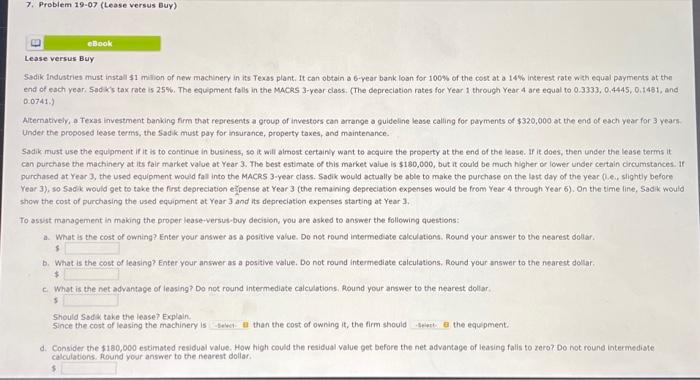

Lease versus Buy Sidik industries must instali $1 milion of new machinery in its Texss plant. It can obtain a 6 -vear bank loan for 100% of the cost at a 14% interest rate wah equal payments at the end of each year. Sadk's tax rate is 25%. The equipment falls in the Macks 3-year class. (The depreciation rates for Year 1 through Year 4 are equal to 0.3333, 0.4445, 0.1481, and 0.0741.) Aternatively, a Texas investment banking firm that represents a group of investocs can arrange a guideline lease calling for parments of $320,000 at the end of each year for 3 years. Under the proposed lease terms, the Sadik must pay for insurance, property taxes, and maintenance. Sadik must use the equlpment if it is to continue in business, so it will almost certainy want to bcquire the property at the end of the loase. If it does, then uncer the lease terms it can purchase the machinery at its fair market value at Year 3 . The best estimate of this market value is $180,000, but it could be much higher or lower under certain orcumstances. If purchased at Year 3, the used equipment would fal into the MACRS 3-year class. Sadik would actually be able to make the purchase on the last day of the year 0. .., slightly before Year 3), so sadk would get to take the frst depreciation ejpense at Year 3 (the remaining depreciation expenses would be from Yeac 4 through Year 5 ). On the time line, Sadik would show the cont of purchasing the used equipment at Year 3 and its depreciation expenses starting at Year 3 . To aswst management in making the proper lease-versut-buy decition, you are asked to answer the following questions: a. What is the cost of owning? Enter your answer as a positive value. Do not round intermediste calculatians. Round your answer to the nearest doliar. 5 D. What is the cost of leasing? Enter your answer as a positive value. Do not round intermediate calculations, Round your answer to the nearest deltar. $ C. What is the net advantage of lessing? Do not round intermediate calculations. Round your answer to the nearest dollar. s Should sodk take the lease? Explain. Since the cost of leasing the machinery is than the cost of owning it, the firm should the equipment. d. Consider the $180,000 estimated residual value. How high could the resleual vatue get before the net advantage of leating falfs to zero? Do not round intermediate calnitatians. thound your answer to the nearest dollar. 5