Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lemon Brothers, a large Lemon distributor in the U.S., is selling 50,000 tons per year on credit at an average selling price of $1000

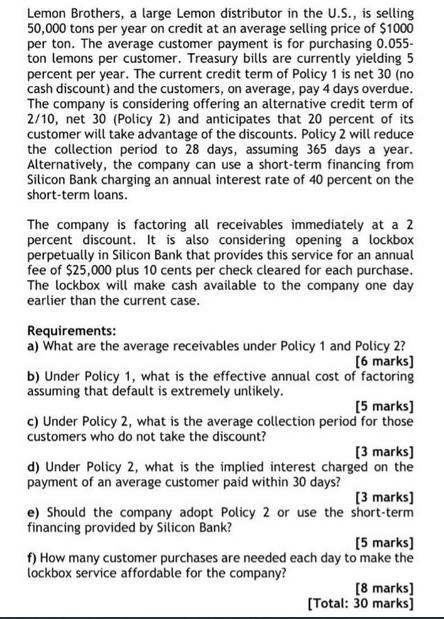

Lemon Brothers, a large Lemon distributor in the U.S., is selling 50,000 tons per year on credit at an average selling price of $1000 per ton. The average customer payment is for purchasing 0.055- ton lemons per customer. Treasury bills are currently yielding 5 percent per year. The current credit term of Policy 1 is net 30 (no cash discount) and the customers, on average, pay 4 days overdue. The company is considering offering an alternative credit term of 2/10, net 30 (Policy 2) and anticipates that 20 percent of its customer will take advantage of the discounts. Policy 2 will reduce the collection period to 28 days, assuming 365 days a year. Alternatively, the company can use a short-term financing from Silicon Bank charging an annual interest rate of 40 percent on the short-term loans. The company is factoring all receivables immediately at a 2 percent discount. It is also considering opening a lockbox perpetually in Silicon Bank that provides this service for an annual fee of $25,000 plus 10 cents per check cleared for each purchase. The lockbox will make cash available to the company one day earlier than the current case. Requirements: a) What are the average receivables under Policy 1 and Policy 2? [6 marks] b) Under Policy 1, what is the effective annual cost of factoring assuming that default is extremely unlikely. [5 marks] c) Under Policy 2, what is the average collection period for those customers who do not take the discount? [3 marks] d) Under Policy 2, what is the implied interest charged on the payment of an average customer paid within 30 days? [3 marks] e) Should the company adopt Policy 2 or use the short-term financing provided by Silicon Bank? [5 marks] f) How many customer purchases are needed each day to make the lockbox service affordable for the company? [8 marks] [Total: 30 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Average Receivables under Policy 1 and Policy 2 Policy 1 Average daily sales 50000 tonsyear 1000to...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started