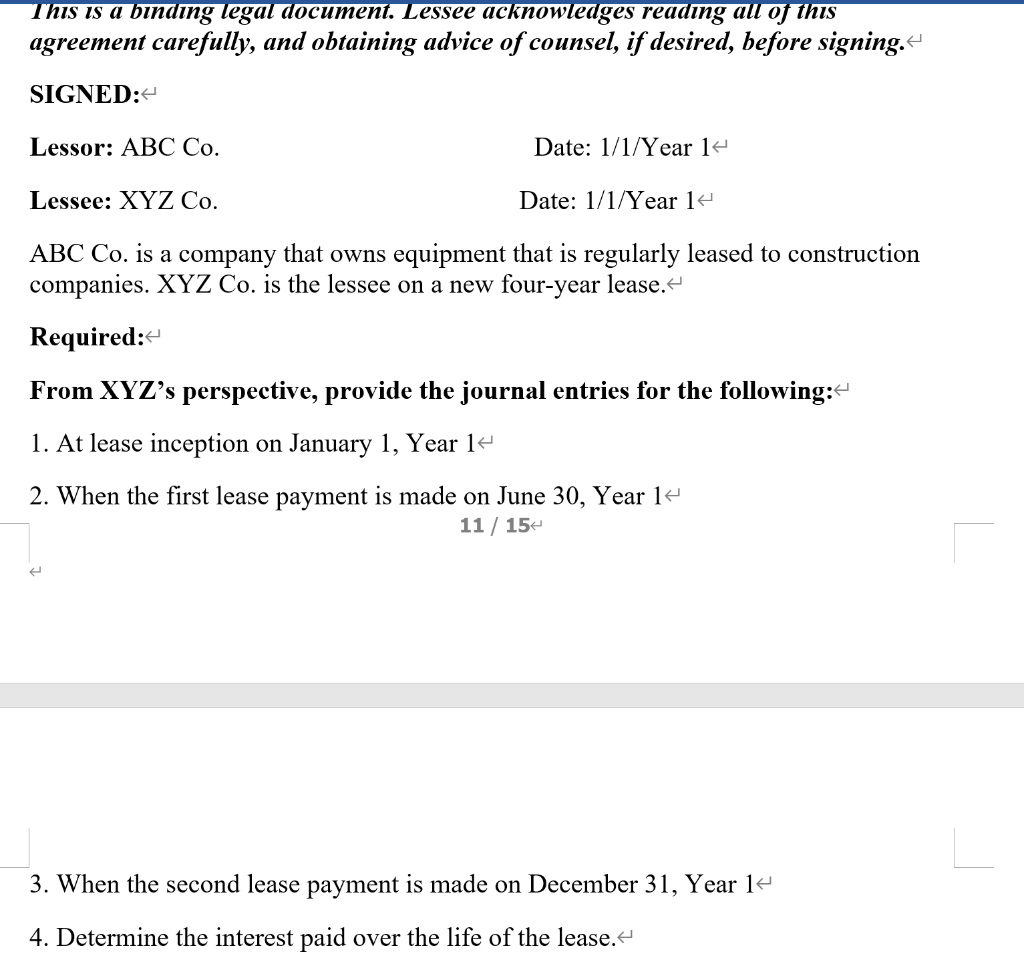

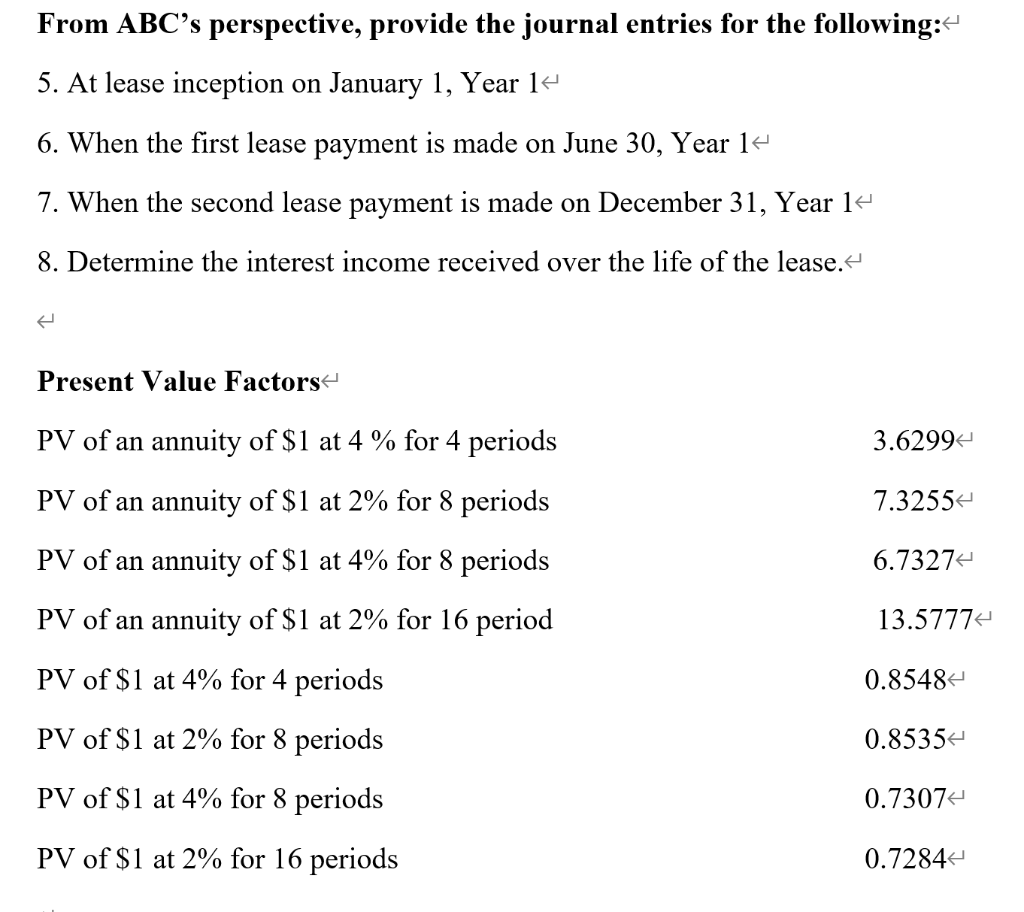

Lease Agreement This Lease Agreement (Agreement) is entered into by and between ABC Co. (Lessor), and XYZ Co. (Lessee). Lessor and Lessee are collectively referred to in this Agreement as the Parties. This Agreement shall be effective as of the date executed by the Lessor, as set forth below." For the covenants contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows: 1. Asset: The leased assets shall be machine leased by the lessee and leased from the Lessor. Lessor leases the assets to the Lessee on the terms and conditions set forth herein. The equipment has a carrying value of $1,000,000 at the time of the lease, a useful life of eight (8) years, and no salvage value. 2. Term: The term of this Agreement shall be a period of four (4) years, beginning on January 1, Year 1, and ending on December 31, Year 4. Any earlier termination of the term without Lessor's prior written consent shall be a default of this Agreement. The lease has the option to extend the lease for another 4 years. Normally, the lease would exercise this option. 5. Lease Value/Semiannual Payments: The lease payments to be paid by Lessee to the Lessor will be thirty thousand dollars ($30,000) every six months for the duration of the lease, with payments to be made on June 30 and December 31 each year. The payments will be based on an annual interest rate of 4%. 12.Entire Agreement: This document constitutes the entire agreement and may be modified or amended only written agreement signed by both Parties. There are no oral agreements between the Parties. IN WITNESS THEREOF, the Parties have caused this Agreement to be executed on the dates set forth below. This is a binding legal document. Lessee acknowledges reading all of this agreement carefully, and obtaining advice of counsel, if desired, before signing. SIGNED: Lessor: ABC Co. Date: 1/1/Year 14 Lessee: XYZ Co. Date: 1/1/Year 14 ABC Co. is a company that owns equipment that is regularly leased to construction