Answered step by step

Verified Expert Solution

Question

1 Approved Answer

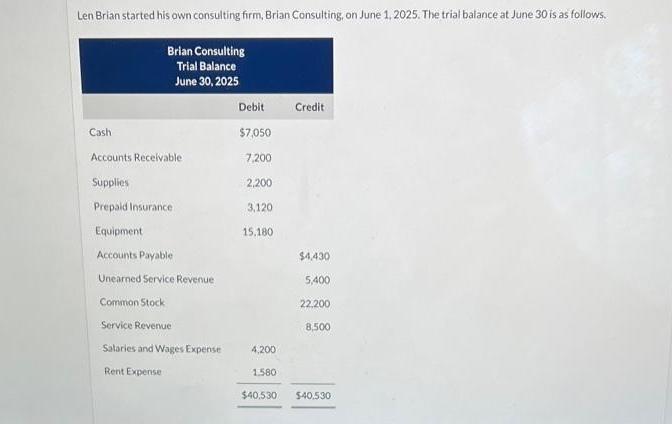

Len Brian started his own consulting firm, Brian Consulting, on June 1, 2025. The trial balance at June 30 is as follows. Brian Consulting

![]()

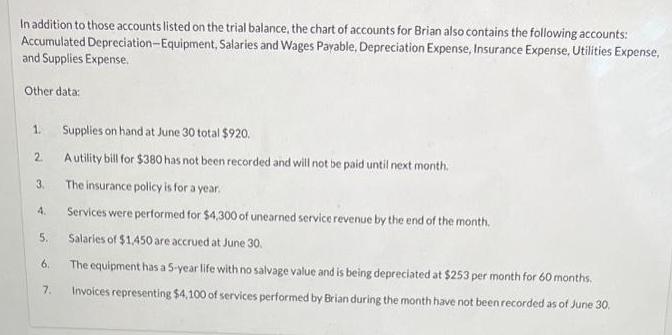

Len Brian started his own consulting firm, Brian Consulting, on June 1, 2025. The trial balance at June 30 is as follows. Brian Consulting Trial Balance June 30, 2025 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Unearned Service Revenue Common Stock Service Revenue Salaries and Wages Expense Rent Expense Debit $7,050 7,200 2,200 3,120 15,180 4,200 1.580 Credit $4,430 5,400 22,200 8,500 $40.530 $40.530 In addition to those accounts listed on the trial balance, the chart of accounts for Brian also contains the following accounts: Accumulated Depreciation-Equipment, Salaries and Wages Payable, Depreciation Expense, Insurance Expense, Utilities Expense, and Supplies Expense. Other data: 1. 2 3. 4. 5. 6. 7. Supplies on hand at June 30 total $920. A utility bill for $380 has not been recorded and will not be paid until next month. The insurance policy is for a year. Services were performed for $4,300 of unearned service revenue by the end of the month. Salaries of $1,450 are accrued at June 30. The equipment has a 5-year life with no salvage value and is being depreciated at $253 per month for 60 months. Invoices representing $4,100 of services performed by Brian during the month have not been recorded as of June 30. Post these entries in T-Accounts

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Cash TAccount Date Debit Credit Balance 7050 7050 Accounts Receivable TAccount Date Debit Credit Bal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started