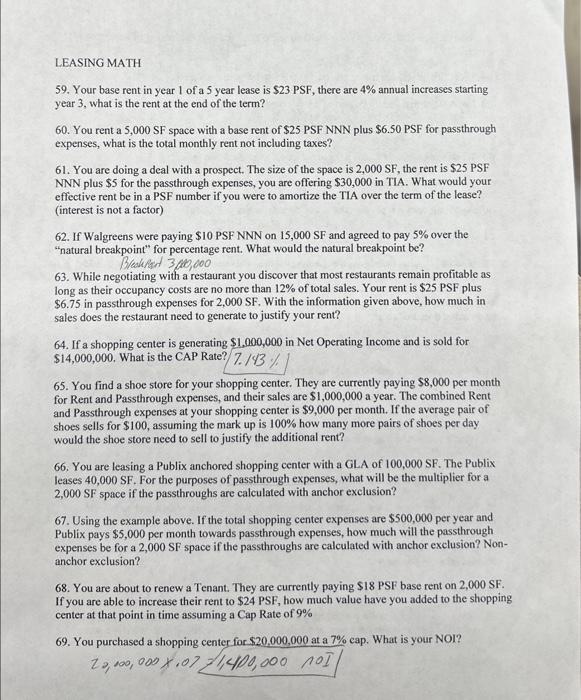

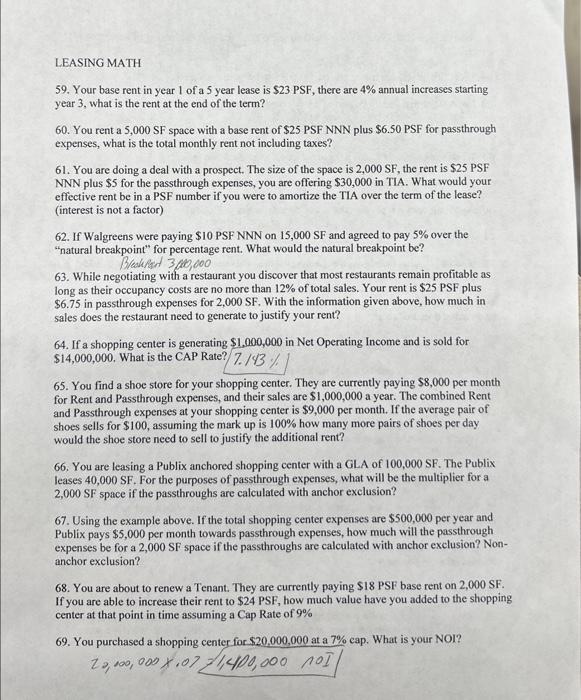

LEASING MATH 59. Your base rent in year 1 of a 5 year lease is $23 PSF, there are 4% annual increases starting year 3 , what is the rent at the end of the term? 60. You rent a 5,000 SF space with a base rent of \$25 PSF NNN plus $6.50 PSF for passthrough expenses, what is the total monthly rent not including taxes? 61. You are doing a deal with a prospect. The size of the space is 2,000SF, the rent is $25 PSF NNN plus $5 for the passthrough expenses, you are offering $30,000 in TIA. What would your effective rent be in a PSF number if you were to amortize the TIA over the term of the lease? (interest is not a factor) 62. If Walgreens were paying $10 PSF NNN on 15,000SF and agreed to pay 5% over the "natural breakpoint" for percentage rent. What would the natural breakpoint be? Bradisist 3,0,000 63. While negotiating with a restaurant you discover that most restaurants remain profitable as long as their occupancy costs are no more than 12% of total sales. Your rent is $25 PSF plus $6.75 in passthrough expenses for 2,000SF. With the information given above, how much in sales does the restaurant need to generate to justify your rent? 64. If a shopping center is generating $1,000,000 in Net Operating Income and is sold for $14,000,000. What is the CAP Rate? 7.143% 65. You find a shoe store for your shopping center. They are currently paying $8,000 per month for Rent and Passthrough expenses, and their sales are $1,000,000 a year. The combined Rent and Passthrough expenses at your shopping center is $9,000 per month. If the average pair of shoes sells for $100, assuming the mark up is 100% how many more pairs of shoes per day would the shoe store need to sell to justify the additional rent? 66. You are leasing a Publix anchored shopping center with a GLA of 100,000 SF. The Publix leases 40,000SF. For the purposes of passthrough expenses, what will be the multiplier for a 2,000 SF space if the passthroughs are calculated with anchor exclusion? 67. Using the example above. If the total shopping center expenses are $500,000 per year and Publix pays $5,000 per month towards passthrough expenses, how much will the passthrough expenses be for a 2,000 SF space if the passthroughs are calculated with anchor exclusion? Nonanchor exclusion? 68. You are about to renew a Tenant. They are currently paying $18 PSF base rent on 2,000SF. If you are able to increase their rent to $24PSF, how much value have you added to the shopping center at that point in time assuming a Cap Rate of 9% 69. You purchased a shopping center for $20,000,000 at a 7% cap. What is your NOI? 22,100,000,07=1,4100,000 A0I