Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lebron Tatum Inc. just paid a dividend ( D 0 ) of $ 2 . 0 0 ? share. The firm's dividend payment is expected

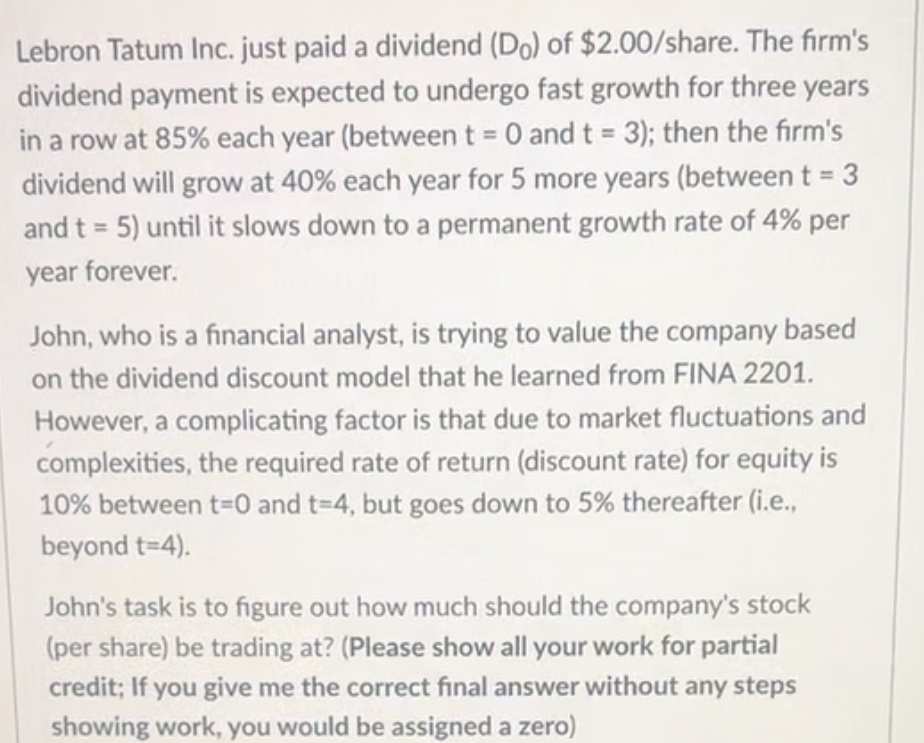

Lebron Tatum Inc. just paid a dividend of $ share. The firm's dividend payment is expected to undergo fast growth for three years in a row at each year between and ; then the firm's dividend will grow at each year for more years between and until it slows down to a permanent growth rate of per year forever.

John, who is a financial analyst, is trying to value the company based on the dividend discount model that he learned from FINA However, a complicating factor is that due to market fluctuations and complexities, the required rate of return discount rate for equity is between and but goes down to thereafter ie beyond

John's task is to figure out how much should the company's stock per share be trading atPlease show all your work for partial credit; If you give me the correct final answer without any steps showing work, you would be assigned a zero

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started