LECTURE NOTES P.23

THE QUESTION:

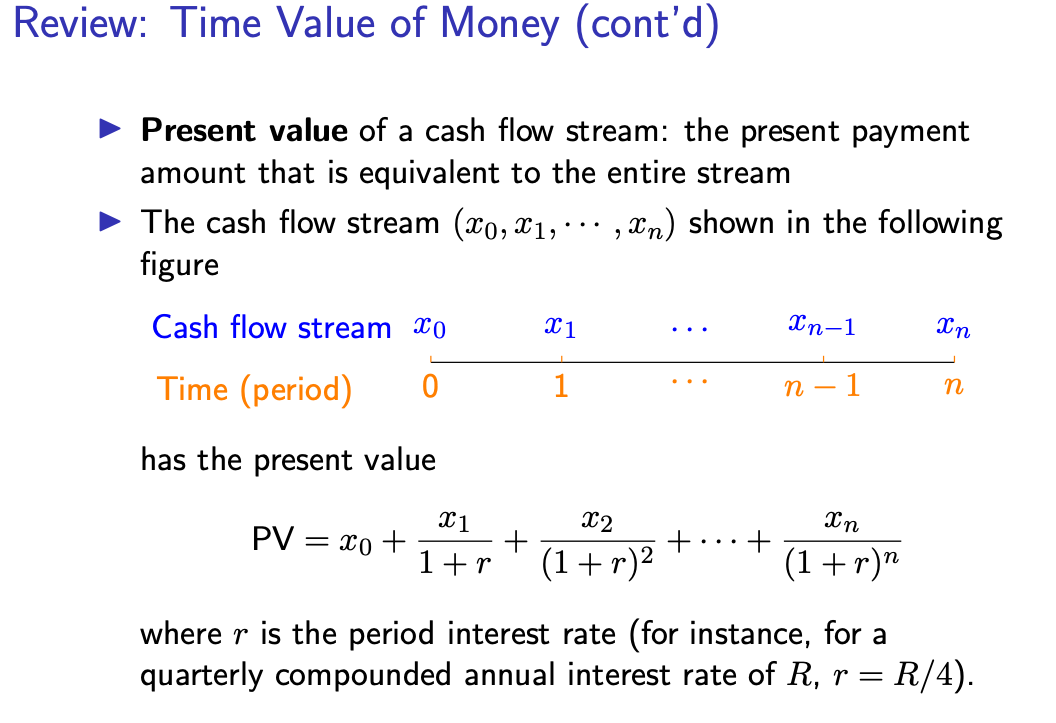

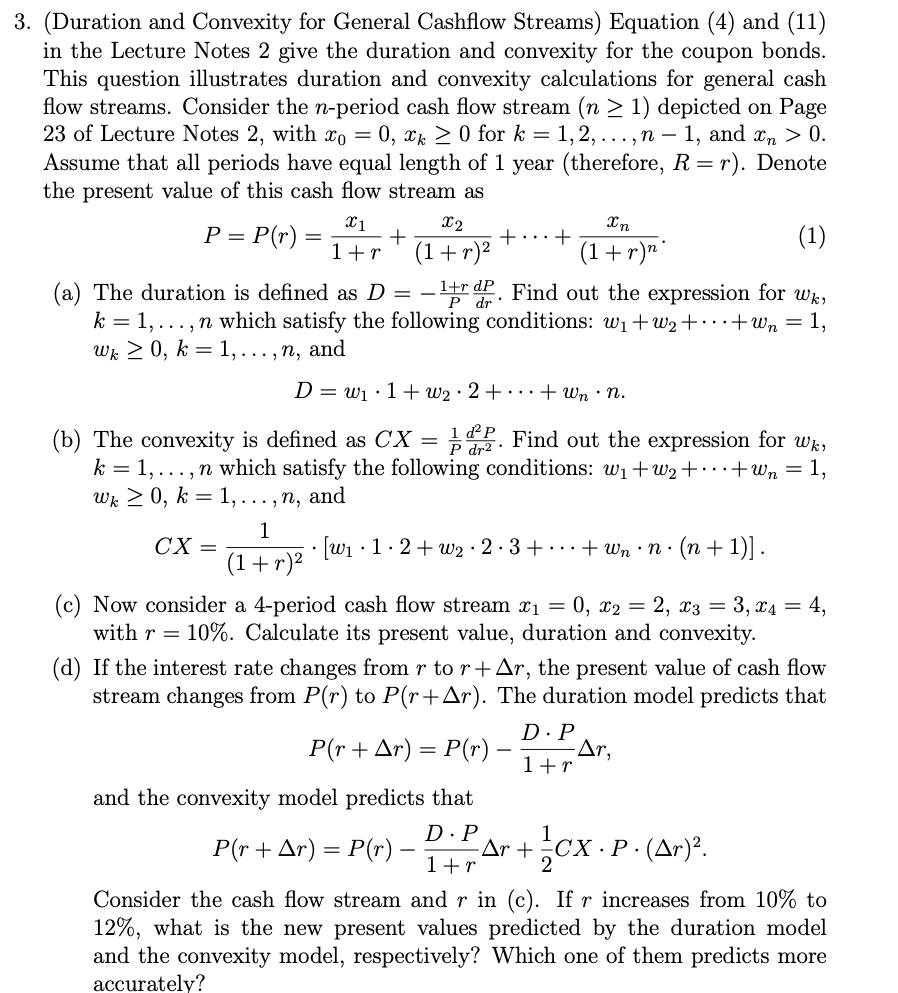

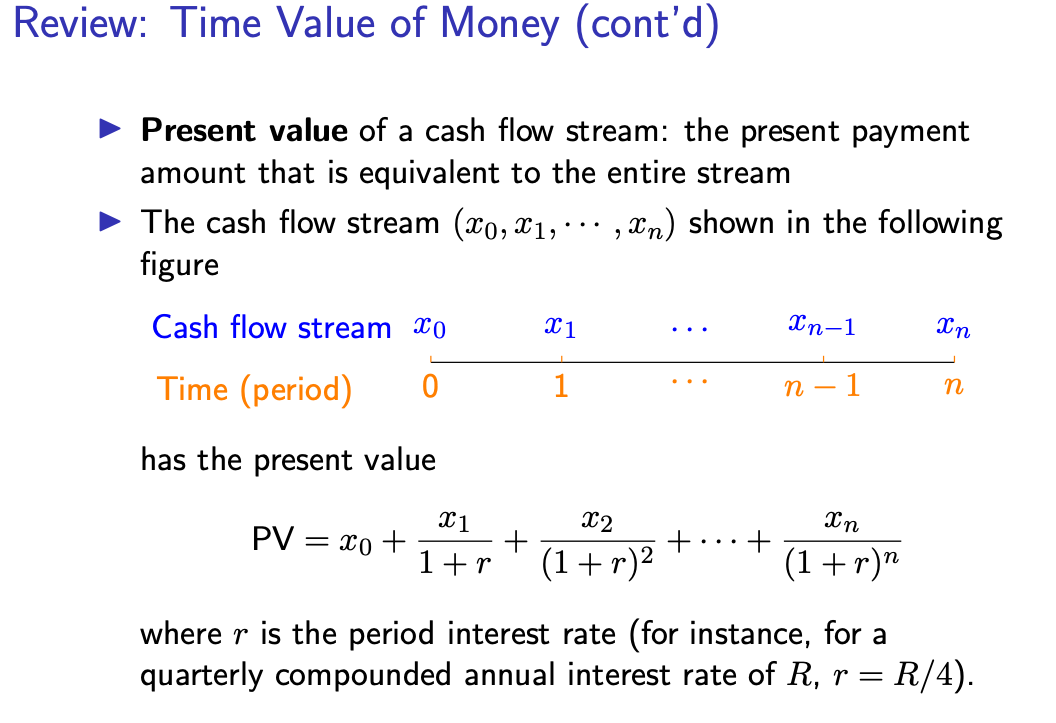

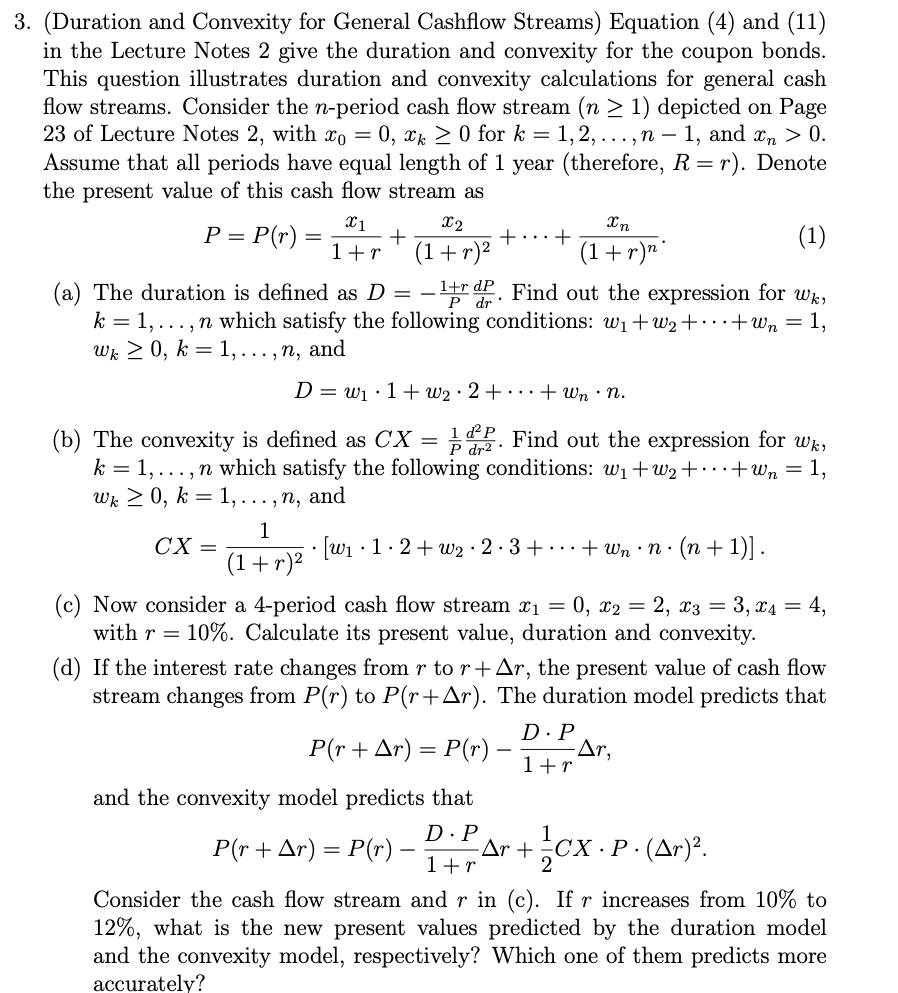

Review: Time Value of Money (cont'd) Present value of a cash flow stream: the present payment amount that is equivalent to the entire stream The cash flow stream (20, X1, Un) shown in the following figure Cash flow stream X0 X 1 In-1 xn Time (period) 0 1 n 1 has the present value X 1 22 PV = xo + + 1+r (1+r) + + (1+r)" where r is the period interest rate (for instance, for a quarterly compounded annual interest rate of R, r = R/4). 3. (Duration and Convexity for General Cashflow Streams) Equation (4) and (11) in the Lecture Notes 2 give the duration and convexity for the coupon bonds. This question illustrates duration and convexity calculations for general cash flow streams. Consider the n-period cash flow stream (n > 1) depicted on Page 23 of Lecture Notes 2, with Xo = 0, xk > 0 for k = 1,2,...,n - 1, and xn > 0. Assume that all periods have equal length of 1 year (therefore, R=r). Denote the present value of this cash flow stream as 22 In P= P(r) = +...