Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an automobile with a fair value of $80,000 under a 5-year lease

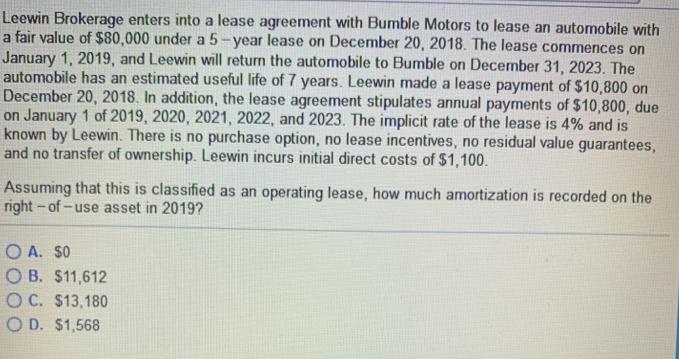

Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an automobile with a fair value of $80,000 under a 5-year lease on December 20, 2018. The lease commences on January 1, 2019, and Leewin will return the automobile to Bumble on December 31, 2023. The automobile has an estimated useful life of 7 years. Leewin made a lease payment of $10,800 on December 20, 2018. In addition, the lease agreement stipulates annual payments of $10,800, due on January 1 of 2019, 2020, 2021, 2022, and 2023. The implicit rate of the lease is 4% and is known by Leewin. There is no purchase option, no lease incentives, no residual value guarantees, and no transfer of ownership. Leewin incurs initial direct costs of $1,100. Assuming that this is classified as an operating lease, how much amortization is recorded on the right - of -use asset in 2019? O A. SO O B. $11,612 O C. $13,180 O D. $1,568

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Ans 11612 Option 2nd Amortization recorded Annual lease expense Interest expense An...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started