Answered step by step

Verified Expert Solution

Question

1 Approved Answer

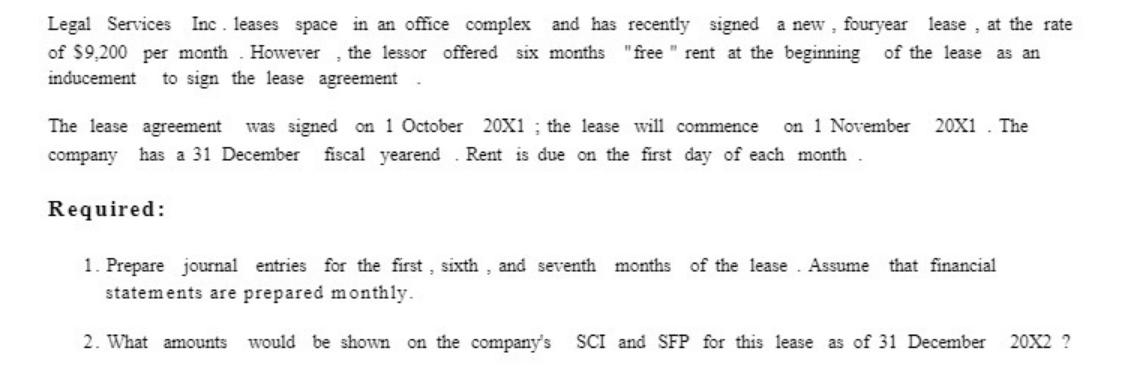

Legal Services Inc. leases space in an office complex and has recently signed a new, fouryear lease, at the rate of $9,200 per month.

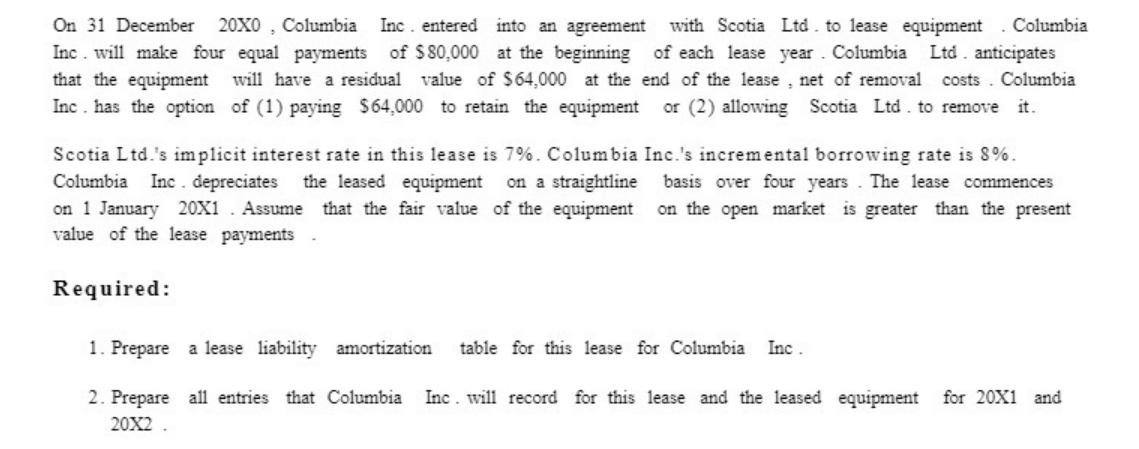

Legal Services Inc. leases space in an office complex and has recently signed a new, fouryear lease, at the rate of $9,200 per month. However the lessor offered six months "free" rent at the beginning of the lease as an inducement to sign the lease agreement The lease agreement was signed on 1 October 20X1; the lease will commence on 1 November 20X1. The company has a 31 December fiscal yearend Rent is due on the first day of each month. Required: 1. Prepare journal entries for the first, sixth, and seventh months of the lease. Assume that financial statements are prepared monthly. 2. What amounts would be shown on the company's SCI and SFP for this lease as of 31 December 20X2 ? On 31 December 20X0, Columbia Inc. entered into an agreement with Scotia Ltd. to lease equipment. Columbia Inc. will make four equal payments of $80,000 at the beginning of each lease year. Columbia Ltd. anticipates that the equipment will have a residual value of $64,000 at the end of the lease, net of removal costs Columbia Inc. has the option of (1) paying $64,000 to retain the equipment or (2) allowing Scotia Ltd. to remove it. Scotia Ltd.'s implicit interest rate in this lease is 7%. Columbia Inc.'s incremental borrowing rate is 8%. Columbia Inc. depreciates the leased equipment on a straightline basis over four years. The lease commences on 1 January 20X1 Assume that the fair value of the equipment on the open market is greater than the present value of the lease payments. Required: 1. Prepare a lease liability amortization table for this lease for Columbia Inc. 2. Prepare all entries that Columbia Inc. will record for this lease and the leased equipment 20X2. for 20X1 and

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Part A Legal Services Inc lease Journal entries a First month November 1 20X1 Lease expense 9...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started