Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lemon Ltd requires a Statement of CashFlows to be prepared for the year ended 3 1 March 2 0 2 4 ; the following information

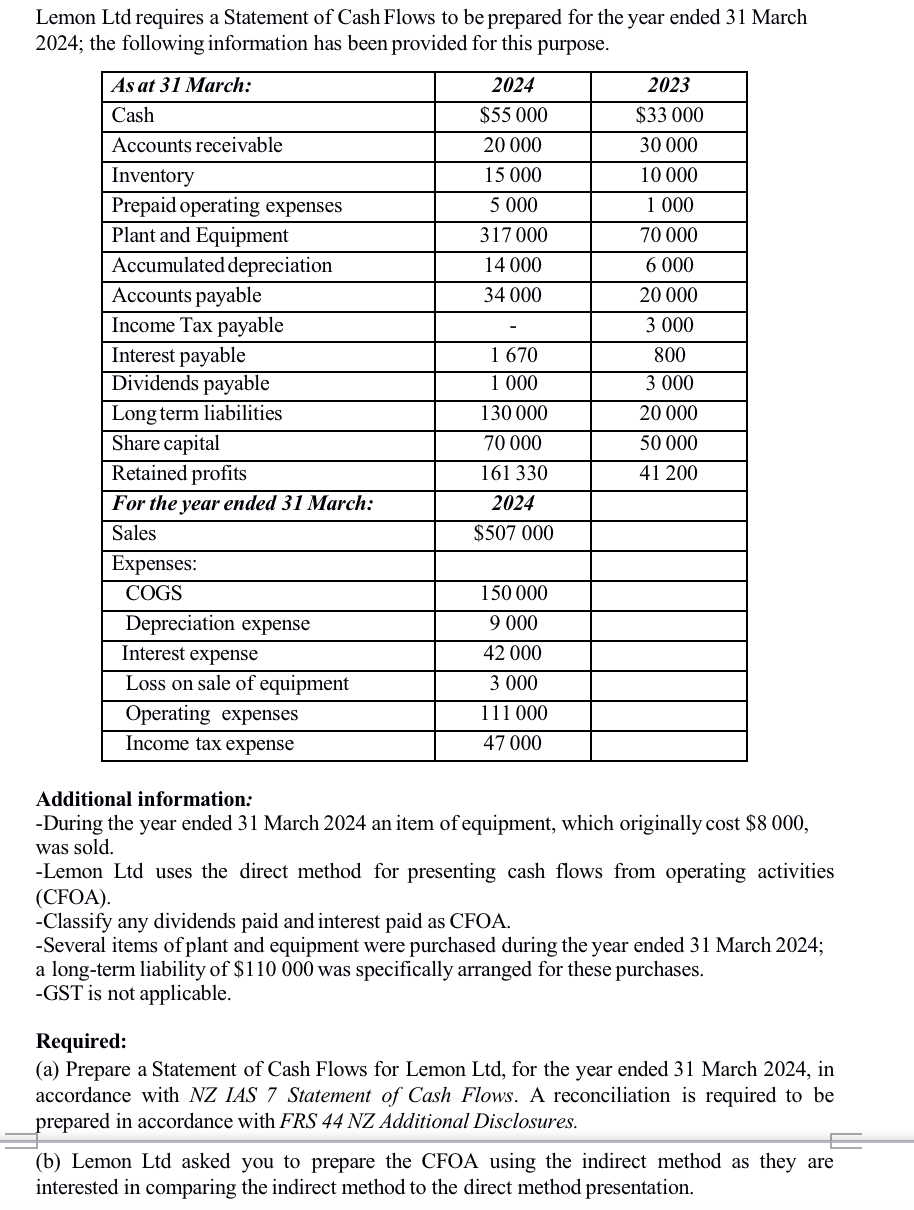

Lemon Ltd requires a Statement of CashFlows to be prepared for the year ended March ; the following information has been provided for this purpose.

tableAs at March:,Cash$$Accounts receivable,InventoryPrepaid operating expenses,Plant and Equipment,Accumulated depreciation,Accounts payable,Income Tax payable,Interest payable,Dividends payable,Long term liabilities,Share capital,Retained profits,For the year ended March:,Sales$Expenses:COGSDepreciation expense,Interest expense,Loss on sale of equipment,Operating expenses,Income tax expense,,

Additional information:

During the year ended March an item of equipment, which originally cost $ was sold.

Lemon Ltd uses the direct method for presenting cash flows from operating activities CFOA

Classify any dividends paid and interest paid as CFOA.

Several items of plant and equipment were purchased during the year ended March ; a longterm liability of $ was specifically arranged for these purchases.

GST is not applicable.

Required:

a Prepare a Statement of Cash Flows for Lemon Ltd for the year ended March in accordance with NZ IAS Statement of Cash Flows. A reconciliation is required to be prepared in accordance with FRS NZ Additional Disclosures.

b Lemon Ltd asked you to prepare the CFOA using the indirect method as they are interested in comparing the indirect method to the direct method presentation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started