Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Leases R Us (LRU) has been approached by New Manufacturing, asking LRU to develop several alternatives for a leasing contract for equipment New Manufacturing

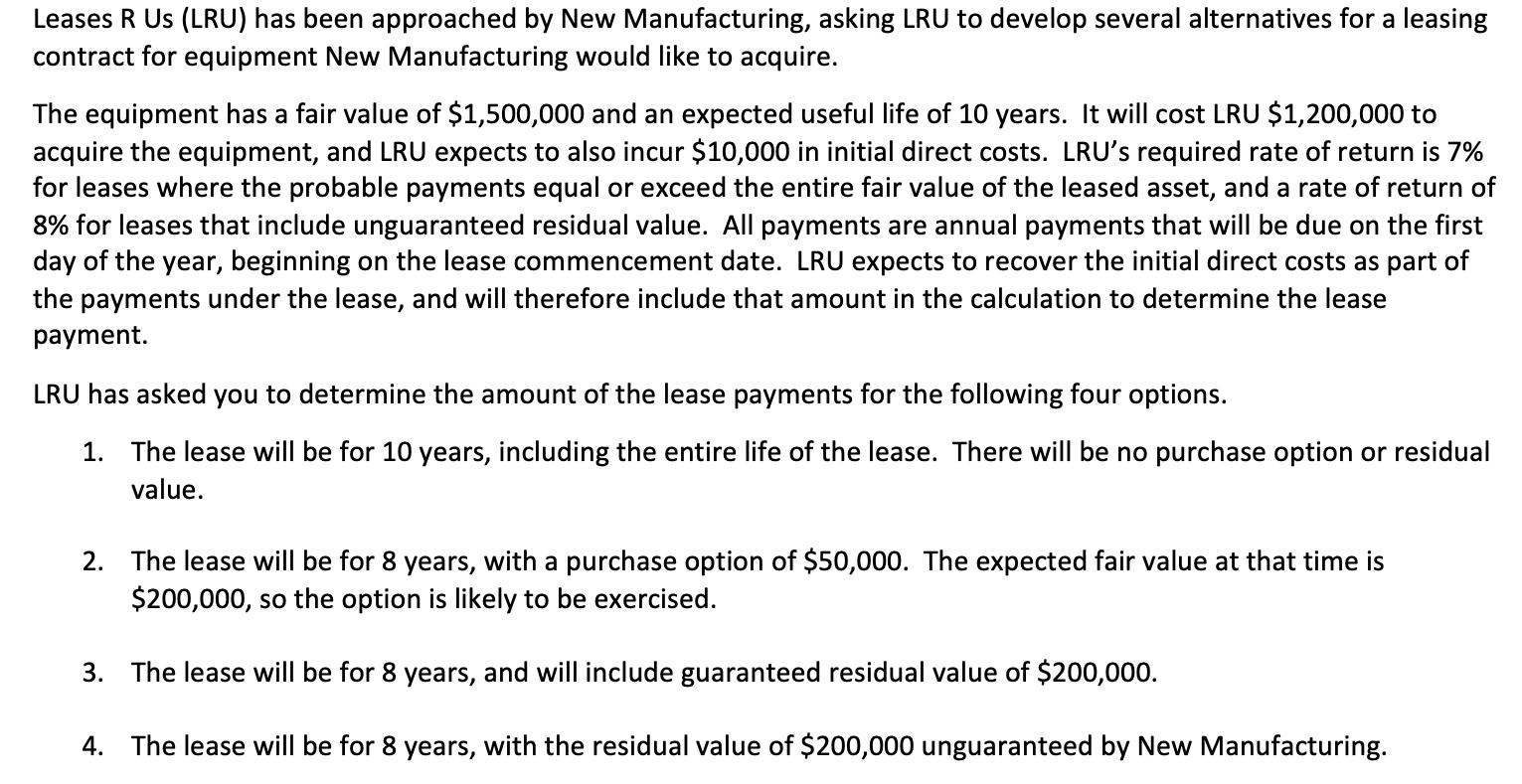

Leases R Us (LRU) has been approached by New Manufacturing, asking LRU to develop several alternatives for a leasing contract for equipment New Manufacturing would like to acquire. The equipment has a fair value of $1,500,000 and an expected useful life of 10 years. It will cost LRU $1,200,000 to acquire the equipment, and LRU expects to also incur $10,000 in initial direct costs. LRU's required rate of return is 7% for leases where the probable payments equal or exceed the entire fair value of the leased asset, and a rate of return of 8% for leases that include unguaranteed residual value. All payments are annual payments that will be due on the first day of the year, beginning on the lease commencement date. LRU expects to recover the initial direct costs as part of the payments under the lease, and will therefore include that amount in the calculation to determine the lease payment. LRU has asked you to determine the amount of the lease payments for the following four options. 1. The lease will be for 10 years, including the entire life of the lease. There will be no purchase option or residual value. 2. The lease will be for 8 years, with a purchase option of $50,000. The expected fair value at that time is $200,000, so the option is likely to be exercised. 3. The lease will be for 8 years, and will include guaranteed residual value of $200,000. 4. The lease will be for 8 years, with the residual value of $200,000 unguaranteed by New Manufacturing.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Case 1 Cost 1210000 Interest rate 8 Given the cost of the Asset as 1200000 and 10000 will be th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started