+ (1) 1+r (1 + r)2 (1+r)n (a) The duration is defined as D = -25 d. Find out the expression for wk, k = 1, ..., n which satisfy the following conditions: Wi+w2+...+wn = 1, Wk > 0, k = 1,...,n, and 21 + D= wi:1+ W22+...+wn.n. (b) The convexity is defined as CX = 142. Find out the expression for wk, k = 1,..., n which satisfy the following conditions: Wi+w2+...+wn = 1, Wk>0, k = 1,..., n, and 1 -r, CX= [w112+W223+...+wn.n. (n + 1)]. (1+r)2 (c) Now consider a 4-period cash flow stream x1 = 0, X2 = 2, x3 = 3,24 = 4, with r = 10%. Calculate its present value, duration and convexity. (d) If the interest rate changes from r to r+ Ar, the present value of cash flow stream changes from P(r) to P(r+Ar). The duration model predicts that D.P P(r + Ar) = P(r) 1+r and the convexity model predicts that D.P P(r + Ar) = P(r) Ar + cx.P.(Ar)? 1+r Consider the cash flow stream and r in (c). If r increases from 10% to 12%, what is the new present values predicted by the duration model and the convexity model, respectively? Which one of them predicts more accurately? Review: Time Value of Money (cont'd) Present value of a cash flow stream: the present payment amount that is equivalent to the entire stream The cash flow stream (20, X1, Un) shown in the following figure Cash flow stream X0 X 1 In-1 xn Time (period) 0 1 n 1 has the present value X 1 22 PV = xo + + 1+r (1+r) + + (1+r)" where r is the period interest rate (for instance, for a quarterly compounded annual interest rate of R, r = R/4). 3. (Duration and Convexity for General Cashflow Streams) Equation (4) and (11) in the Lecture Notes 2 give the duration and convexity for the coupon bonds. This question illustrates duration and convexity calculations for general cash flow streams. Consider the n-period cash flow stream (n > 1) depicted on Page 23 of Lecture Notes 2, with Xo = 0, xk > 0 for k = 1,2,...,n - 1, and xn > 0. Assume that all periods have equal length of 1 year (therefore, R=r). Denote the present value of this cash flow stream as 22 In P= P(r) = +...+ (1) 1+r (1 + r)2 (1+r)n (a) The duration is defined as D = -25 d. Find out the expression for wk, k = 1, ..., n which satisfy the following conditions: Wi+w2+...+wn = 1, Wk > 0, k = 1,...,n, and 21 + D= wi:1+ W22+...+wn.n. (b) The convexity is defined as CX = 142. Find out the expression for wk, k = 1,..., n which satisfy the following conditions: Wi+w2+...+wn = 1, Wk>0, k = 1,..., n, and 1 -r, CX= [w112+W223+...+wn.n. (n + 1)]. (1+r)2 (c) Now consider a 4-period cash flow stream x1 = 0, X2 = 2, x3 = 3,24 = 4, with r = 10%. Calculate its present value, duration and convexity. (d) If the interest rate changes from r to r+ Ar, the present value of cash flow stream changes from P(r) to P(r+Ar). The duration model predicts that D.P P(r + Ar) = P(r) 1+r and the convexity model predicts that D.P P(r + Ar) = P(r) Ar + cx.P.(Ar)? 1+r Consider the cash flow stream and r in (c). If r increases from 10% to 12%, what is the new present values predicted by the duration model and the convexity model, respectively? Which one of them predicts more accurately