lease answer the question step by step with detail report: Requirement:::: Make a report to address the following matters/concerns that have been raised by the

lease answer the question step by step with detail report:

Requirement::::

Make a report to address the following matters/concerns that have been raised by the Managing Director of the company.

Step-1:: As a going concern, he wishes to evaluate the six divisions in light of growing competition as the economy continues to grow. He has asked you to identify and assess: the product divisions that are producing low value-added items and require huge working capital investments, and the implications of low value-added items for financial returns and profitability.

Step-2:: He wishes to make a strategic decision about the long-term viability of both the bathroom accessories division and the pipes division due to the very competitive environment both divisions are competing in. As both divisions would require considerable capital expenditure to improve efficiency and to make them more competitive, he has decided to sell them. BMPJ 6204 MANAGERIAL ACCOUNTING | MASTER IN MANAGEMENT 2 Critically evaluate the arguments for selling the two divisions, even though both are profitable.

Step-=::3

The company needs to reduce its financial gearing, which is too high. However, the company also needs to spend large sums of capital for equipment replacement and modernisation programmes, investments in new projects and new product developments. All capital investment projects should have a target payback period.

(i) Identify and analyse the factors which should influence how long the payback period should be for equipment replacement programmes and new development projects.

(ii) Critically analyse the relative importance of the strategic aim of reducing gearing and the aim to continue to invest in modernisation programmes.

Pleased give the answer ,,, i will rate high..

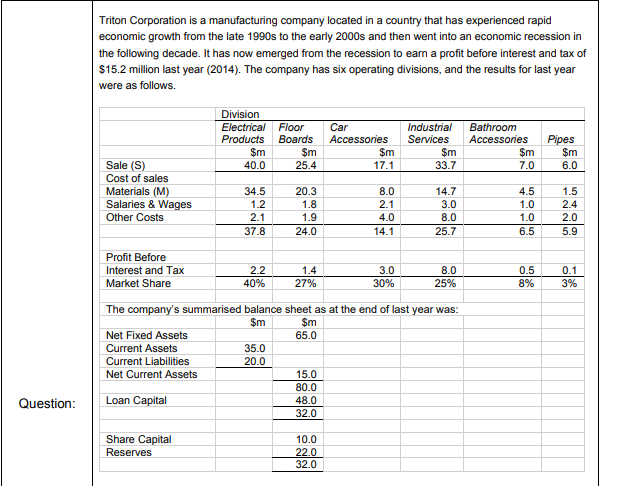

Triton Corporation is a manufacturing company located in a country that has experienced rapid economic growth from the late 1990s to the early 2000s and then went into an economic recession in the following decade. It has now emerged from the recession to earn a profit before interest and tax of $15.2 million last year (2014). The company has six operating divisions, and the results for last year were as follows. Division Electrical Floor Products Boards $m $m 40.0 25.4 Industrial Services Car Accessories $m 17.1 Bathroom Accessories $m 7.0 $m Pipes $m 6.0 33.7 Sale (S) Cost of sales Materials (M) Salaries & Wages Other Costs 34.5 1.2 2.1 37.8 20.3 1.8 1.9 24.0 8.0 2.1 4.0 14.1 14.7 3.0 8.0 4.5 1.0 1.0 6. 1.5 2.4 2.0 5.9 Profit Before Interest and Tax Market Share 2.2 40% 1.4 27% 3.0 30% 8.0 25% 0.5 8% 0.1 3% The company's summarised balance sheet as at the end of last year was: Sm Sm Net Fixed Assets 65.0 Current Assets 35.0 Current Liabilities 20.0 Net Current Assets 15.0 80.0 Loan Capital 48.0 32.0 Question: Share Capital Reserves 10.0 22.0 32.0 Triton Corporation is a manufacturing company located in a country that has experienced rapid economic growth from the late 1990s to the early 2000s and then went into an economic recession in the following decade. It has now emerged from the recession to earn a profit before interest and tax of $15.2 million last year (2014). The company has six operating divisions, and the results for last year were as follows. Division Electrical Floor Products Boards $m $m 40.0 25.4 Industrial Services Car Accessories $m 17.1 Bathroom Accessories $m 7.0 $m Pipes $m 6.0 33.7 Sale (S) Cost of sales Materials (M) Salaries & Wages Other Costs 34.5 1.2 2.1 37.8 20.3 1.8 1.9 24.0 8.0 2.1 4.0 14.1 14.7 3.0 8.0 4.5 1.0 1.0 6. 1.5 2.4 2.0 5.9 Profit Before Interest and Tax Market Share 2.2 40% 1.4 27% 3.0 30% 8.0 25% 0.5 8% 0.1 3% The company's summarised balance sheet as at the end of last year was: Sm Sm Net Fixed Assets 65.0 Current Assets 35.0 Current Liabilities 20.0 Net Current Assets 15.0 80.0 Loan Capital 48.0 32.0 Question: Share Capital Reserves 10.0 22.0 32.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started