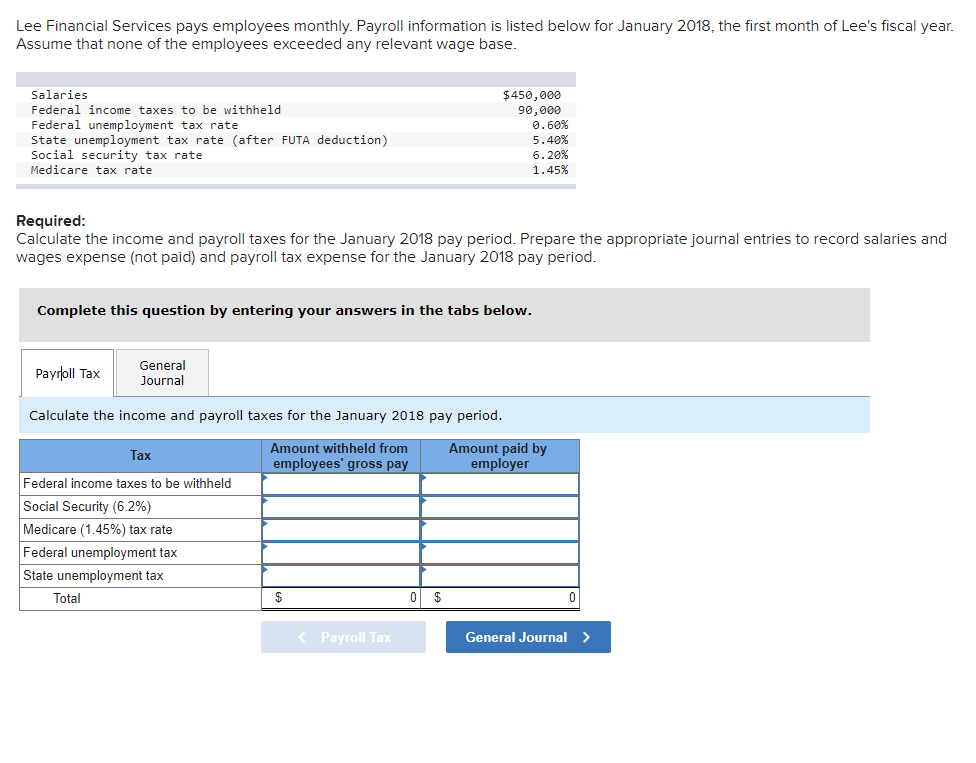

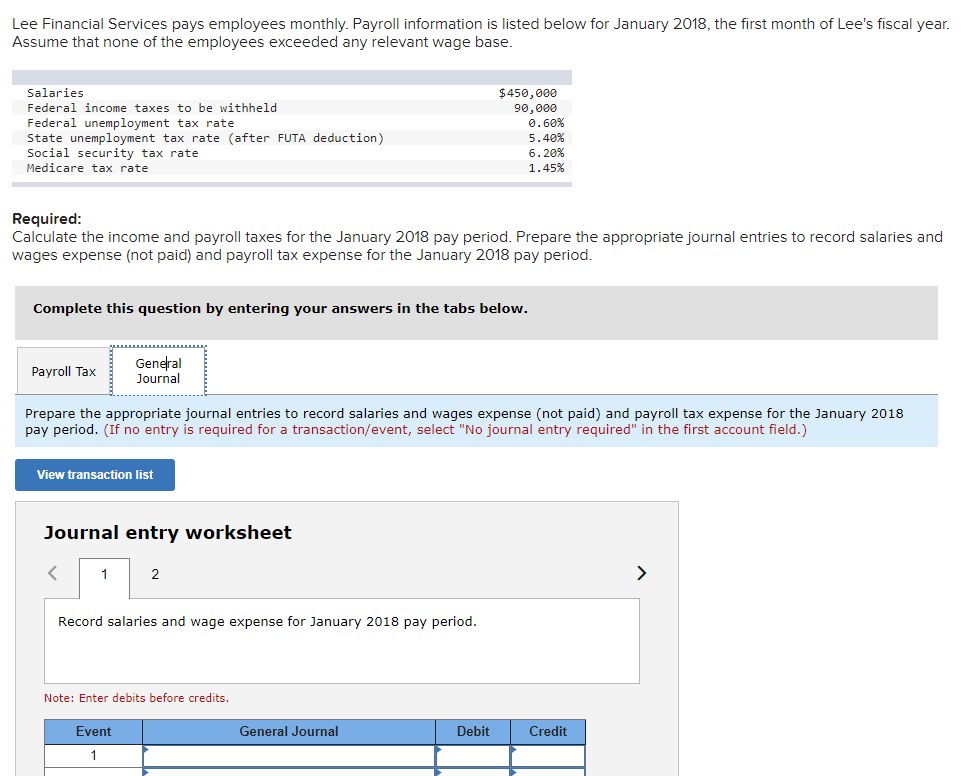

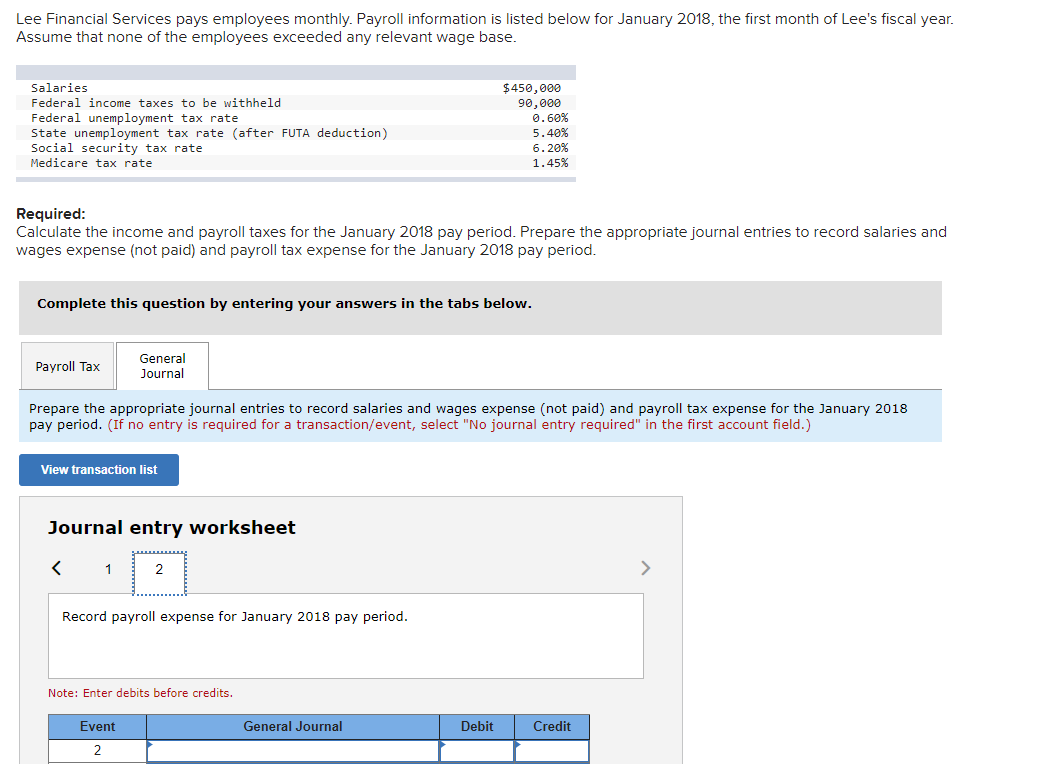

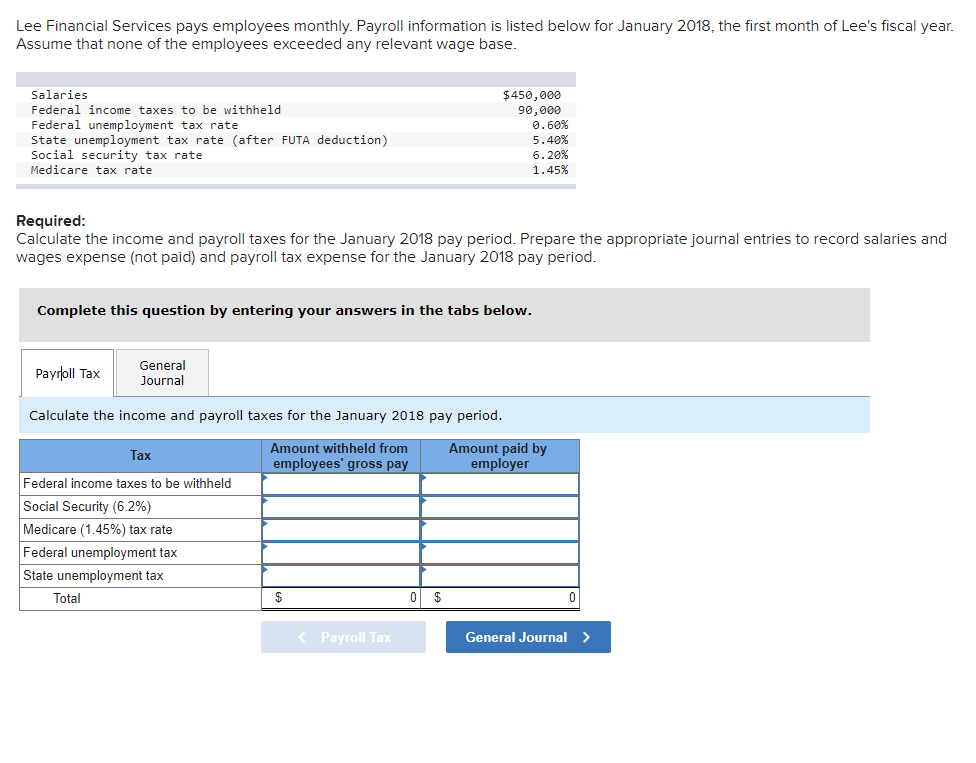

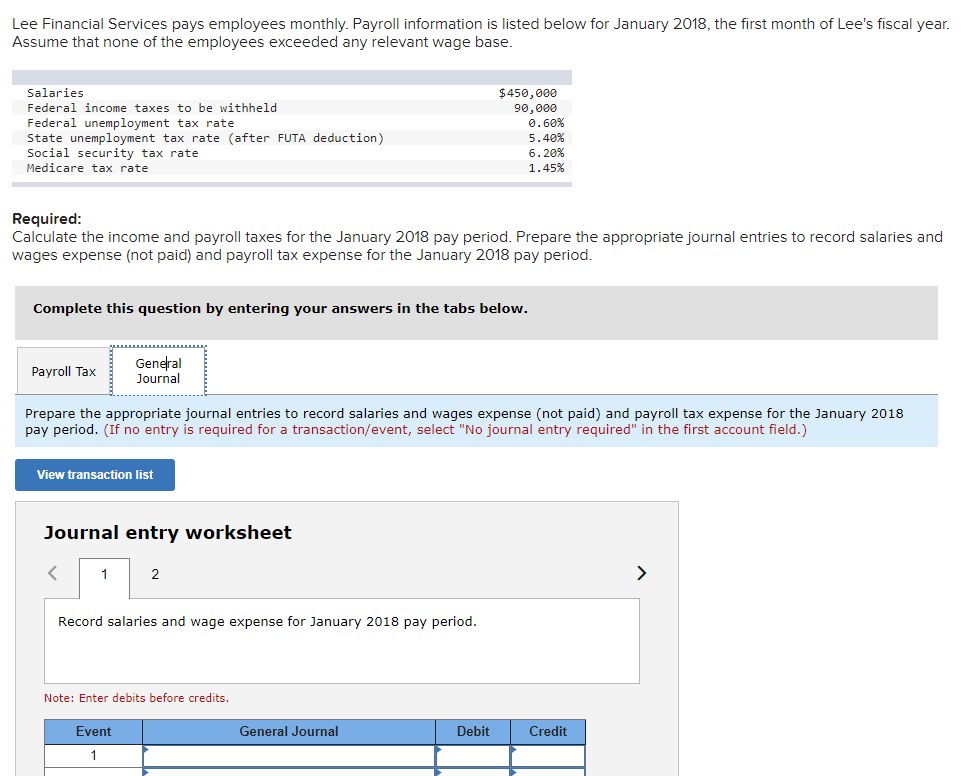

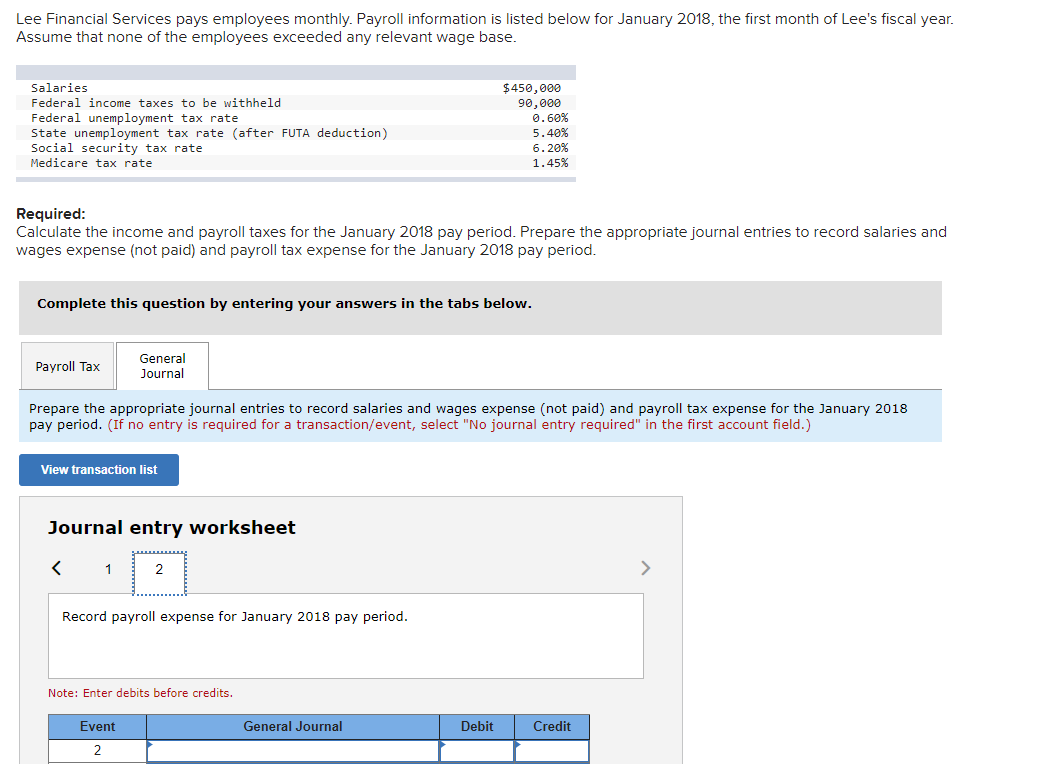

Lee Financial Services pays employees monthly. Payroll information is listed below for January 2018, the first month of Lee's fiscal year. Assume that none of the employees exceeded any relevant wage base. Salaries Federal income taxes to be withheld Federal unemployment tax rate State unemployment tax rate (after FUTA deduction) Social security tax rate Medicare tax rate $450,000 90,000 0.60% 5.40% 6. 20% 1.45% Required: Calculate the income and payroll taxes for the January 2018 pay period. Prepare the appropriate journal entries to record salaries and wages expense (not paid) and payroll