companies. XYZ Co. is the lessee on a new four-year lease. Required: From XYZ's perspective, provide the journal entries for the following: - 1. At lease inception on January 1, Year 14 2. When the first lease payment is made on June 30, Year 14 11 / 154 3. When the second lease payment is made on December 31, Year 14 4. Determine the interest paid over the life of the lease. From ABC's perspective, provide the journal entries for the following: 5. At lease inception on January 1, Year 14 6. When the first lease payment is made on June 30, Year 14 7. When the second lease payment is made on December 31, Year 14 8. Determine the interest income received over the life of the lease. Present Value Factors PV of an annuity of $1 at 4 % for 4 periods 3.62994 PV of an annuity of $1 at 2% for 8 periods 7.32554 PV of an annuity of $1 at 4% for 8 periods 6.7327 PV of an annuity of $1 at 2% for 16 period 13.5777 PV of $1 at 4% for 4 periods 0.85484 PV of $1 at 2% for 8 periods 0.85354 PV of $1 at 4% for 8 periods 0.7307 PV of $1 at 2% for 16 periods 0.72844 Lease Agreement This Lease Agreement (Agreement) is entered into by and between ABC Co. (Lessor), and XYZ Co. (Lessee). Lessor and Lessee are collectively referred to in this Agreement as the Parties. This Agreement shall be effective as of the date executed by the Lessor, as set forth below." For the covenants contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows: 1. Asset: The leased assets shall be machine leased by the lessee and leased from the Lessor. Lessor leases the assets to the Lessee on the terms and conditions set forth herein. The equipment has a carrying value of $1,000,000 at the time of the lease, a useful life of eight (8) years, and no salvage value. 2. Term: The term of this Agreement shall be a period of four (4) years, beginning on January 1, Year 1, and ending on December 31, Year 4. Any earlier termination of the term without Lessor's prior written consent shall be a default of this Agreement. The lease has the option to extend the lease for another 4 years. Normally, the lease would exercise this option. 