Leave your Venmo @ in the comments/ answer.

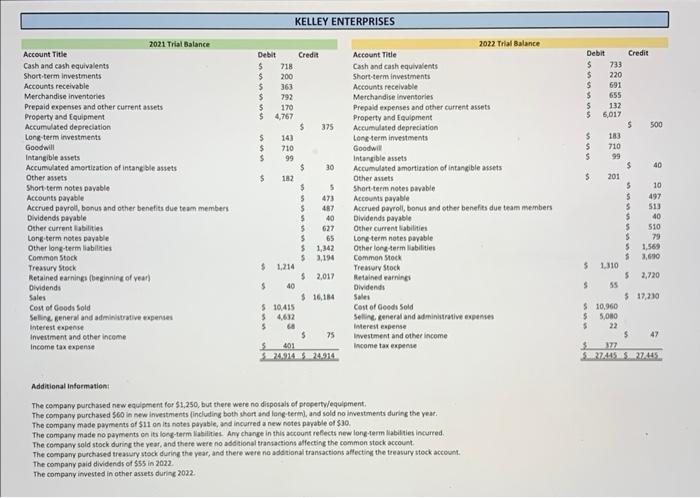

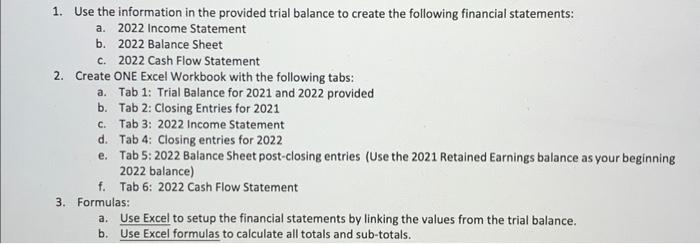

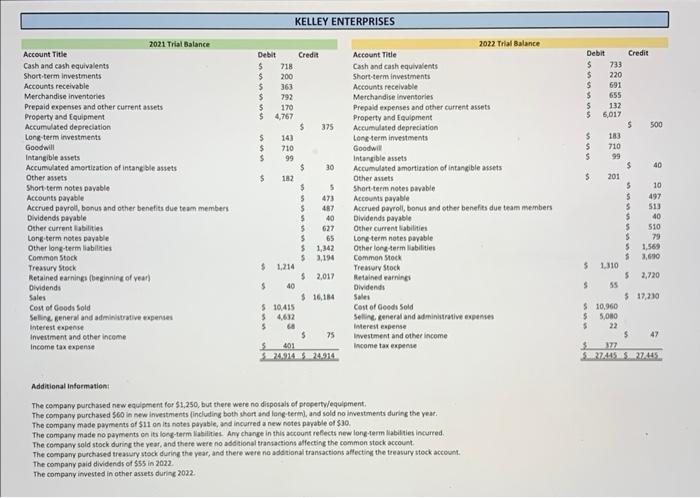

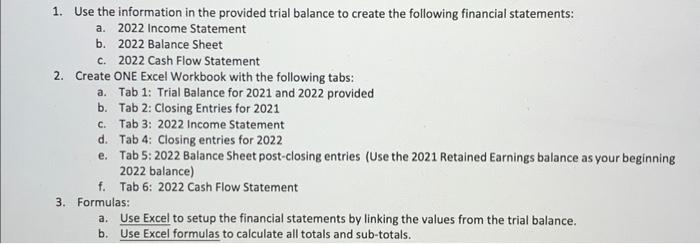

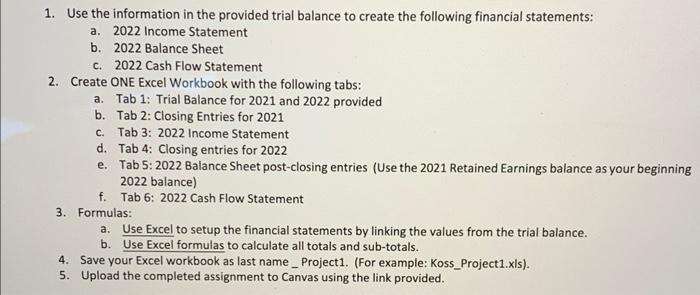

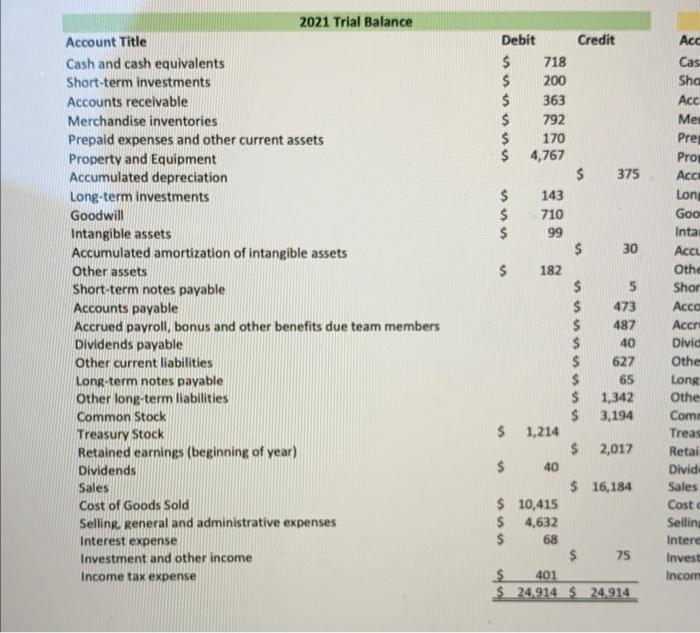

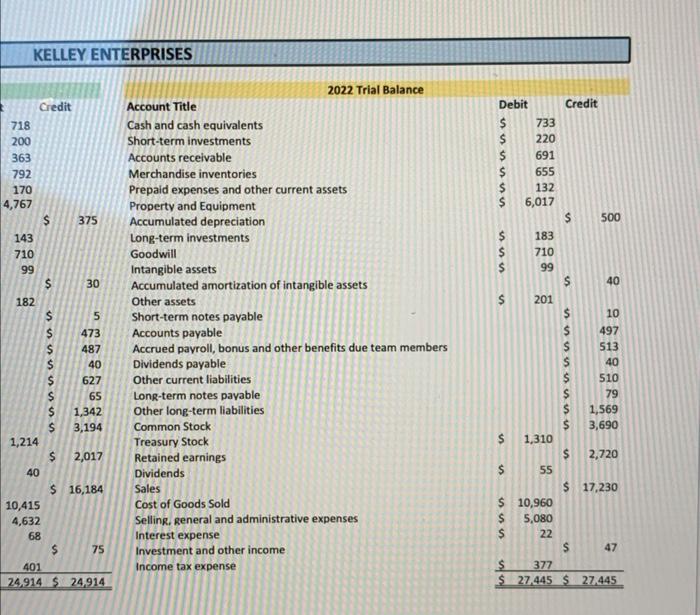

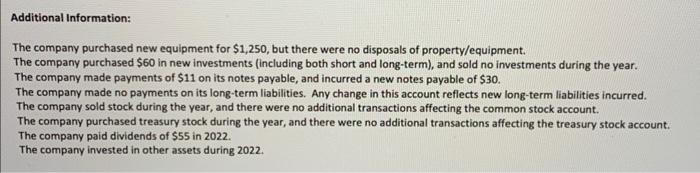

KELLEY ENTERPRISES Additional Information: The company purchased new equipment for 51.250, but there were no dispotals of properthilequlpment, The company parthased 500 in new investments (including both thait and long-term), and sold no investments during the yeat. The company made payments of $11 on its notes payable, and incurred a new notes payable of $30. The compary made no payments co its loct-tarm lakilities. Any change in this account refects new long-term liabilties incurred. The compary sold stock during the yeaf, and there were no add tional trantactions alfectifg the common stock account. The company purchased treawiry stock during the year, and there were na add tional transactions affectict the tee atury stock account. The company paid dividends of 555 in 2022. The company itvested in other assets durine 2022 . 1. Use the information in the provided trial balance to create the following financial statements: a. 2022 Income Statement b. 2022 Balance Sheet c. 2022 Cash Flow Statement 2. Create ONE Excel Workbook with the following tabs: a. Tab 1: Trial Balance for 2021 and 2022 provided b. Tab 2: Closing Entries for 2021 c. Tab 3: 2022 Income Statement d. Tab 4: Closing entries for 2022 e. Tab 5: 2022 Balance Sheet post-closing entries (Use the 2021 Retained Earnings balance as your beginning 2022 balance) f. Tab 6: 2022 Cash Flow Statement 3. Formulas: a. Use Excel to setup the financial statements by linking the values from the trial balance. b. Use Excel formulas to calculate all totals and sub-totals. 