Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lend me your ears corporation's financing pattern Lend me your ears corporation is a leading producer of mobile devises based out of UAE. Sales of

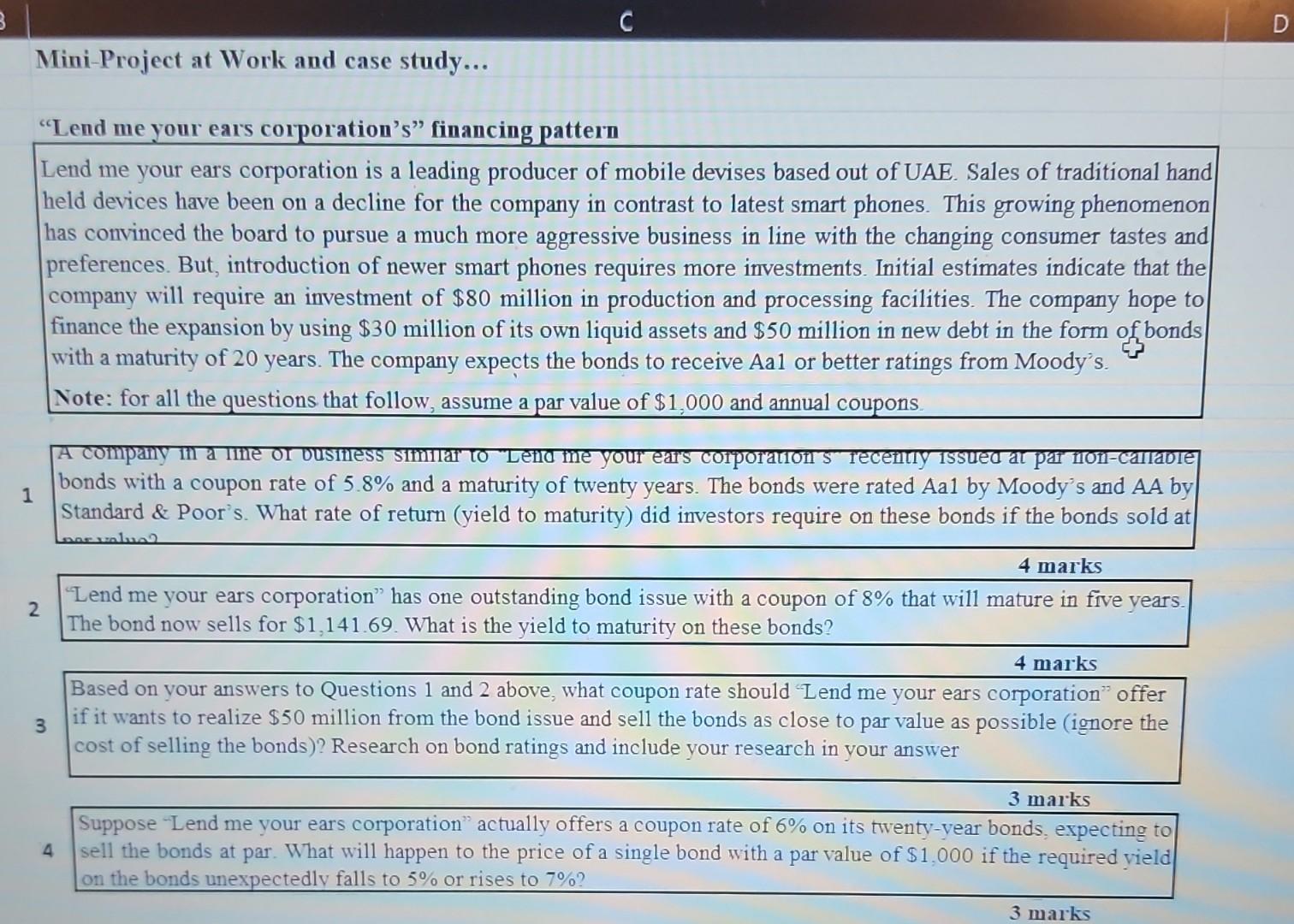

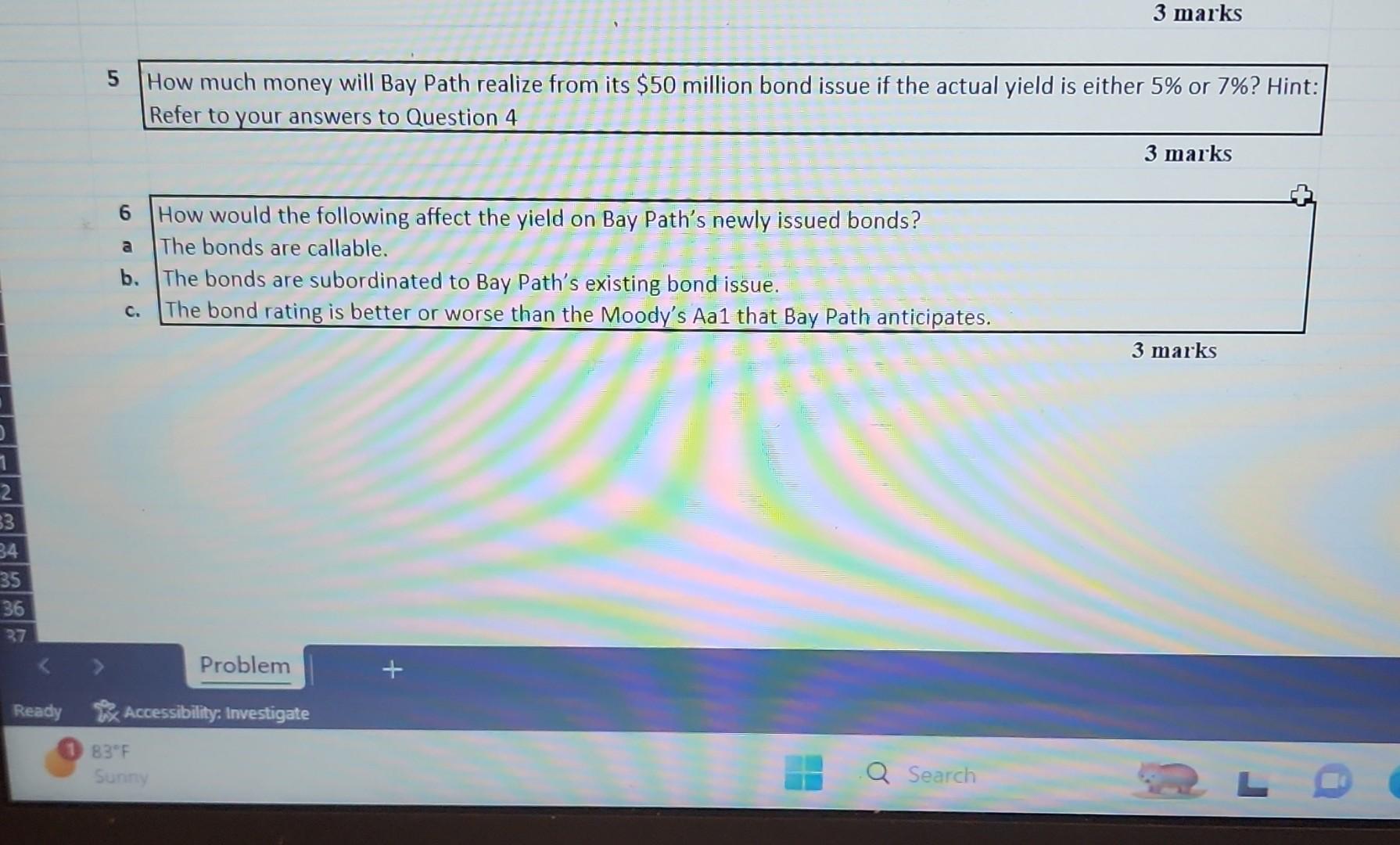

"Lend me your ears corporation's" financing pattern Lend me your ears corporation is a leading producer of mobile devises based out of UAE. Sales of traditional hand held devices have been on a decline for the company in contrast to latest smart phones. This growing phenomenon has convinced the board to pursue a much more aggressive business in line with the changing consumer tastes and preferences. But, introduction of newer smart phones requires more investments. Initial estimates indicate that the company will require an investment of $80 million in production and processing facilities. The company hope to finance the expansion by using $30 million of its own liquid assets and $50 million in new debt in the form of bonds with a maturity of 20 years. The company expects the bonds to receive Aal or better ratings from Moody's. Note: for all the questions that follow, assume a par value of $1,000 and annual coupons. Standard \& Poor's. What rate of return (yield to maturity) did investors require on these bonds if the bonds sold at 4 marks "Lend me your ears corporation" has one outstanding bond issue with a coupon of 8% that will mature in five years. The bond now sells for $1,141.69. What is the yield to maturity on these bonds? 4 marks Based on your answers to Questions 1 and 2 above, what coupon rate should "Lend me your ears corporation" offer 3 if it wants to realize $50 million from the bond issue and sell the bonds as close to par value as possible (ignore the cost of selling the bonds)? Research on bond ratings and include your research in your answer 3 marks Suppose "Lend me your ears corporation" actually offers a coupon rate of 6% on its twenty-year bonds, expecting to 4 sell the bonds at par. What will happen to the price of a single bond with a par value of $1,000 if the required yield on the bonds unexpectedly falls to 5% or rises to 7% ? 3 marks How much money will Bay Path realize from its $50 million bond issue if the actual yield is either 5% or 7% ? Hint: Refer to your answers to Question 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started