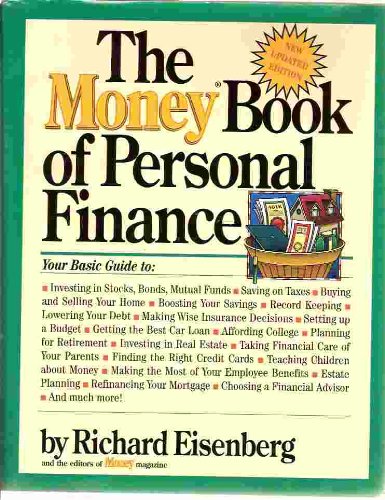

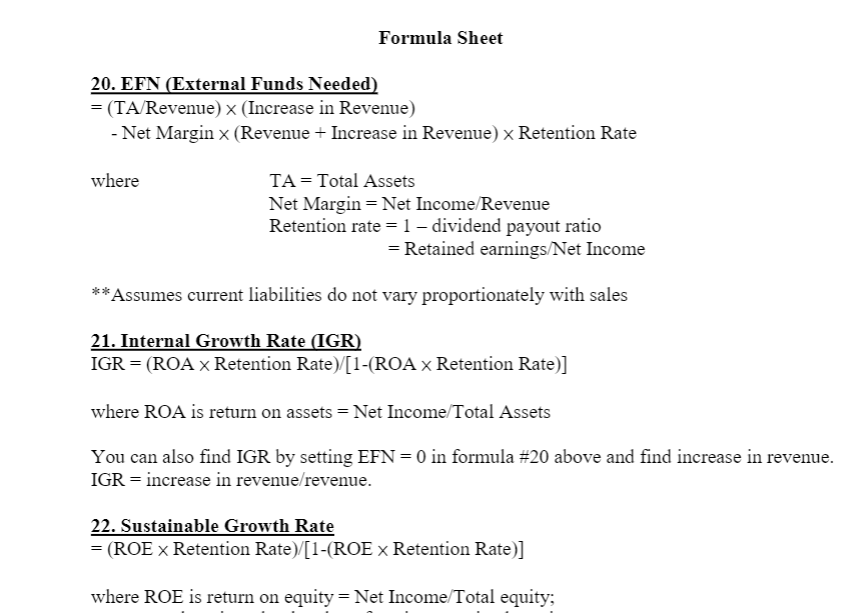

Lecture 4 Mini Case Background Happy Foods Limited Happy Foods Limited is a local chain of organic foods stores. Based on market demand that is consistent with the trend of eating healthy, the outlook for Happy Foods seems very promising. Sales are expected to increase significantly in the next few years. The industry growth forecast had been estimated to be between 25 to 40%! In order to plan for the future, the management at Happy Foods needs to prepare a solid set of Proforma Statements (i.e., financial forecasts). One of the key issues is how much external financing would be needed to fund the potential revenue growth projected by industry analysis. Now is the end of 2020. Page 2 contains Table 1 Income Statement and Table 2 Balance Sheet for Happy Foods at the end of 2020. Please answer the following questions (follow hints below): (total 100 points) 1. What is the internal growth rate for Happy Foods? Internal growth rate is the highest growth rate the firm can grow at without any external financing. (20 points) 2. Given the current debt ratio (or capital structure) and assume that the firm would like to keep its current debt ratio constant, what rate of growth in revenue can the firm support? This is called the sustainable growth rate. Sustainable growth rate is the rate of growth that the firm can grow at assuming that the firm maintains its current debt ratio. What are the assumptions underlying the calculation of the sustainable growth rate? (15 points) 3. Assume that the firm is considering 25% to 40% revenue growth in the future, how much additional financing (S) will it need to support this growth plan? (25 points) 4. Based on the analysis above, will Happy Foods have a problem supporting the growth if the industry growth prediction turns out to be true? If external financing is needed, will Happy Foods need to be concerned about raising additional external funds? Analyze this question based on liquidity and interest coverage ratio. (20 points) 5. If the retention rate is 0.80 and sales grows by 36%, how much external fund does the firm need to raise in order to fund the growth? (10 points) 6. Similar to question 5, what if the firm decides not to retain any profits, and if the sales growth is 28%, how much external fund would the firm need to raise? (10 points) Hints: Q1: Must use Formula #20 in the formula sheet, set EFN = 0 to solve for increase in revenue. Then internal growth rate (IGR) = increase in revenue/ revenue. You can use Formula #21 to confirm. Q2: Use Formula #22 to calculate sustainable growth rate. Q3: Use Formula #20 to calculate EFN (S) for each of the following four expected growth rate: 25%, 30%, 35%, and 40%. Should have four EFN dollar amounts. . Q4: Provide detailed discussions. Q5 and 26: Use Formula #20 to calculate EFN (S) for each question. Formula Sheet 20. EFN (External Funds Needed) = (TA/Revenue) x (Increase in Revenue) -Net Margin x (Revenue + Increase in Revenue)