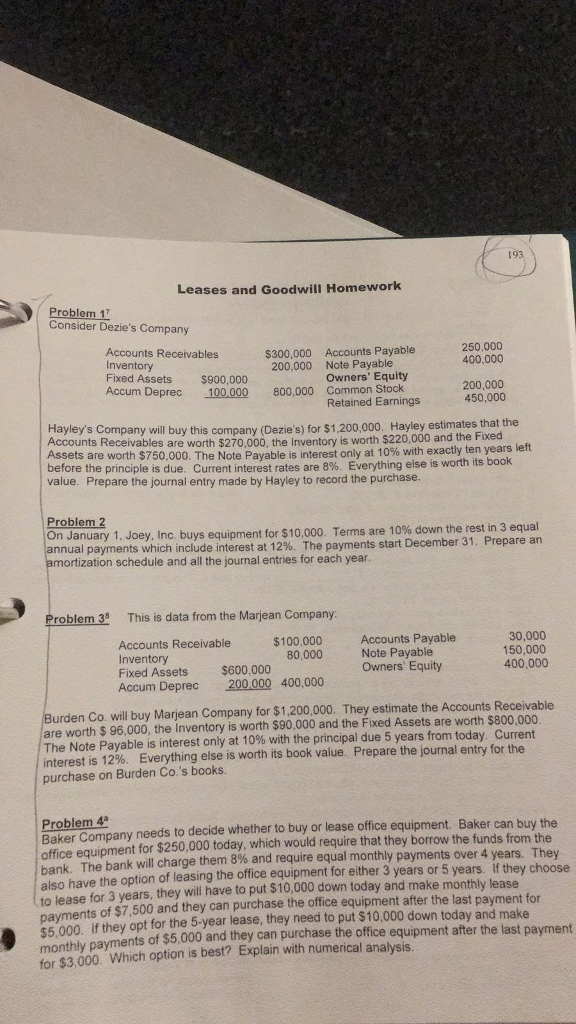

Leases and Goodwill Homework Problem 1 Consider Dezie's Company Accounts Receivables Inventory Fixed Assets $900,000 Accum D 250,000 400,000 $300,000 Accounts Payable 200,000 Note Payable Owners' Equity 200,000 450,000 eprec 100,000 800,000 Common Stock Retained Earnings Hayley's Company will buy this company (Dezie's) for $1.200,000. Hayley estimates that th Accounts Receivables are worth $270,000, the inventory is worth $220,000 and the Fixed Assets are worth $750,000. The Note Payable is interest only at 10% with exactly ten years le before the principle is due. Current interest rates are 8%. Everything else is w value. Prepare the journal entry made by Hayley to record the purchase ft orth its book Probiem 2 On January 1, Joey, Inc. buys equipment for $10,000. Terms are 1 annual payments amortization schedule and all the journal entries for each year 0% down the rest in 3 equal which include interest at 12%. The payments start December 31, Prepare an Prohlem2 This a da fomth MiaCany Accounts Receivable $100,000 nventory Fixed Assets $600,000 Accum Deprec 200.000 400,000 Accounts Payable 30,000 150,000 400,000 80,000Note Payable Owners Equity Burden Co. will buy Marjean Company for $1,200,000. They estimate the Accounts Receivable are worth $ 96,000, the Inventory is worth $90,000 and the Fixed Assets are worth $800,000 The Note Payable is interest only at 10% with the principal due 5 years from today Current interest is 12%. Everything else is worth its book value. Prepare the journal entry for the purchase on Burden Co.'s books. roblem 4a Baker Company needs to decide whether to buy or lease office equipment. Baker can buy the office equipment for $250,000 today, which would require that they borrow the funds from the bank, The bank will charge them 8% and require equal monthly payments over 4 years. They also have the option of leasing the office equipment for either 3 years or 5 years. if they choose to lease for 3 years, they will have to put $10,000 down today and make monthly lease payments of $7,500 and they can purchase the office equipment after the last payment for 55,000. If they opt for the 5-year lease, they need to put $10,000 down today and make monthly payments of $5,000 and they can purchase the office equipment after the last payment for $3,000. Which option is best? Explain with numerical analysis