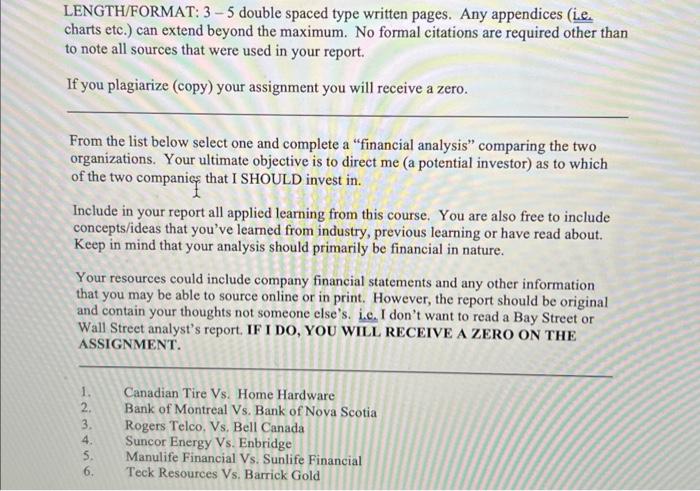

LENGTH/FORMAT: 35 double spaced type written pages. Any appendices (i.e. charts etc.) can extend beyond the maximum. No formal citations are required other than to note all sources that were used in your report. If you plagiarize (copy) your assignment you will receive a zero. From the list below select one and complete a "financial analysis" comparing the two organizations. Your ultimate objective is to direct me (a potential investor) as to which of the two companies that I SHOULD invest in. Include in your report all applied learning from this course. You are also free to include concepts/ideas that you've learned from industry, previous learning or have read about. Keep in mind that your analysis should primarily be financial in nature. Your resources could include company financial statements and any other information that you may be able to source online or in print. However, the report should be original and contain your thoughts not someone else's. L.e. I don't want to read a Bay Street or Wall Street analyst's report. IF I DO, YOU WILL RECEIVE A ZERO ON THE ASSIGNMENT. 1. Canadian Tire Vs. Home Hardware 2. Bank of Montreal Vs. Bank of Nova Scotia 3. Rogers Telco, Vs. Bell Canada 4. Suncor Energy Vs. Enbridge 5. Manulife Financial Vs. Sunlife Financial 6. Teck Resources Vs. Barrick Gold LENGTH/FORMAT: 35 double spaced type written pages. Any appendices (i.e. charts etc.) can extend beyond the maximum. No formal citations are required other than to note all sources that were used in your report. If you plagiarize (copy) your assignment you will receive a zero. From the list below select one and complete a "financial analysis" comparing the two organizations. Your ultimate objective is to direct me (a potential investor) as to which of the two companies that I SHOULD invest in. Include in your report all applied learning from this course. You are also free to include concepts/ideas that you've learned from industry, previous learning or have read about. Keep in mind that your analysis should primarily be financial in nature. Your resources could include company financial statements and any other information that you may be able to source online or in print. However, the report should be original and contain your thoughts not someone else's. L.e. I don't want to read a Bay Street or Wall Street analyst's report. IF I DO, YOU WILL RECEIVE A ZERO ON THE ASSIGNMENT. 1. Canadian Tire Vs. Home Hardware 2. Bank of Montreal Vs. Bank of Nova Scotia 3. Rogers Telco, Vs. Bell Canada 4. Suncor Energy Vs. Enbridge 5. Manulife Financial Vs. Sunlife Financial 6. Teck Resources Vs. Barrick Gold