Question

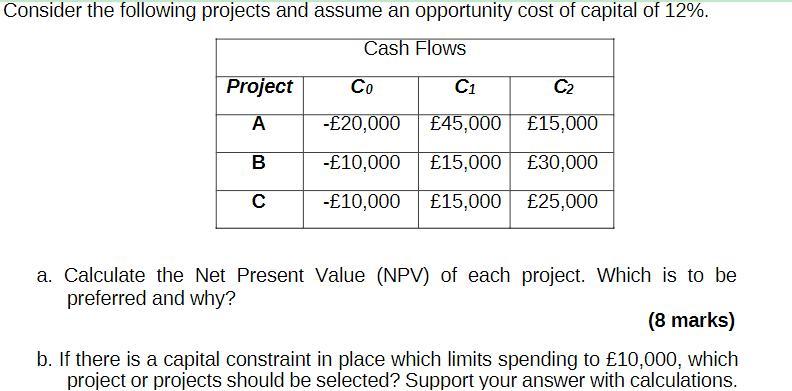

Consider the following projects and assume an opportunity cost of capital of 12%. Cash Flows Project A B C Co C1 C -20,000 45,000

Consider the following projects and assume an opportunity cost of capital of 12%. Cash Flows Project A B C Co C1 C -20,000 45,000 15,000 -10,000 15,000 30,000 -10,000 15,000 25,000 a. Calculate the Net Present Value (NPV) of each project. Which is to be preferred and why? (8 marks) b. If there is a capital constraint in place which limits spending to 10,000, which project or projects should be selected? Support your answer with calculations.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

In the capital budgeting analysis Net Present Value refers to the discounting method to determine pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Algebra and Trigonometry

Authors: Ron Larson

10th edition

9781337514255, 1337271179, 133751425X, 978-1337271172

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App