1. Use the information in the provided trial balance to create the following financial statements: a. 2022 Income Statement b. 2022 Balance Sheet c. 2022 Cash Flow Statement 2. Create ONE Excel Workbook with the following tabs: a. Tab 1: Trial Balance for 2021 and 2022 provided b. Tab 2: Closing Entries for 2021 c. Tab 3: 2022 Income Statement d. Tab 4: Closing entries for 2022 e. Tab 5: 2022 Balance Sheet post-closing entries (Use the 2021 Retained Earnings balance as your beginning 2022 balance) f. Tab 6: 2022 Cash Flow Statement 3. Formulas: a. Use Excel to setup the financial statements by linking the values from the trial balance. b. Use Excel formulas to calculate all totals and sub-totals. KELLEY ENTERPRISES Additional Information: The company purchased new equipment for $1,250, but there were no disposals of property/equipment. The company purchased $60 in new investments (including both short and long-term), and sold no investments during the year. The company made payments of $11 on its notes payable, and incurred a new notes payable of $30. The company made no payments on its long-term liabilities. Any change in this account reflects new long-term liabilities incurred. The company sold stock during the year, and there were no additional transactions affecting the common stock account. The company purchased treasury stock during the year, and there were no additional transactions affecting the treasury stock account. The company paid dividends of $55 in 2022 . The company invested in other assets during 2022. KELLEY ENTERPRISES Additional Information: The company purchased new equipment for 51.250, but there were no dispotals of properthilequlpment, The company parthased 500 in new investments (including both thait and long-term), and sold no investments during the yeat. The company made payments of $11 on its notes payable, and incurred a new notes payable of $30. The compary made no payments co its loct-tarm lakilities. Any change in this account refects new long-term liabilties incurred. The compary sold stock during the yeaf, and there were no add tional trantactions alfectifg the common stock account. The company purchased treawiry stock during the year, and there were na add tional transactions affectict the tee atury stock account. The company paid dividends of 555 in 2022. The company itvested in other assets durine 2022 . 