5. Lease Value/Semiannual Payments: The lease payments to be paid by Lessee to the Lessor will be thirty thousand dollars ($30,000) every six months for the duration of the lease, with payments to be made on June 30 and December 31 each year. The payments will be based on an annual interest rate of 4%. 12.Entire Agreement: This document constitutes the entire agreement and may be modified or amended only written agreement signed by both Parties. There are no oral agreements between the Parties. IN WITNESS THEREOF, the Parties have caused this Agreement to be executed on the dates set forth below. This is a binding legal document. Lessee acknowledges reading all of this agreement carefully, and obtaining advice of counsel, if desired, before signing. SIGNED: Lessor: ABC Co. Date: 1/1/Year 14 Lessee: XYZ Co. Date: 1/1/Year 14 ABC Co. is a company that owns equipment that is regularly leased to construction companies. XYZ Co. is the lessee on a new four-year lease. Required: From XYZ's perspective, provide the journal entries for the following: - 1. At lease inception on January 1, Year 14 2. When the first lease payment is made on June 30, Year 14 11 / 154 3. When the second lease payment is made on December 31, Year 14 4. Determine the interest paid over the life of the lease. From ABC's perspective, provide the journal entries for the following: 5. At lease inception on January 1, Year 14 6. When the first lease payment is made on June 30, Year 14 7. When the second lease payment is made on December 31, Year 14 8. Determine the interest income received over the life of the lease. Present Value Factors PV of an annuity of $1 at 4 % for 4 periods 3.62994 PV of an annuity of $1 at 2% for 8 periods 7.32554 PV of an annuity of $1 at 4% for 8 periods 6.7327 PV of an annuity of $1 at 2% for 16 period 13.5777 PV of $1 at 4% for 4 periods 0.85484 PV of $1 at 2% for 8 periods 0.85354 PV of $1 at 4% for 8 periods 0.7307 PV of $1 at 2% for 16 periods 0.72844