Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lenno, Inc., is contemplating purchasing a new machine to replace an existing machine that it acquired three years ago for $150,000. For income tax

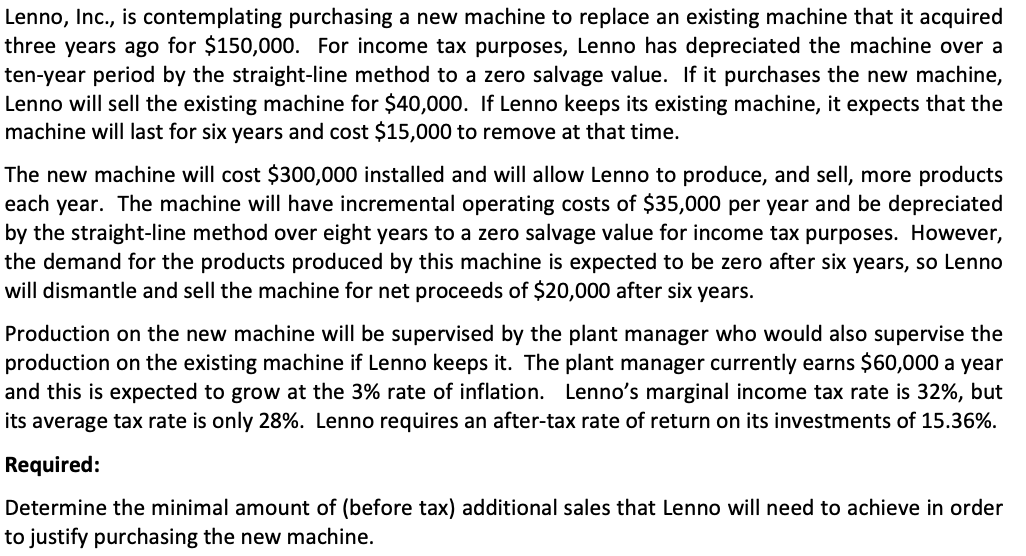

Lenno, Inc., is contemplating purchasing a new machine to replace an existing machine that it acquired three years ago for $150,000. For income tax purposes, Lenno has depreciated the machine over a ten-year period by the straight-line method to a zero salvage value. If it purchases the new machine, Lenno will sell the existing machine for $40,000. If Lenno keeps its existing machine, it expects that the machine will last for six years and cost $15,000 to remove at that time. The new machine will cost $300,000 installed and will allow Lenno to produce, and sell, more products each year. The machine will have incremental operating costs of $35,000 per year and be depreciated by the straight-line method over eight years to a zero salvage value for income tax purposes. However, the demand for the products produced by this machine is expected to be zero after six years, so Lenno will dismantle and sell the machine for net proceeds of $20,000 after six years. Production on the new machine will be supervised by the plant manager who would also supervise the production on the existing machine if Lenno keeps it. The plant manager currently earns $60,000 a year and this is expected to grow at the 3% rate of inflation. Lenno's marginal income tax rate is 32%, but its average tax rate is only 28%. Lenno requires an after-tax rate of return on its investments of 15.36%. Required: Determine the minimal amount of (before tax) additional sales that Lenno will need to achieve in order to justify purchasing the new machine.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started