tax expense for the January 2018 pay period. Complete this question by entering your answers in the tabs below. Payroll Tax General Journal Calculate the income and payroll taxes for the January 2018 pay period. Tax Amount withheld from employees' gross pay Amount paid by employer Federal income taxes to be withheld Social Security (6.2%) Medicare (1.45%) tax rate Federal unemployment tax State unemployment tax Total $ 0 $ Lee Financial Services pays employees monthly. Payroll information is listed below for January 2018, the first month of Lee's fiscal year. Assume that none of the employees exceeded any relevant wage base. Salaries Federal income taxes to be withheld Federal unemployment tax rate State unemployment tax rate (after FUTA deduction) Social security tax rate Medicare tax rate $450,000 90,000 0.60% 5.40% 6. 20% 1.45% Required: Calculate the income and payroll taxes for the January 2018 pay period. Prepare the appropriate journal entries to record salaries and wages expense (not paid) and payroll tax expense for the January 2018 pay period. Complete this question by entering your answers in the tabs below. Payroll Tax General Journal Prepare the appropriate journal entries to record salaries and wages expense (not paid) and payroll tax expense for the January 2018 pay period. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record salaries and wage expense for January 2018 pay period. Note: Enter debits before credits. Event General Journal Debit Credit 1 Lee Financial Services pays employees monthly. Payroll information is listed below for January 2018, the first month of Lee's fiscal year. Assume that none of the employees exceeded any relevant wage base. Salaries Federal income taxes to be withheld Federal unemployment tax rate State unemployment tax rate (after FUTA deduction) Social security tax rate Medicare tax rate $450,000 90,000 0.60% 5.40% 6. 20% 1.45% Required: Calculate the income and payroll taxes for the January 2018 pay period. Prepare the appropriate journal entries to record salaries and wages expense (not paid) and payroll tax expense for the January 2018 pay period. Complete this question by entering your answers in the tabs below. Payroll Tax General Journal Prepare the appropriate journal entries to record salaries and wages expense (not paid) and payroll tax expense for the January 2018 pay period. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record payroll expense for January 2018 pay period. Note: Enter debits before credits. Event General Journal Debit Credit 2