1. Use the information in the provided trial balance to create the following financial statements: a. 2022 Income Statement b. 2022 Balance Sheet c. 2022 Cash Flow Statement 2. Create ONE Excel Workbook with the following tabs: a. Tab 1: Trial Balance for 2021 and 2022 provided b. Tab 2: Closing Entries for 2021 c. Tab 3: 2022 Income Statement d. Tab 4: Closing entries for 2022 e. Tab 5: 2022 Balance Sheet post-closing entries (Use the 2021 Retained Earnings balance as your beginning 2022 balance) f. Tab 6: 2022 Cash Flow Statement 3. Formulas: a. Use Excel to setup the financial statements by linking the values from the trial balance. b. Use Excel formulas to calculate all totals and sub-totals. 1. Use the information in the provided trial balance to create the following financial statements: a. 2022 Income Statement b. 2022 Balance Sheet c. 2022 Cash Flow Statement 2. Create ONE Excel Workbook with the following tabs: a. Tab 1: Trial Balance for 2021 and 2022 provided b. Tab 2: Closing Entries for 2021 c. Tab 3: 2022 Income Statement d. Tab 4: Closing entries for 2022 e. Tab 5: 2022 Balance Sheet post-closing entries (Use the 2021 Retained Earnings balance as your beginning 2022 balance) f. Tab 6: 2022 Cash Flow Statement 3. Formulas: a. Use Excel to setup the financial statements by linking the values from the trial balance. b. Use Excel formulas to calculate all totals and sub-totals. KELLEY ENTERPRISES Additional Information: The company purchased new equipment for $1,250, but there were no disposals of property/equipment. The company purchased $60 in new investments (including both short and long-term), and sold no investments during the year. The company made payments of $11 on its notes payable, and incurred a new notes payable of $30. The company made no payments on its long-term liabilities. Any change in this account reflects new long-term liabilities incurred. The company sold stock during the year, and there were no additional transactions affecting the common stock account. The company purchased treasury stock during the year, and there were no additional transactions affecting the treasury stock account. The company paid dividends of $55 in 2022 . The company invested in other assets during 2022